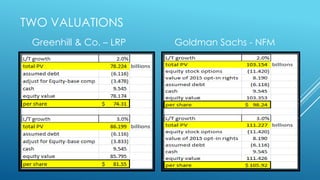

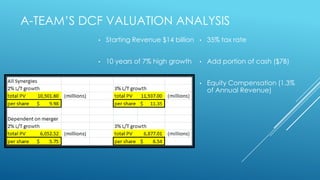

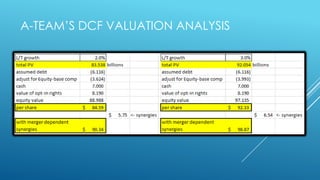

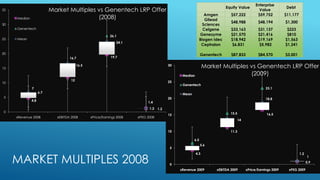

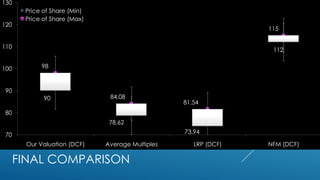

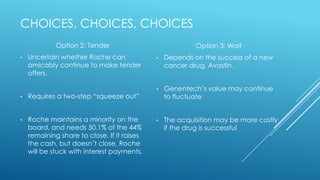

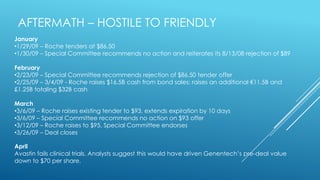

This document analyzes Roche's potential acquisition of Genentech. It discusses Roche's choices to either concede but negotiate a higher price, make a tender offer directly to shareholders, or wait in hopes that a new cancer drug fails which would lower Genentech's value. It then provides valuations of Genentech from $78-115 per share and compares to other company multiples. Finally, it describes how the acquisition progressed from hostile to friendly after Roche raised its offer price.