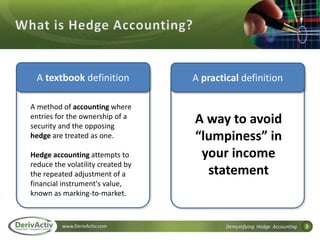

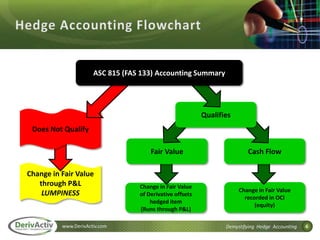

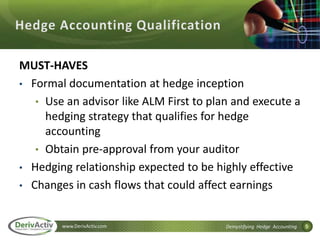

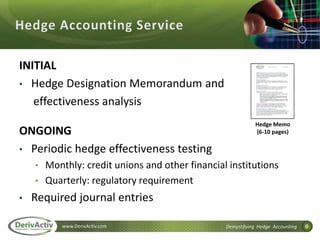

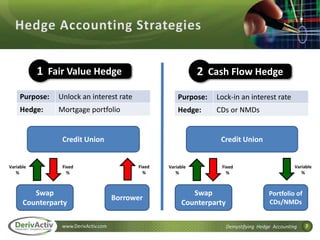

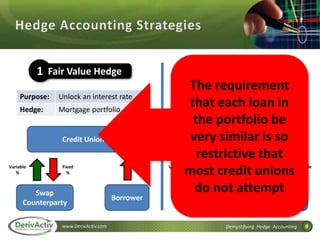

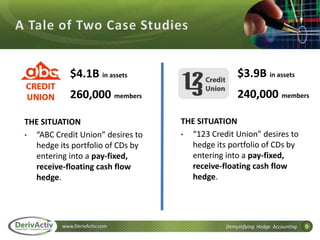

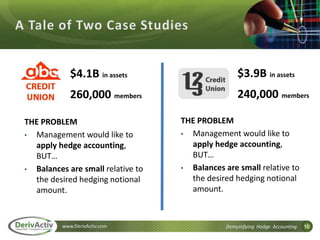

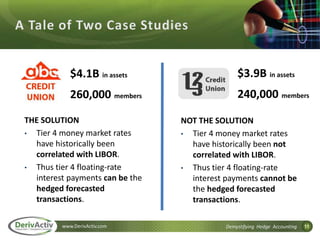

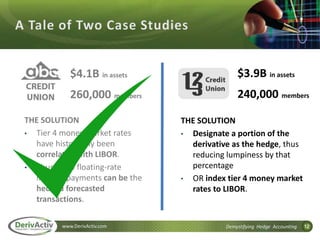

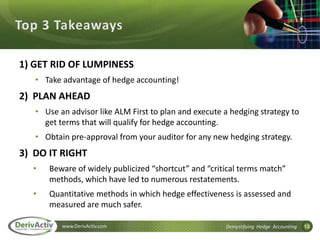

The document discusses hedge accounting strategies for credit unions, presenting case studies of two credit unions - ABC Credit Union and 123 Credit Union - that were seeking to hedge their portfolios of CDs against interest rate risk using cash flow hedges, and the different solutions for qualifying for hedge accounting based on the historical correlation of their balances to the hedge instrument benchmark rate. Key takeaways include using an advisor to properly plan and execute hedging strategies that qualify for hedge accounting, obtaining auditor approval, and ensuring hedge effectiveness is quantitatively assessed.