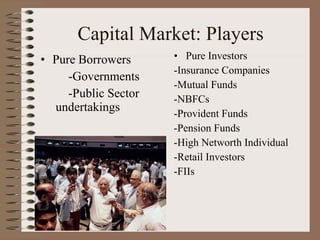

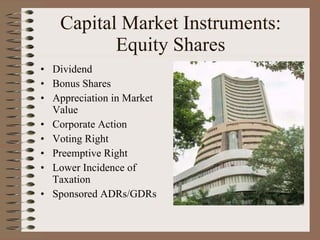

This document discusses treasury products in India, including money market instruments like treasury bills, repo/reverse repo, certificates of deposit, and commercial paper. It also discusses capital market instruments like equity shares, preference shares, and various types of debt securities. The primary market for equity shares involves either a fixed price offer or book building process. Various entities are involved in the money market as players, including the central government, public sector undertakings, insurance companies, and banks. Pure borrowers and lenders as well as entities that are both borrowers and lenders participate in the capital market.