This document reviews 3 articles on hedge accounting:

1) SFAS 133 hedge accounting numbers were less associated with market values than alternative matching methods. Accelerating gains/losses recognition generated numbers more associated with equity values.

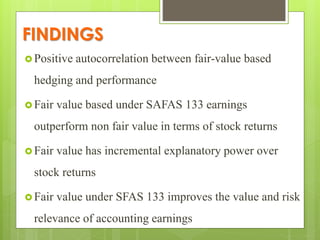

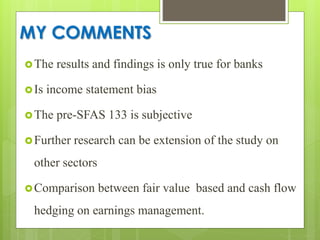

2) SFAS 133 fair value accounting improved banks' earnings' explanatory power for stock returns versus non-fair value.

3) Transparent hedge disclosures under SFAS 161 attracted new airline competitors and positively impacted stock returns. Competitors used disclosures in market decisions.