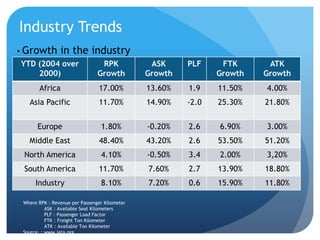

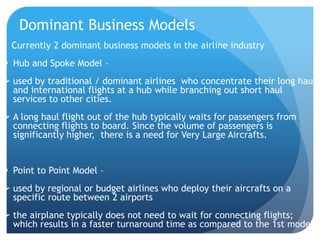

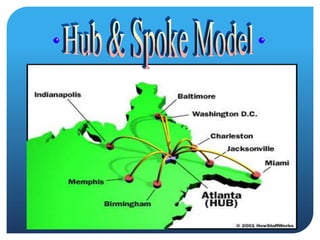

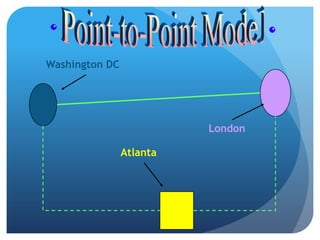

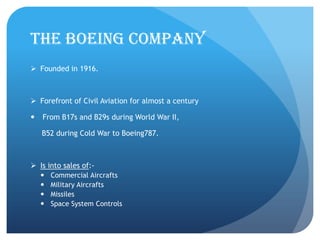

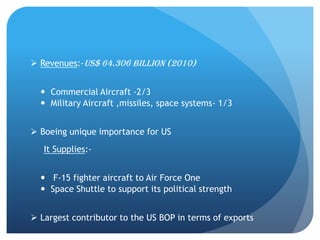

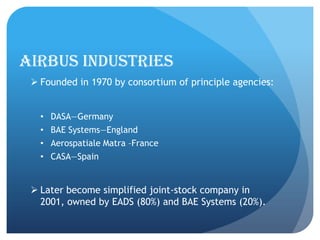

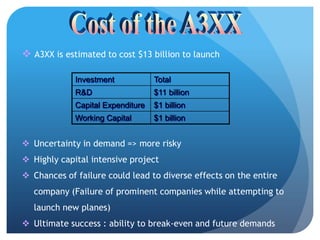

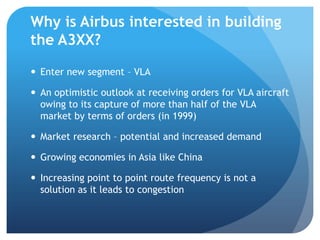

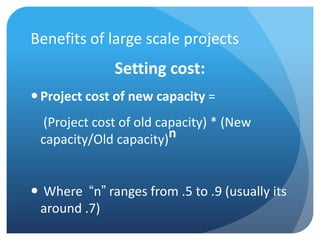

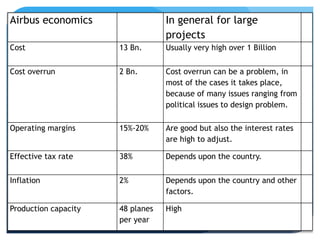

The document discusses the development of the Airbus A3XX, the world’s largest commercial jet, and the competitive nature of the airline industry. It outlines industry trends, dominant business models, and the significance of both Airbus and Boeing within the market. Additionally, it addresses the financial implications, objectives, and challenges associated with launching large-scale aircraft projects in aviation.