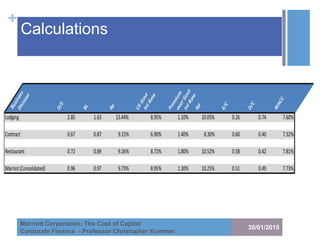

This document discusses Marriott Corporation's calculation of the weighted average cost of capital (WACC) for its three divisions: lodging, restaurants, and contract services. It outlines the steps taken to determine the cost of equity using the CAPM model and leverage betas using Hamada's equation. It also discusses determining the cost of debt based on company debt premiums over government interest rates. The WACC is then calculated using the costs of equity and debt and weightings based on the capital structure. The WACC is calculated to be 7.60% for lodging, 7.32% for restaurants, 7.81% for contract services, and 7.73% for Marriott Corporation overall.

![+

Betas

Beta was re-levered for each division

using Hamada's equation and the

appropriate capital structure for the

division.

30/01/2015

Marriott Corporation: The Cost of Capital

Corporate Finance - Professor Christopher Kummer

BL = BU * [1 + (1-T) * D / E]](https://image.slidesharecdn.com/869755ee-8451-4404-87d7-f19ee5dccb50-150130154420-conversion-gate01/85/Marriot-Corp-Case-10-320.jpg)