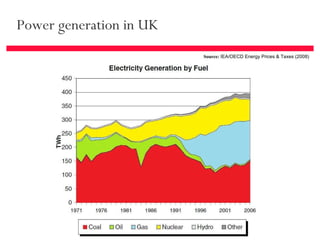

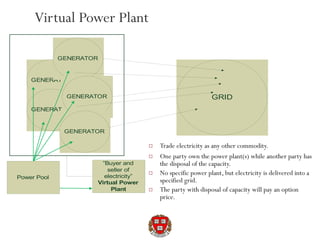

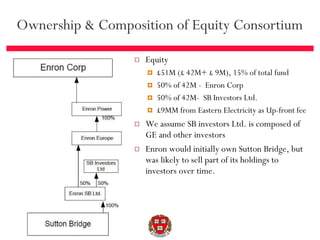

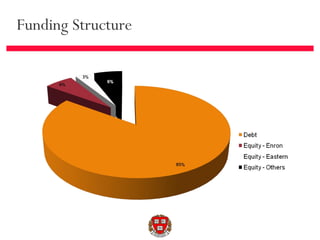

The document summarizes a project to build the Sutton Bridge Power Project, a 790 MW natural gas-fired power plant in the UK. A consortium including Enron and GE planned to invest over £300 million in the project. Enron would take on construction and market risks, while GE guaranteed turbine performance. The project involved tolling agreements with Eastern Electricity for 15 years and was expected to generate over £250 million in net present value over 15 years based on financial projections. The project demonstrated innovation in operating without long-term power purchase agreements.