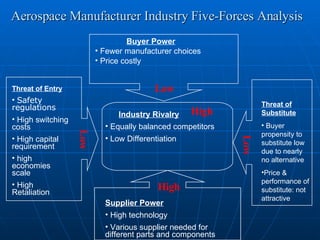

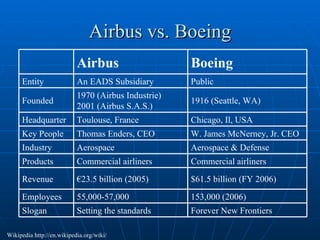

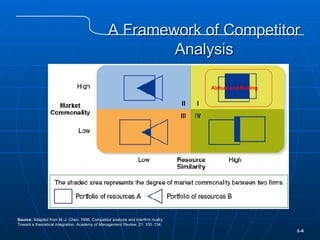

- The document analyzes Airbus A380 and its position in the aerospace industry using Porter's five forces model and discusses Airbus' core competencies, business strategy, and recommendation to proceed with building the A380.

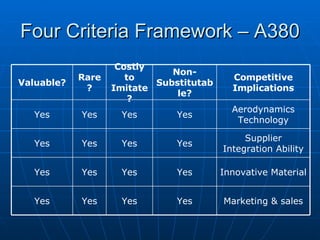

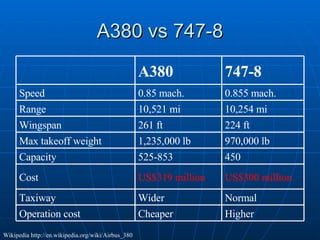

- It finds that the A380 can help Airbus gain market share in large aircraft by replacing the Boeing 747, utilizing Airbus' strengths in areas like innovative materials, aerodynamic design, and supply chain management.

- Proceeding with the A380 production is recommended to expand Airbus' product range and take advantage of growing demand for fuel-efficient, high-capacity aircraft.