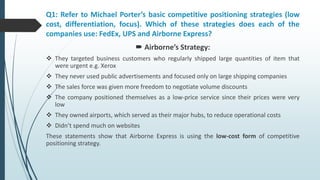

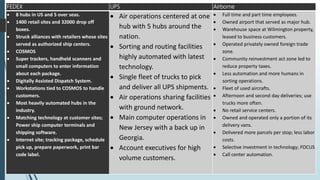

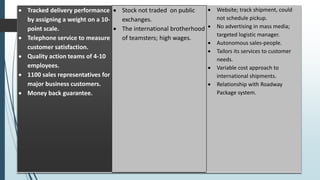

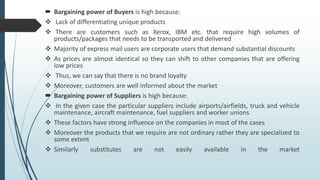

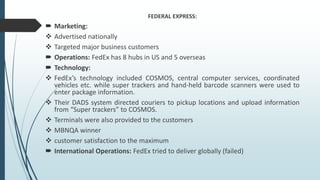

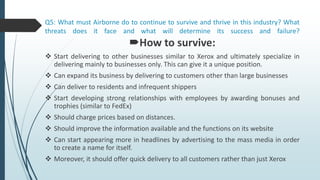

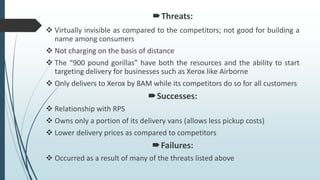

Airborne Express uses a low-cost competitive strategy focused on large business customers shipping urgent, high volumes of items. It owns airports as hubs to reduce costs and targets customers like Xerox. To survive, Airborne must expand its customer base beyond large businesses, improve its website, advertise more widely, and match competitors' quick delivery times for all customers. Its distinctive capabilities include low prices and relationships with partners, but it faces threats from larger competitors targeting its niche and from not charging based on distance.