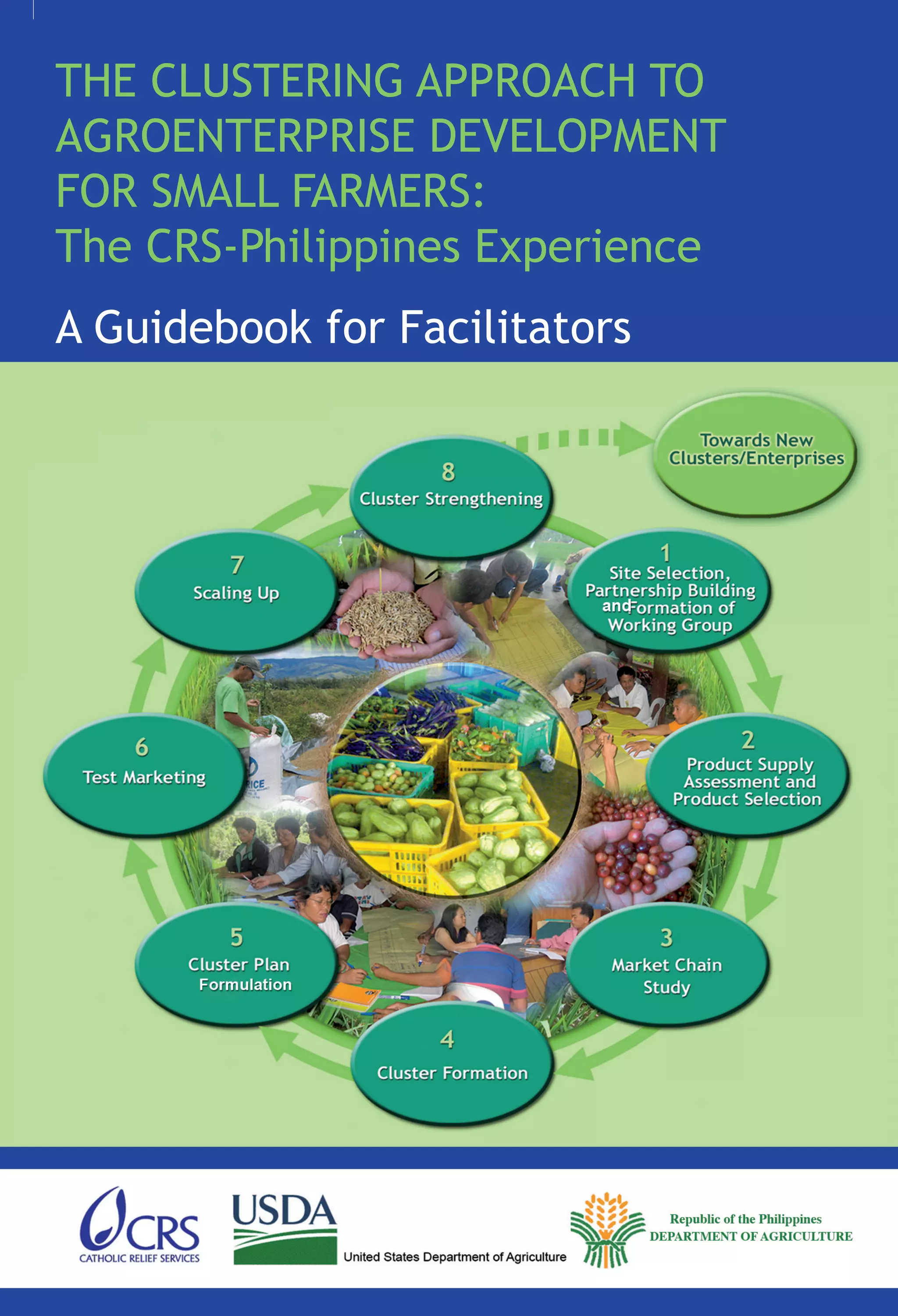

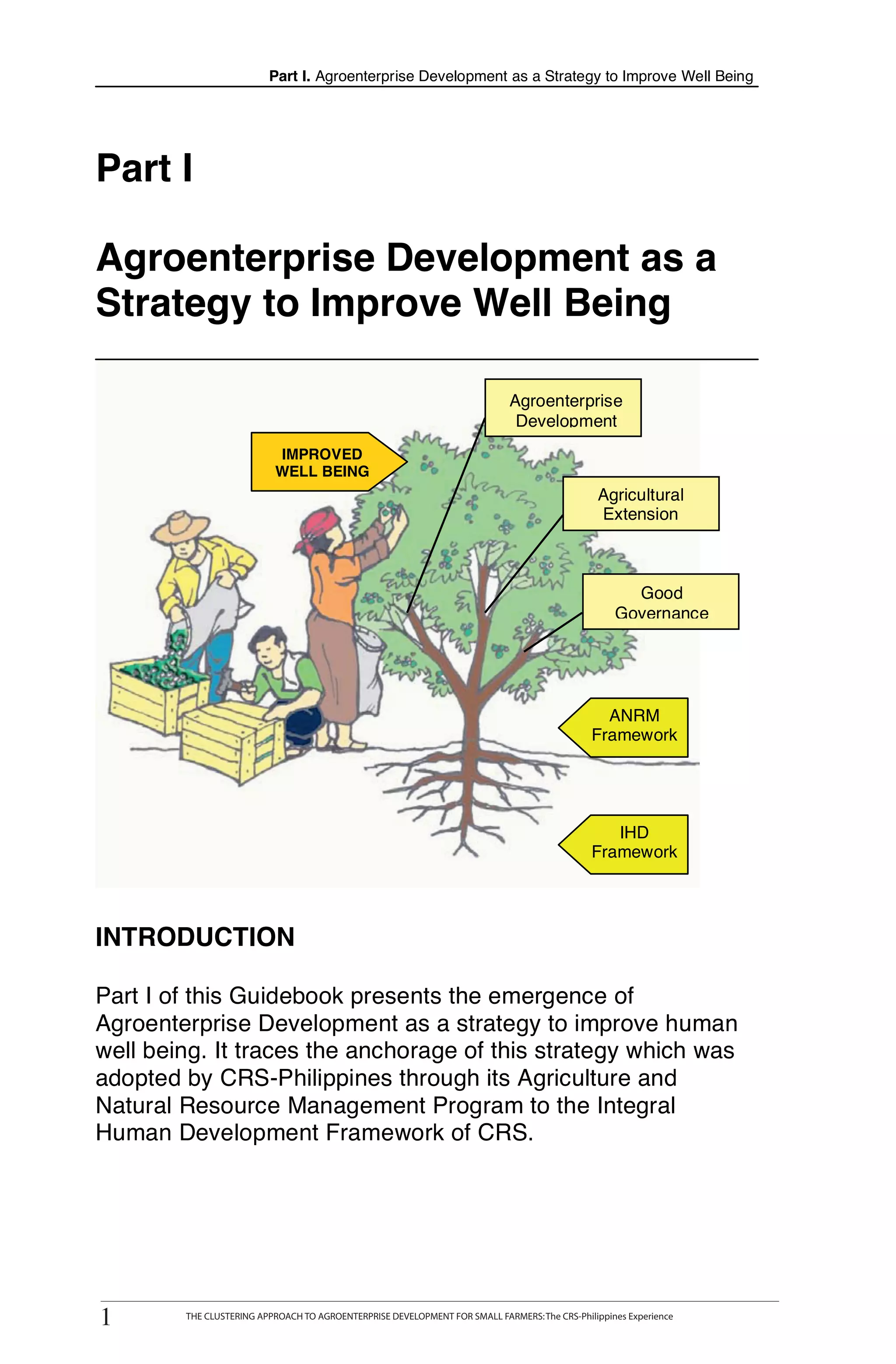

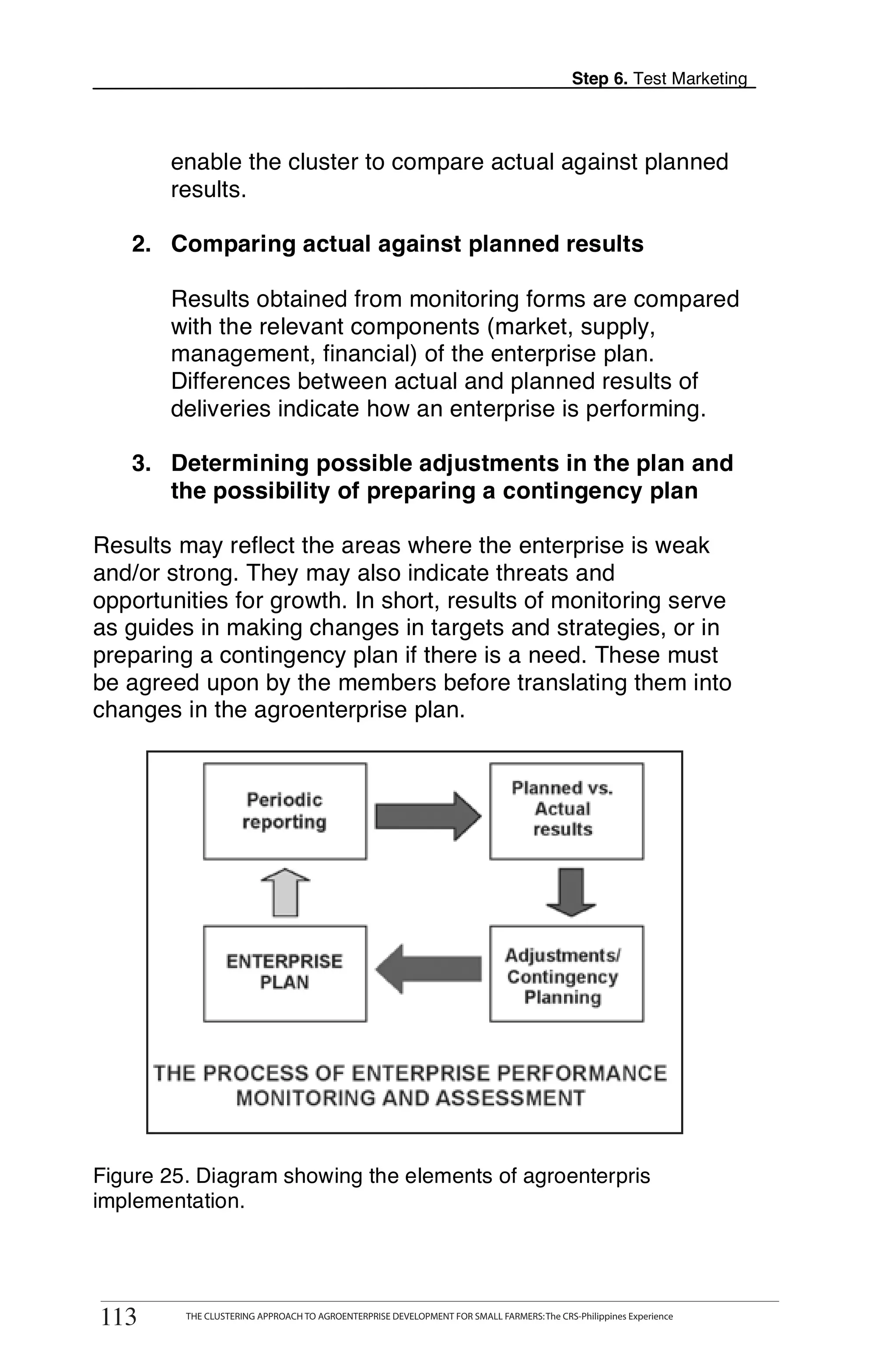

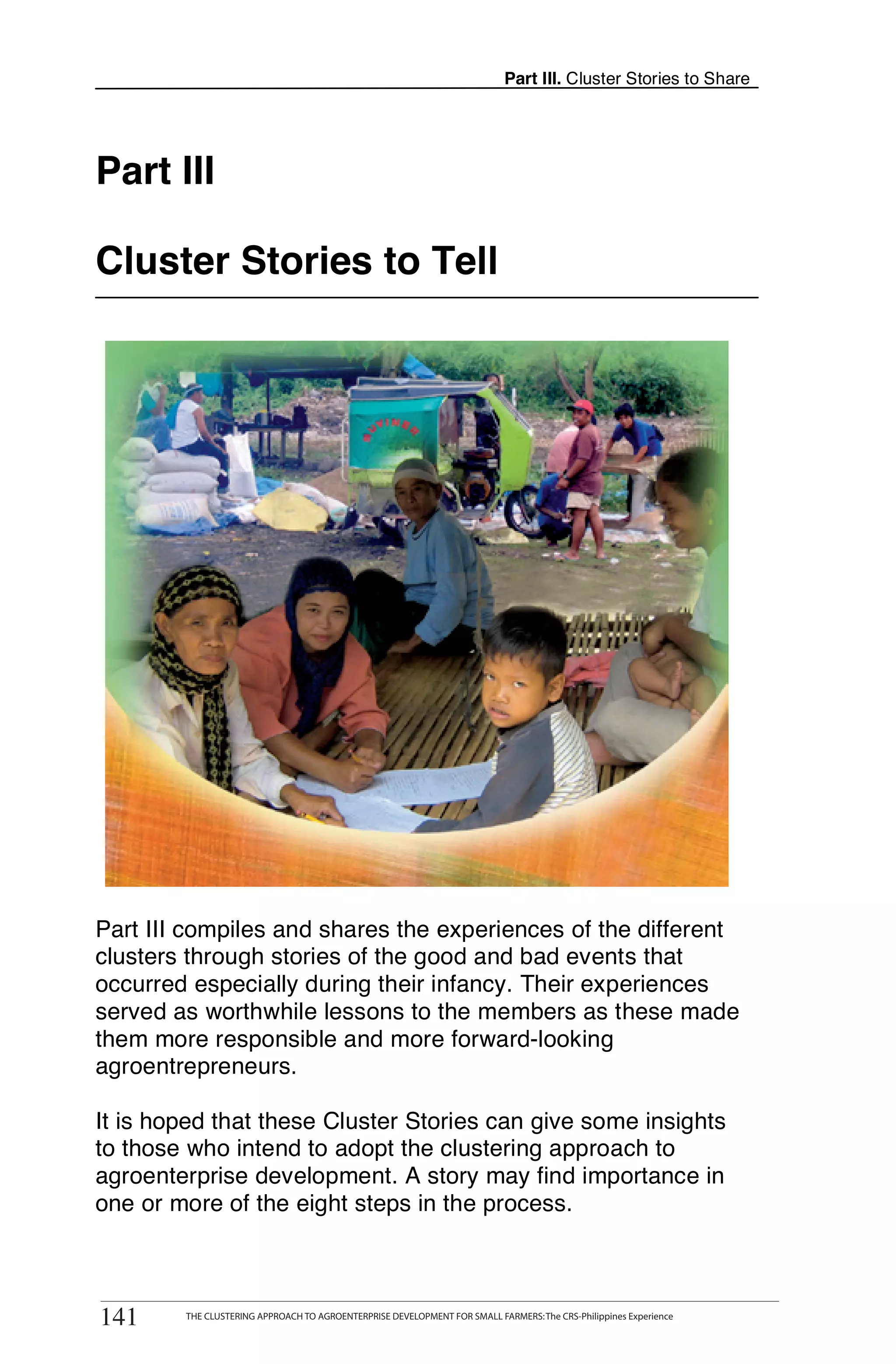

The document is a guidebook for facilitators focused on the clustering approach to agroenterprise development for small farmers in the Philippines, designed to enhance their market participation and income. It outlines an eight-step participatory process that empowers farmers by forming clusters to collaboratively engage in the market. The guide also emphasizes the importance of partnerships among farmers, NGOs, and local government to create innovative supply chains and improve the livelihoods of small farmers.

![Preface

Over the past several years, a new trend in the marketing of

agricultural produce has emerged driven by the increasing

population of urban consumers with higher incomes and

dynamic lifestyles. The increase in the demand for high quality

and safe produce, coupled with the want for leisure and

convenience, gave rise to the rapid growth of supermarkets,

quick service restaurants and food manufacturers/processors.

Globalization, which made it easier to move a variety of high

quality products across geographical areas, has fueled this

demand and contributed to this dramatic change in the

markets.

With funding support from the United States Department of

Agriculture – Food for Progress Act of 2004, Catholic Relief

Services (CRS) Philippines started implementing in mid 2004

the Small Farms Marketing Project (SFMP) in the following

provinces of Mindanao: Bukidnon, Compostela Valley,

Maguindanao, Zamboanga Sibugay and the upper watershed

of Davao City. All CRS agriculture and natural resource

management programs are guided by the following six

principles: [1] Work with farmers as partners; [2] Treat farming

as a family business, acknowledging that rural communities

are linked to markets and that farm families need income for

off-farm products and services; [3] Focus on farming systems,

supporting diverse production - crops, livestock, trees and

fish; [4] Promote agricultural practices that do not deplete or

damage resources, linking production to conservation; [5] Use

watershed approaches, fostering cross-community

collaboration for resource protection, natural disaster

mitigation, and upstream/downstream cooperation to meet

competing water needs; and [6] Ensure immediate benefits;

invest in long-term production.

CRS Philippines, through the Small Farms Marketing

Project, has organized small farmers into marketing clusters

xiv

xiv](https://image.slidesharecdn.com/agroenterpriseguidebook-120215124226-phpapp02/75/Agroenterprise-Guidebook-16-2048.jpg)

![SFMP

The Small Farms Marketing Project (SFMP) is a three-year program

(2004-2007) funded through the USDA Food for Progress Program

monetization. The SFMP aims to improve the livelihoods of 3,500 resource-

poor upland farmers in Mindanao by increasing the productivity of

marketable horticultural crops in small farms and by improving the efficiency

of domestic market chains for these products. CRS will support farmers

through (a) agriculture extension, (b) marketing assistance, (c)

infrastructure projects, and (d) by funding natural resource conservation

projects to promote the sustainability of agricultural development efforts.

The overall objectives of the program are:

[1] Increased on farm incomes for rural households; and

[2] Community-based environmental and conservation initiatives that lead

to improved natural resource management.

Program Components and Strategy

1. Agricultural Extension: Enhancement of farm productivity through

extension services assisting farmers to reduce their production costs

and risks and to maximize the production of quality marketable

produce.

2. Marketing Assistance: Identification of crops meeting consumer

demand and preferences through a farmer generated Productivity

Agenda; Marketing assistance in research and farmer-to-market

training designed to link farmers more efficiently to the domestic fruit

and vegetable supply chain.

3. Rural Infrastructure: Access to rural infrastructure inputs including post-

harvest handling and other equipment for activities promoting the

economic potential of farmer communities.

4. NRM/Landcare for Watershed Management: Improvement of on-farm

conservation in critical watershed areas allowing for sustainable

production and support to livelihoods.

CRS, its partners, and rural people are engaged in advocacy initiatives for

favorable agriculture and NRM policies at the local, national and

international level; and collaboration among diverse groups to clarify and

uphold shared rights and responsibilities over public and private resources

thru good local governance.

Approaches

The Agri/NRM program and its partners continue using well-tested

participatory rural and agro-enterprise development methodologies such as

COPAR (Community Organizing through Participatory Action Research),

the Territorial Approach to agroenterprise development and Integrated

Watershed Management.

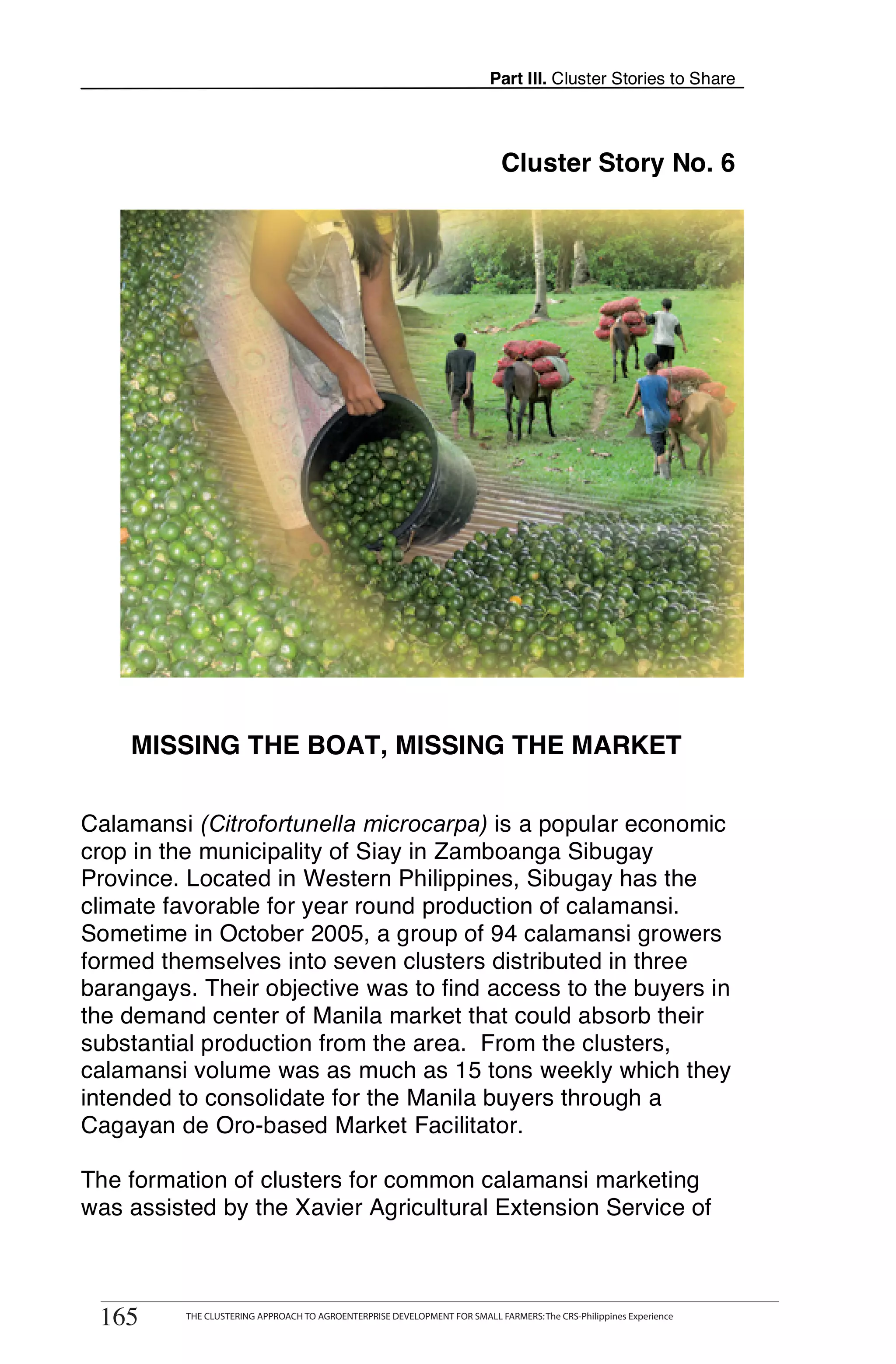

187 THE CLUSTERING APPROACH TO AGROENTERPRISE DEVELOPMENT FOR SMALL FARMERS: The CRS-Philippines Experience](https://image.slidesharecdn.com/agroenterpriseguidebook-120215124226-phpapp02/75/Agroenterprise-Guidebook-214-2048.jpg)