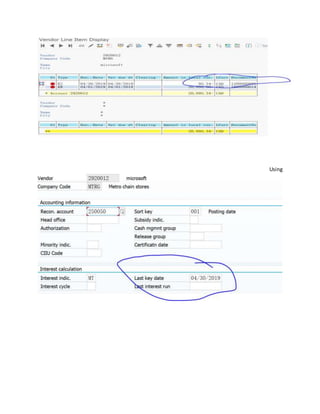

1) The document discusses configuring and calculating interest for open items, customers, and vendors in SAP GL.

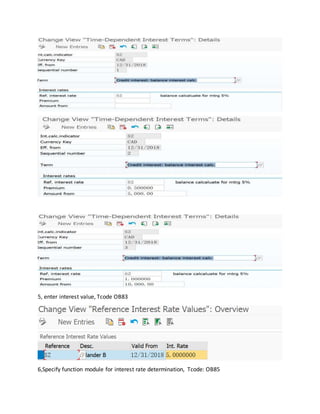

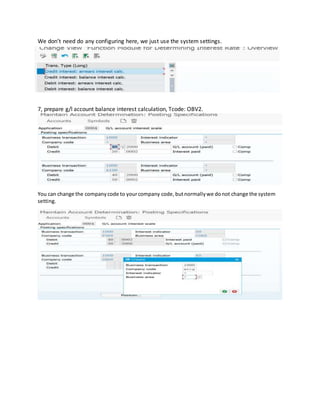

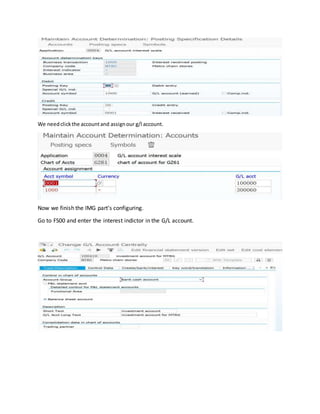

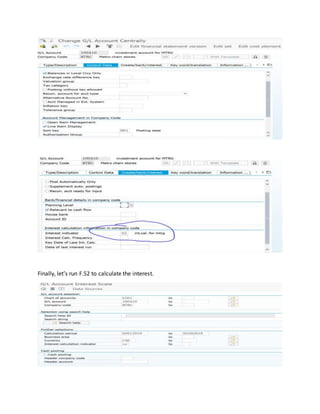

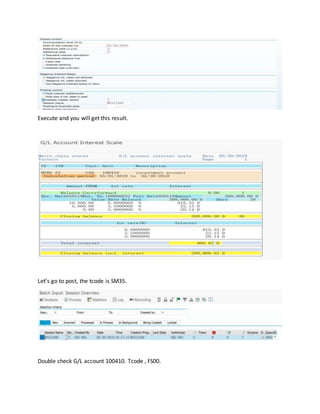

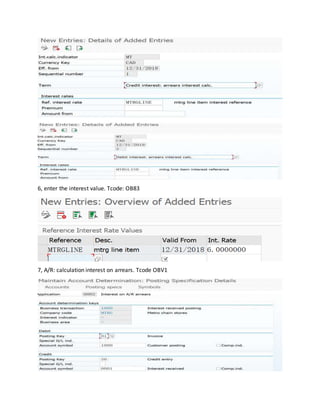

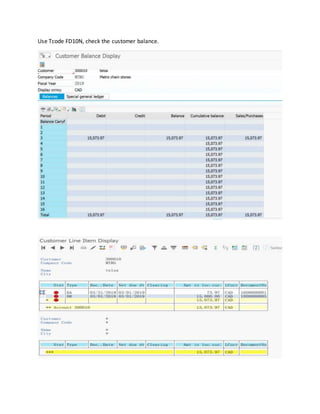

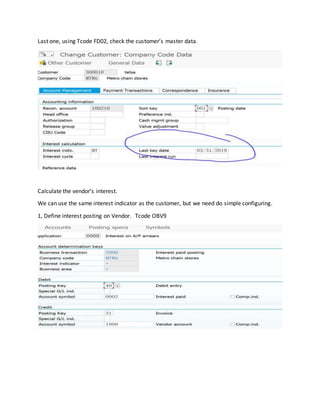

2) It provides steps for configuring account, customer, and vendor interest calculation types and rates, as well as instructions for making postings, running interest calculation programs, and verifying results.

3) Configuration is done using transaction codes OB46, OBAA, OBAC, OB81, OB83, OB85, OBV2, FD01, FK01, and posting and calculation is done using FB50, FB60, FB70, F.52, F.24, F.47.