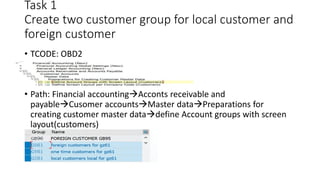

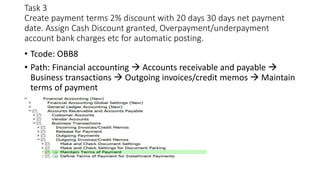

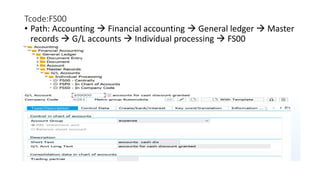

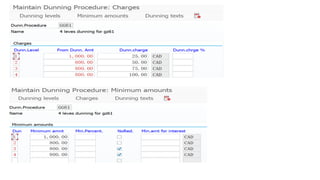

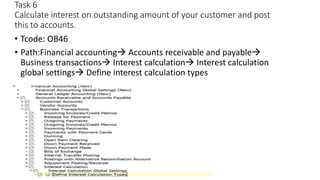

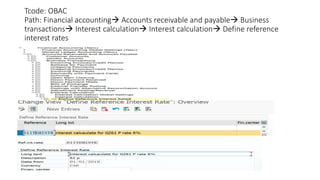

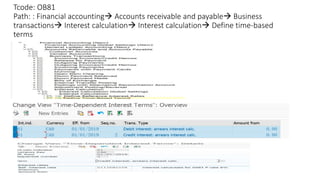

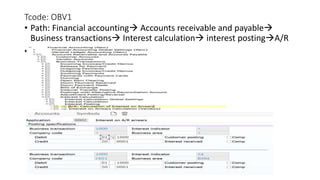

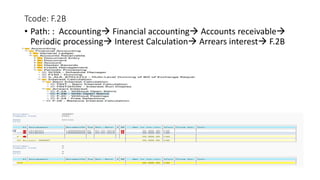

The document outlines tasks for setting up a project in FI AR (financial accounting accounts receivable) including: 1) Creating customer groups and defining required fields; 2) Setting up payment terms for discounts; 3) Assigning accounts for cash discounts and payments; 4) Entering documents like invoices and payments; 5) Creating dunning programs; and 6) Calculating interest on outstanding amounts and posting to accounts. It provides transaction codes and navigation paths for completing each task.