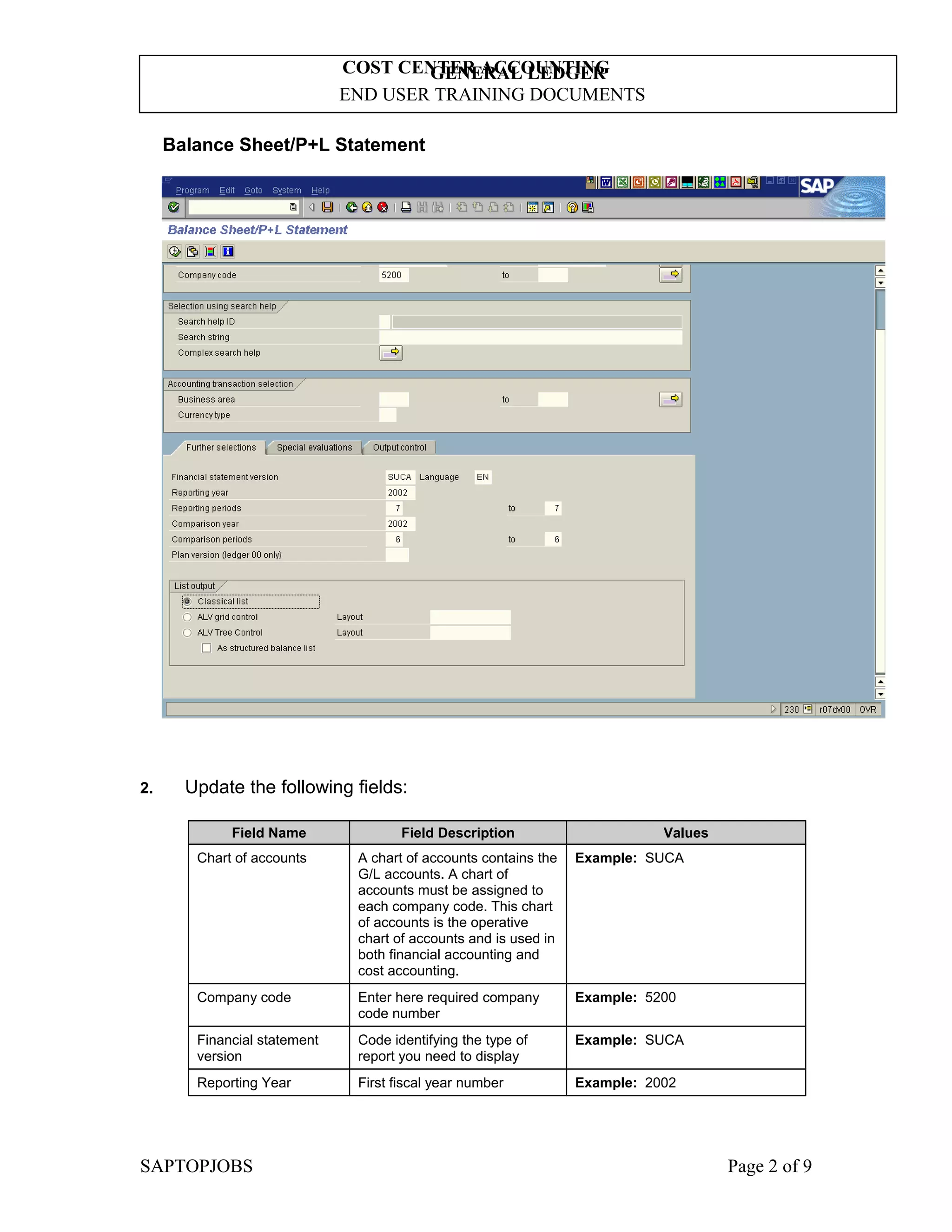

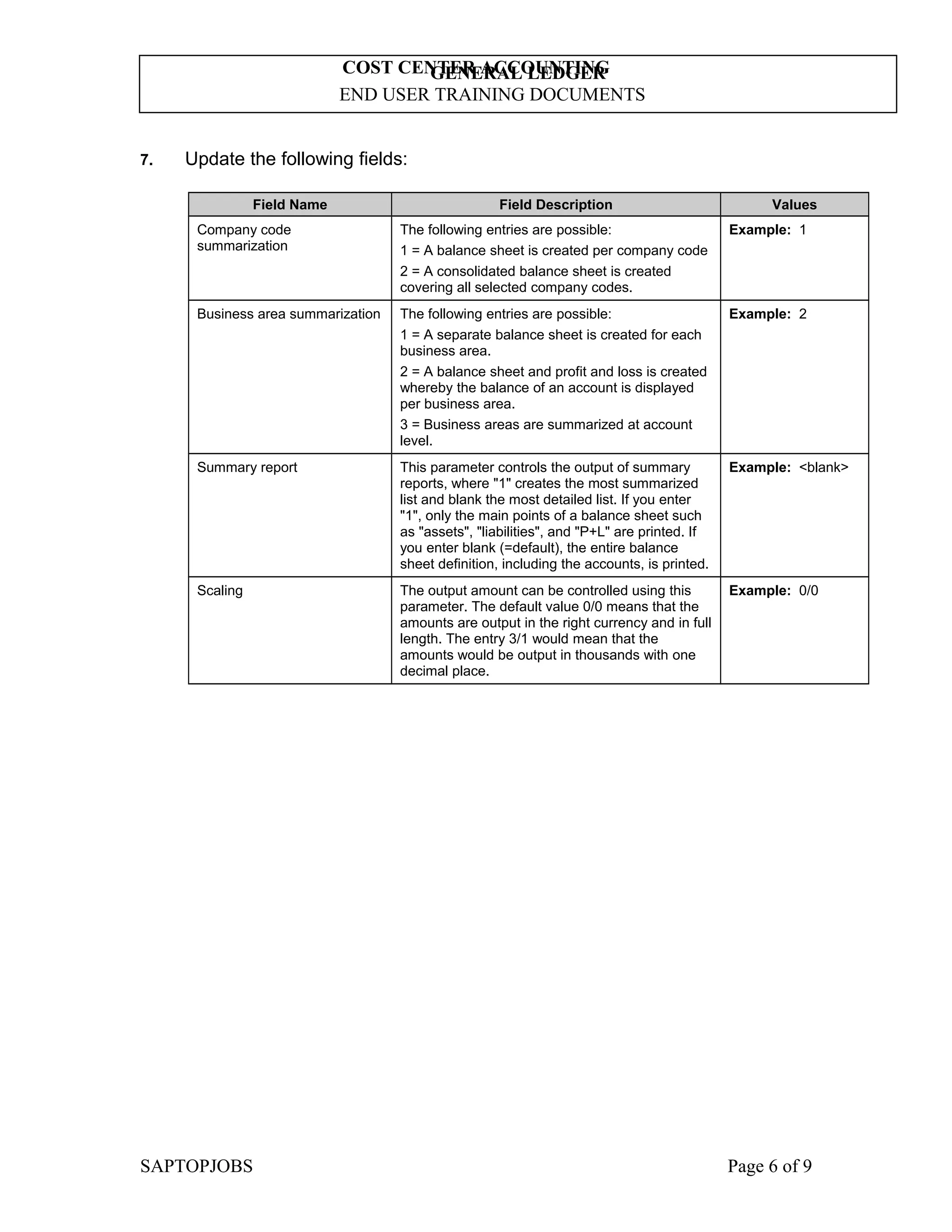

This document provides instructions for generating a financial statement report in SAP for a specified company code and time period. It describes how to run transaction code S_ALR_87012284 to generate a balance sheet and profit and loss statement. Key steps include defining the financial statement version, entering the company code, reporting year and periods, and making selections for output controls like the balance sheet type and summary report level. The transaction code allows generating the required financial reports.