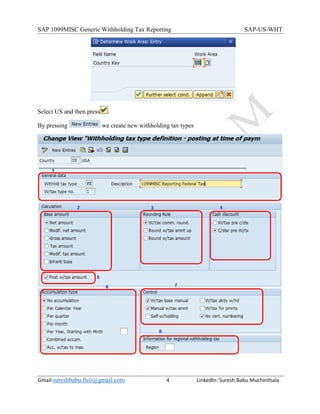

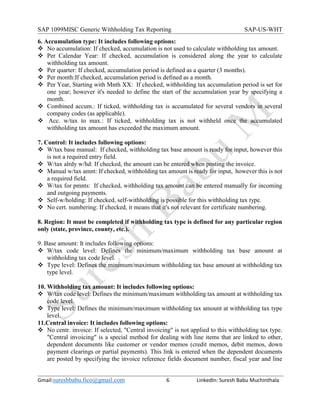

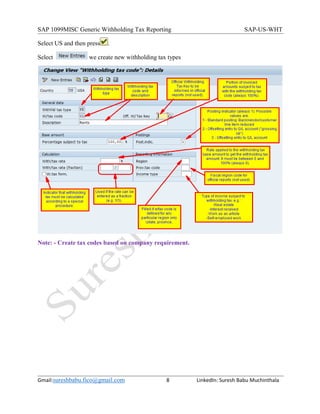

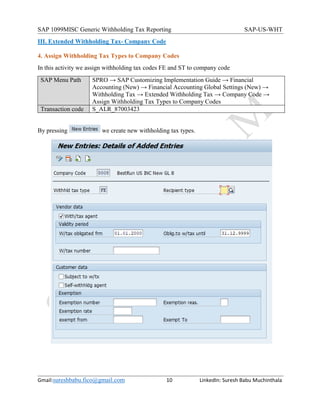

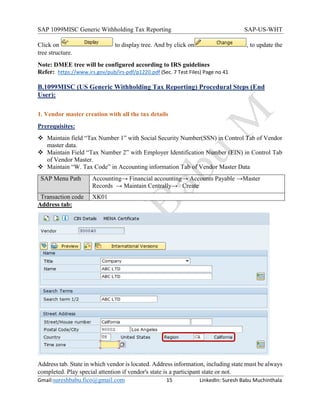

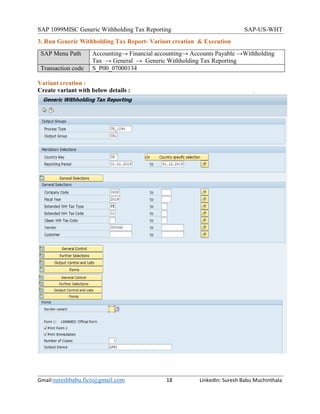

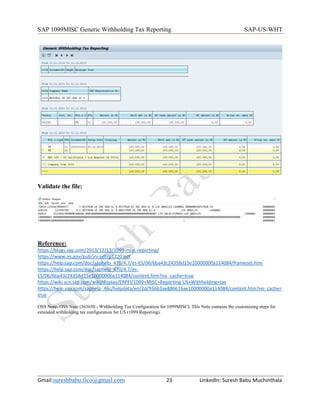

The document discusses SAP's 1099MISC generic withholding tax reporting functionality. It provides steps to configure extended withholding tax types and codes in SAP, and then generate the 1099MISC tax reporting file for the US. Key steps include defining withholding tax types for federal and state taxes, tax codes, recipient types, assigning tax types to company codes, and activating extended withholding tax. It also covers defining output groups and file formats to generate the 1099MISC tax reporting file for the IRS.