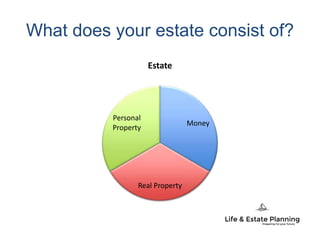

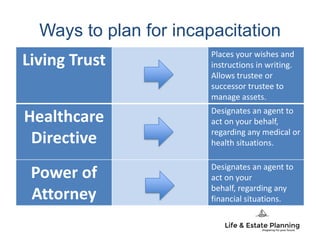

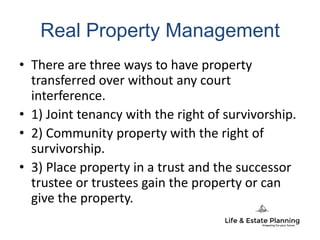

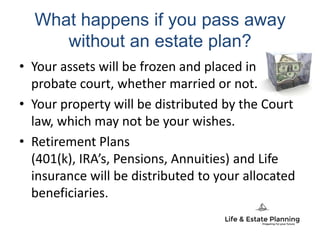

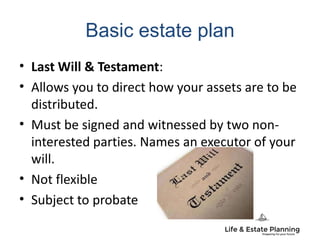

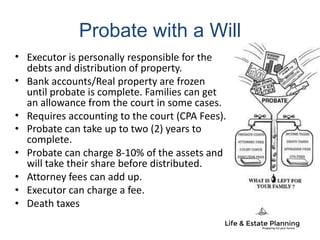

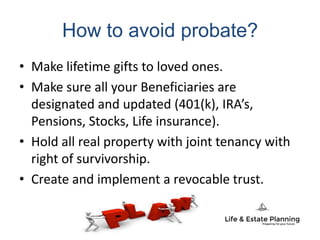

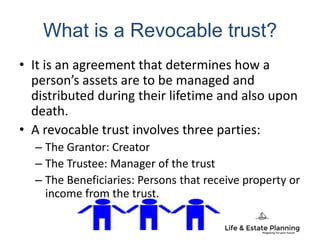

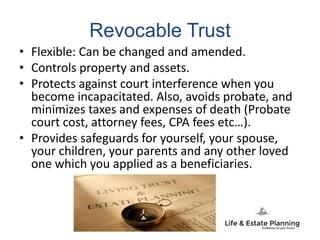

Estate planning benefits everyone, not just the rich, by allowing people to maintain control over their property if they become incapacitated or die. An estate plan such as a living trust or will outlines wishes to avoid disputes and probate court. Without a plan, a court determines how assets are distributed, which may not be the person's wishes. A revocable living trust avoids probate by naming a trustee to manage assets, and is flexible to change over time. Lifetime gifting and estate tax considerations are important parts of a comprehensive estate plan.