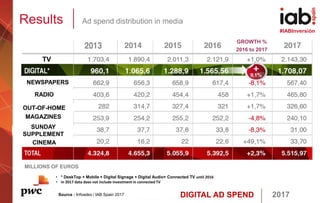

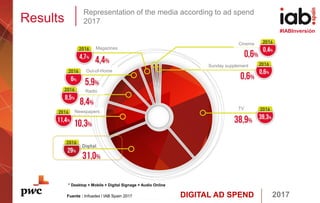

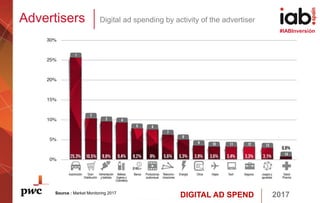

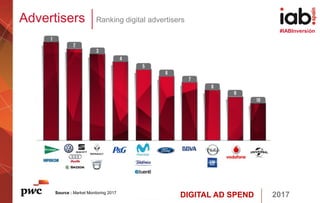

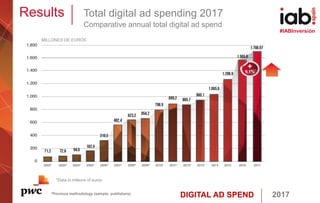

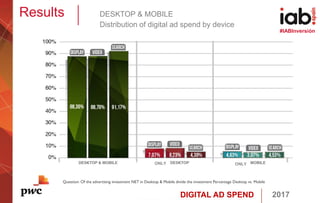

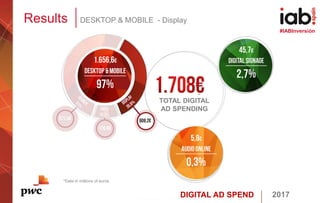

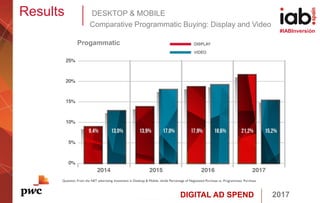

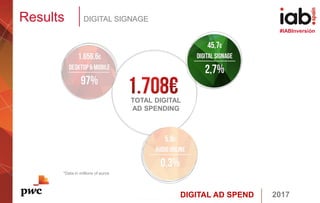

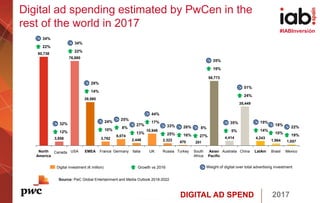

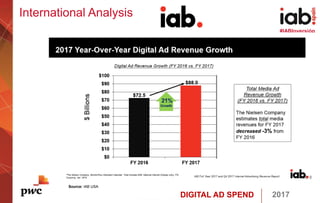

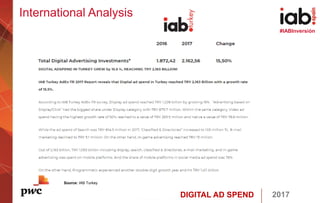

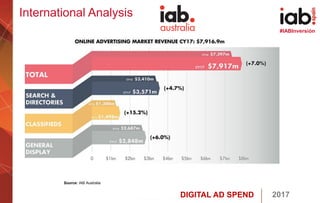

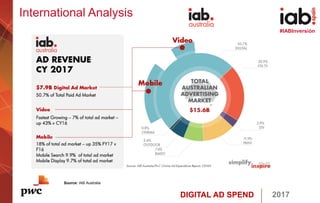

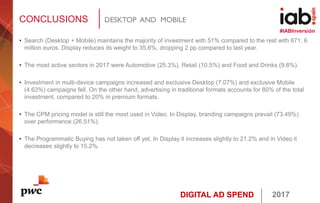

Digital ad spending in Spain grew 9.1% in 2017 to €1,708.1 million, with digital now accounting for 31% of total media spending. Search maintained the majority at 51% while display dropped to 35.6%. The top spending sectors were automotive, retail, and food/drink. Investment increased in multi-device campaigns while desktop and mobile-only campaigns declined. Programmatic buying has not significantly increased, reaching 21.2% for display and 15.2% for video. DOOH grew almost 60% and digital audio was 0.3% of total digital spending. Trends indicate minimum 10% growth, programmatic reaching 25%, and video/native formats increasing share.