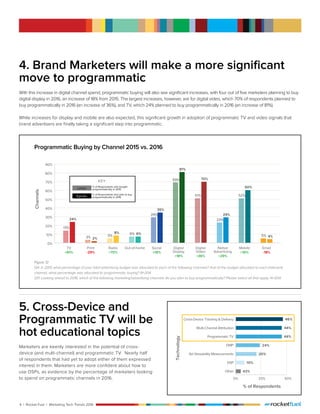

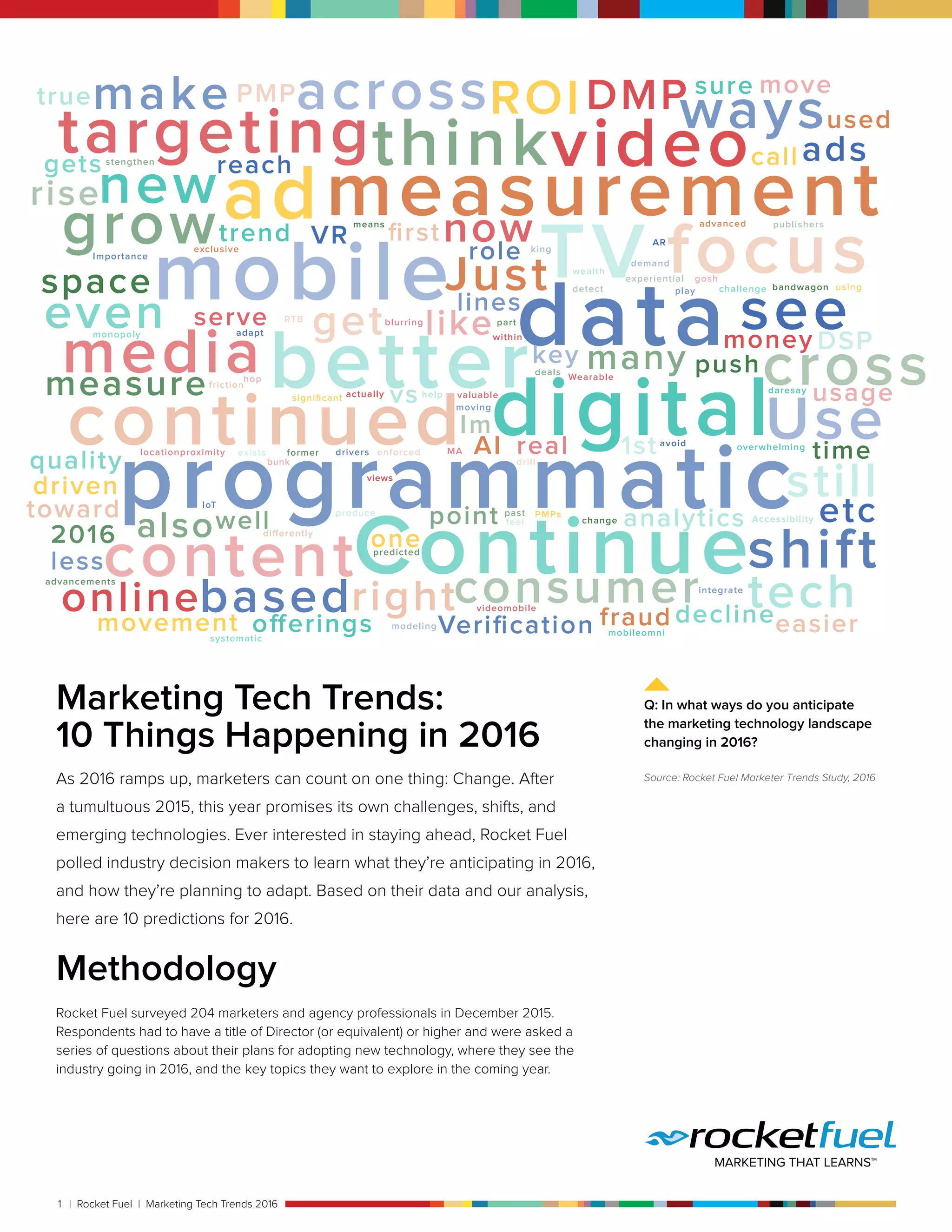

1. The document summarizes 10 marketing technology trends predicted for 2016 based on a survey of 204 marketers.

2. Competition for data analysts and scientists will increase as marketers struggle to manage growing data from multiple tech platforms.

3. Marketers will seek to consolidate their tech platforms to reduce resource demands as the shortage of analysts puts pressure to streamline partners.

![2 | Rocket Fuel | Marketing Tech Trends 2016

1. Competition for

Analysts and Data

Scientists Will Become

[even more] Fierce

The explosion of marketing technology has been a double-edged

sword for marketers. They have access to a trove of new data

across previously unreported channels. But they’re struggling

to analyze it all to produce meaningful insights. When it came to

adopting new technology, respondents frequently listed a lack of

analysts to manage the technology as a key barrier to adoption,

particularly for multi-channel attribution, cross-device delivery/

tracking, and Data Management Platforms (DMPs).

One reason driving the demand for analysts: the ever-expanding

set of platforms being added to marketing technology stacks.

Each new platform adds a new dashboard, new implementation

headaches, and new integration issues, requiring more

experienced analysts to manage the tech and the process

of aggregating data and reporting from across the stack. As

demand for these analysts increases faster than the supply,

competition for good analysts will continue to heat up.

Barriers to adoption

Lack of analysts /

personnel to man-

age the technology

Programmatic TV 15%

Multi-Channel Attribution 20%

Cross-Device Tracking & Delivery 20%

DMP 19%

DSP 13%

Ad Viewability Measurement 16%

2. Marketers Will Seek

to Consolidate Their

Tech Platforms

As marketers compete over analysts, many will find that either

there aren’t enough to go around or they are they are pushing

up against budgetary constraints. While a majority of marketers

and advertisers generally prefer to buy best-in-class solutions,

even if it means working with multiple vendors (51%)1

, the

shortage of analysts to manage each new vendor solution will

put pressure on those marketers to consolidate their partners.

These marketers will seek technology partners that offer a

wider variety of solutions, such as data management, media

delivery, and cross-channel optimization, as a way to reduce

the resource demands of their tech stack. Similarly, although

most marketers prefer self-service tools1, the data analyst

shortage means marketers will find themselves evaluating

more full-service solutions for their tech needs.

1 Industry Index DMP Insight Report, May 2015](https://image.slidesharecdn.com/cc963104-e218-4c02-939c-7e3d749a68b3-160506174527/85/Marketing_Tech_Trends_2016_V4-2-320.jpg)