This document provides an overview and analysis of programmatic advertising. It discusses:

- Programmatic advertising currently represents less than 4% of total ad spending but is growing rapidly, especially in digital formats like display advertising.

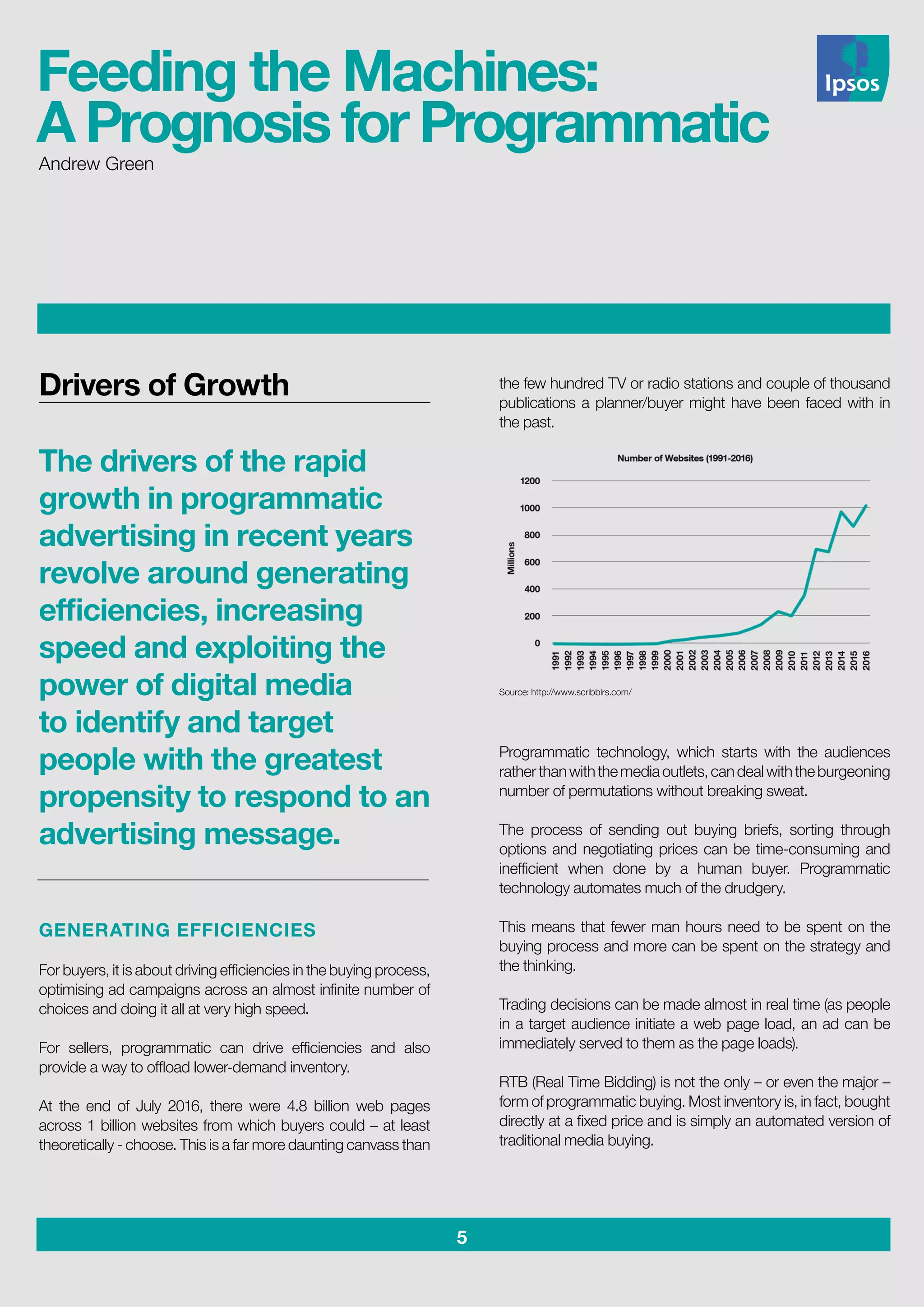

- The key drivers of programmatic advertising's growth are its abilities to generate efficiencies in the buying process, precisely target audiences, and operate at high speeds.

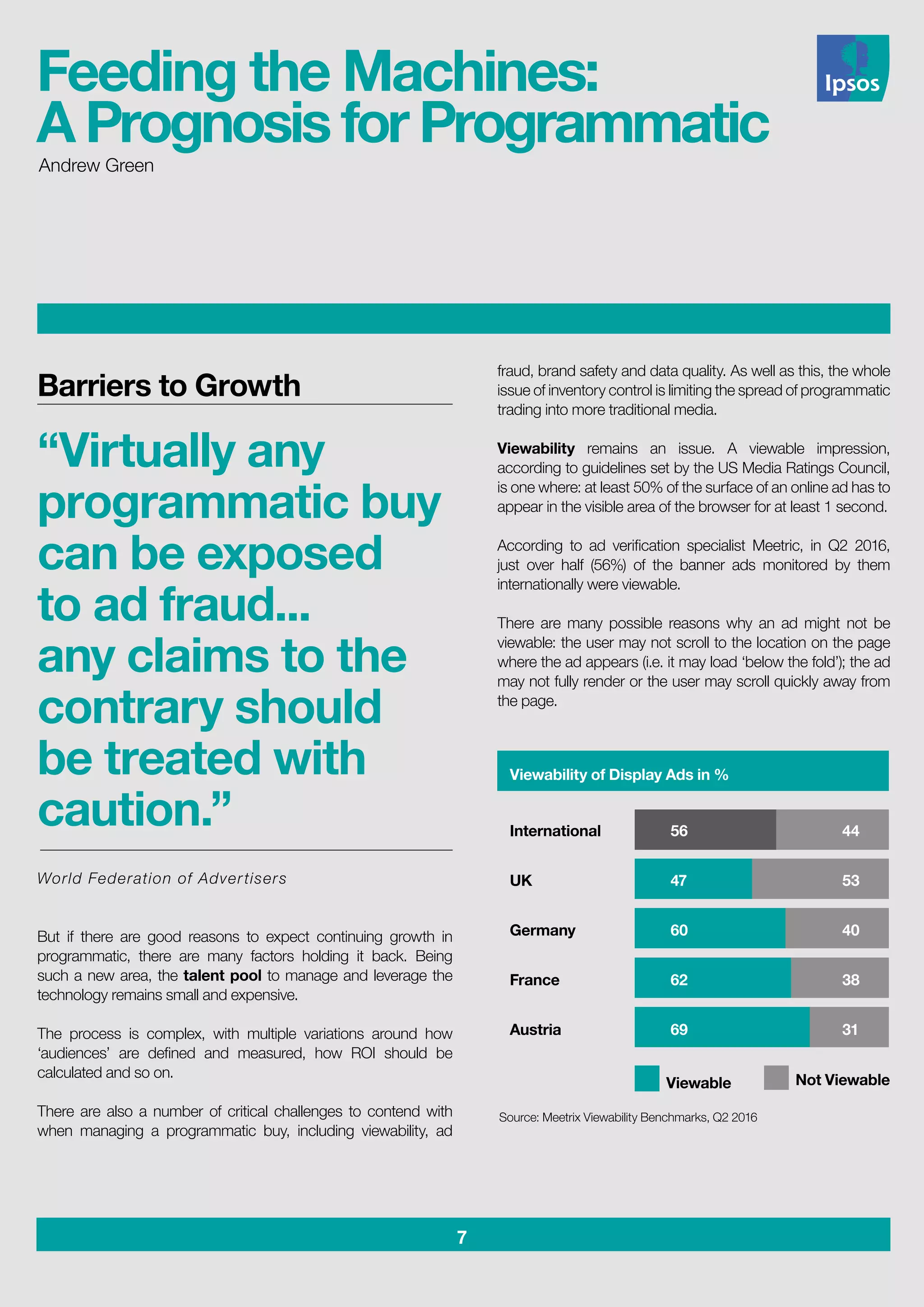

- However, programmatic advertising still faces barriers like viewability issues, ad fraud, lack of skilled talent, and challenges integrating with more traditional media inventory. Addressing these problems will be important for its continued expansion.