Embed presentation

Downloaded 18 times

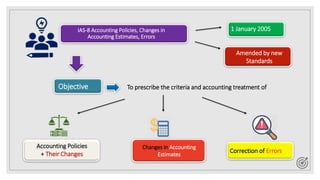

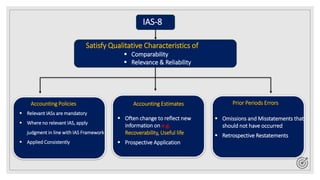

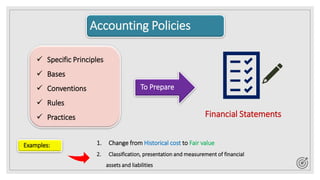

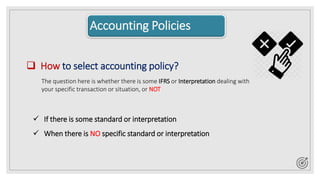

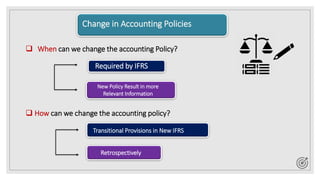

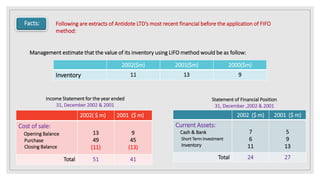

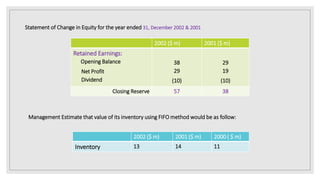

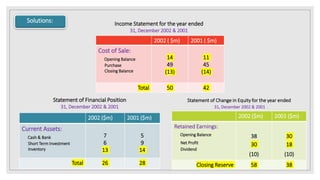

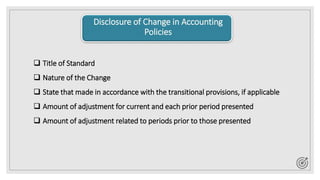

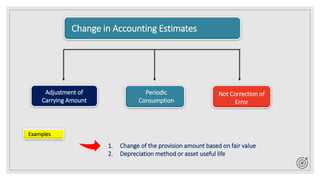

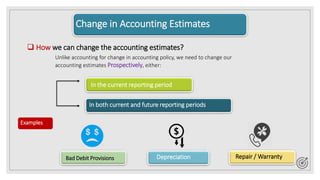

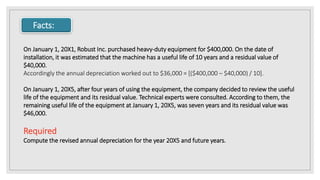

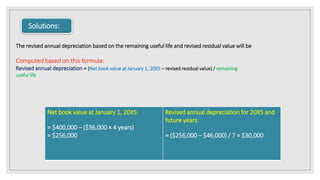

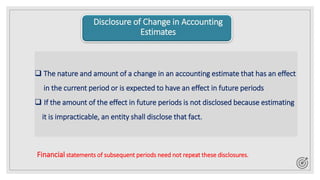

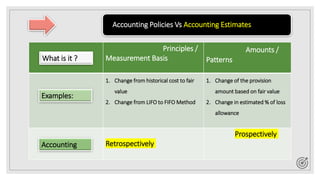

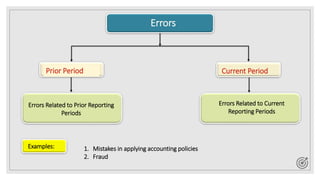

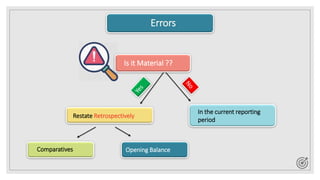

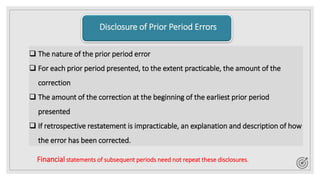

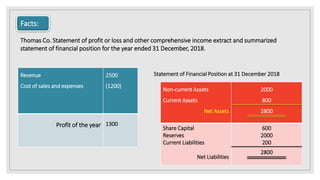

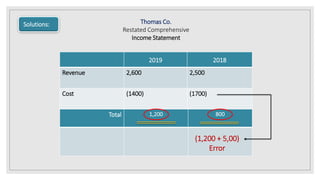

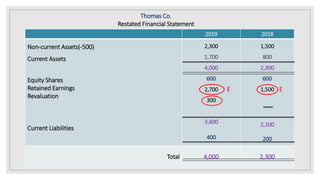

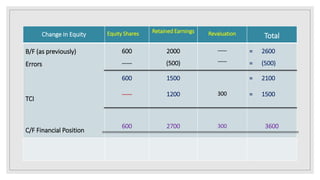

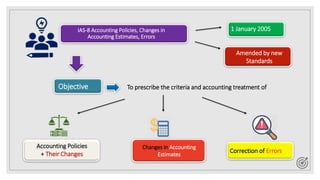

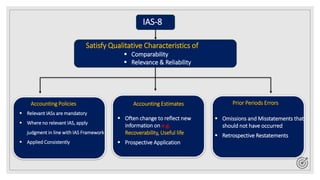

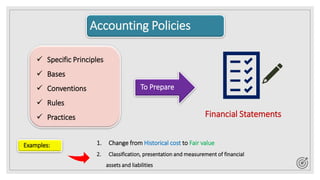

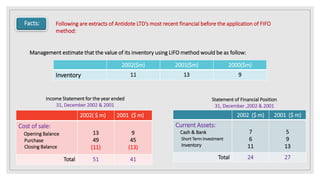

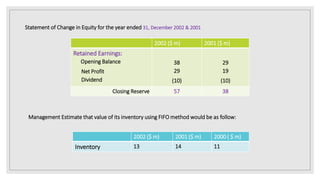

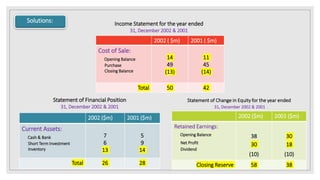

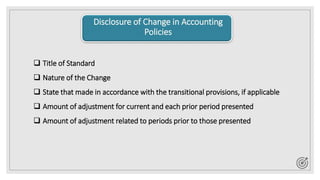

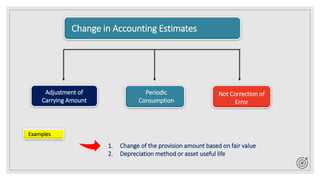

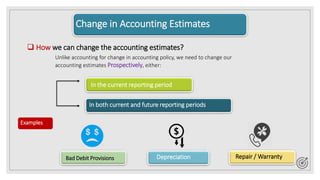

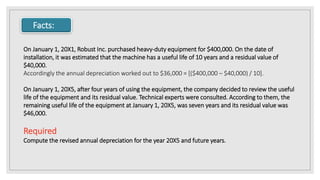

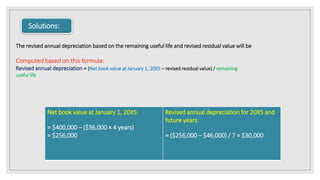

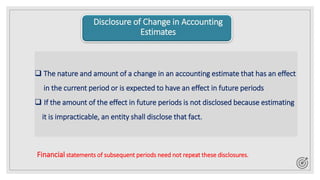

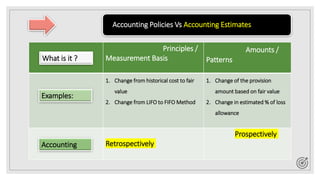

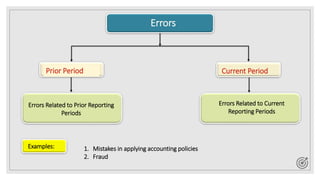

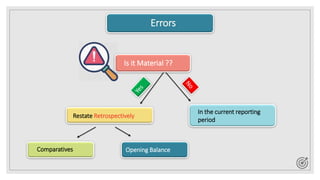

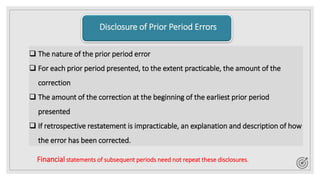

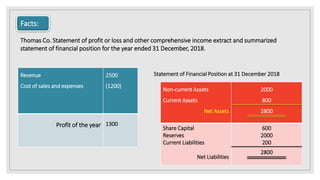

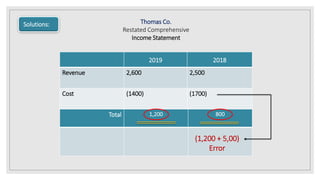

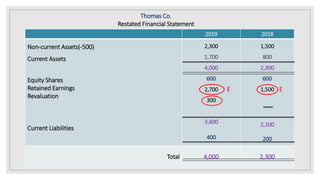

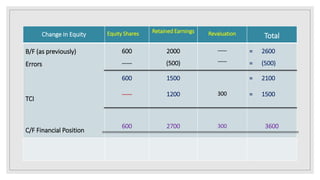

This document presents an introduction to a presentation on IAS 8 Accounting Policies, Changes in Accounting Estimates, and Errors. It lists the names and IDs of the presentation team members and provides an overview of the objectives and requirements of IAS 8. It discusses accounting policies, changes in estimates, and errors, including examples. It also includes sample financial statement extracts and solutions to demonstrate the accounting treatment for changes in policies, estimates, and corrections of prior period errors.