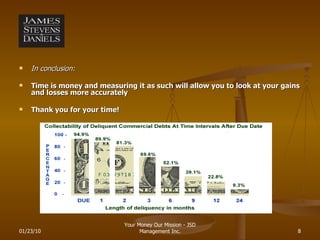

The document discusses strategies for optimizing accounts receivable (A/R) management. It outlines benefits like reducing bad debt risks by 20-50% and generating 10-40% of receivables in cash. Best practices include having senior management commitment, accurate order fulfillment, consistent collection processes, and using metrics and technology. A case study shows how a $1.5B manufacturer improved A/R management, releasing $45M in cash and reducing DSO from 47 to 36 days.