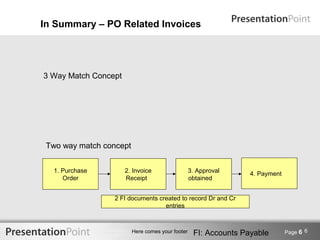

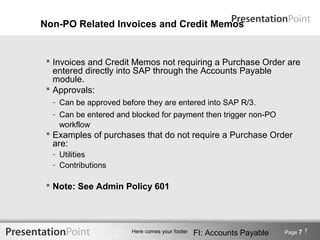

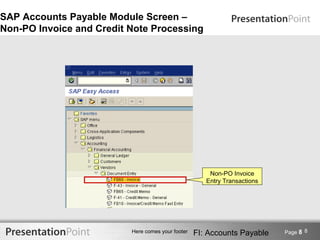

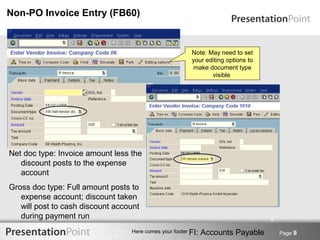

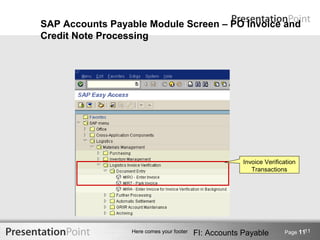

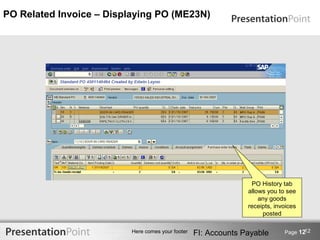

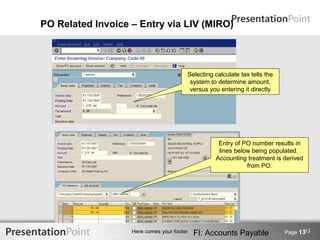

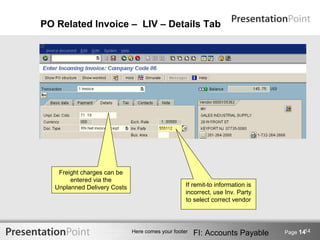

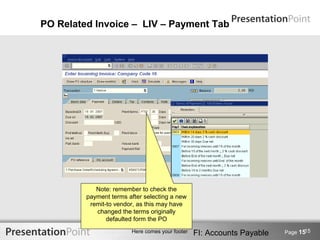

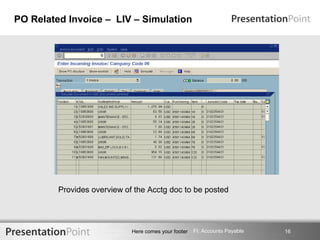

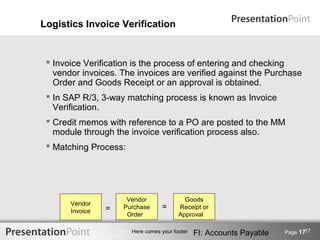

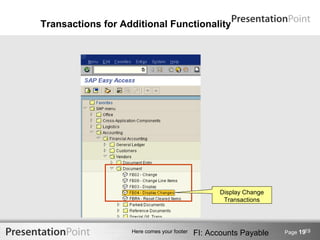

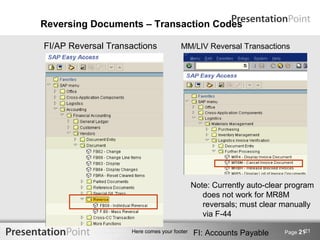

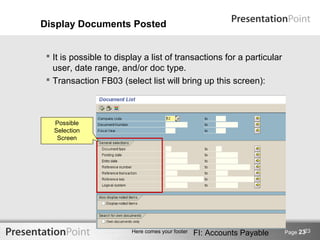

This document provides an overview of invoice and credit note processing in SAP Accounts Payable. It discusses the key differences between processing purchase order (PO) related and non-PO related invoices and credit memos. For PO related documents, it describes the 3-way matching process known as logistics invoice verification. It also reviews functions for reversing documents, changing documents, and displaying posted documents.