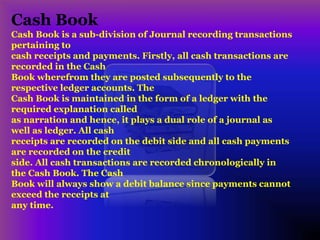

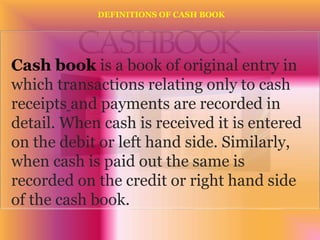

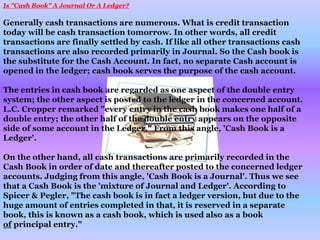

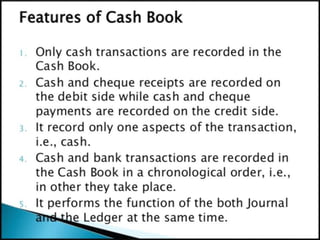

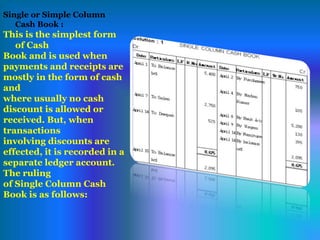

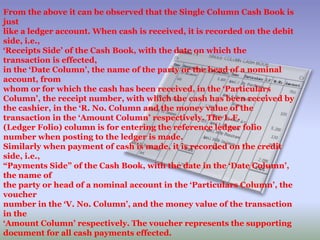

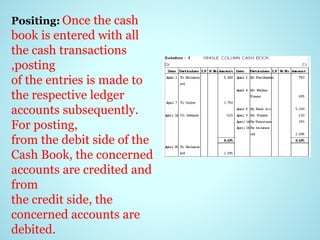

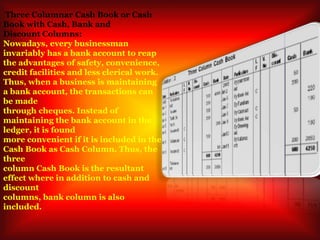

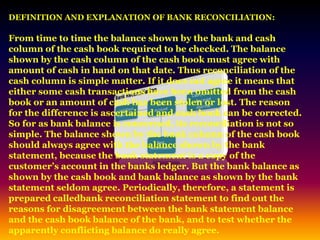

The document discusses the cash book, which is a book of original entry used to record all cash receipts and payments. It can take various forms like single column, two column, or three column based on the type of business transactions. The cash book serves as both a journal and ledger. Transactions are first recorded in the cash book and then posted to individual ledger accounts. Preparing a bank reconciliation statement is necessary to reconcile any discrepancies between the bank balance in the cash book and on the bank statement.

![This presentation is owned by

ABUL KALAM AZAD PATWARY

“for class 9-10[accounting]”](https://image.slidesharecdn.com/accounting-chapter-8-150209050203-conversion-gate01/75/Accounting-chapter-8-1-2048.jpg)