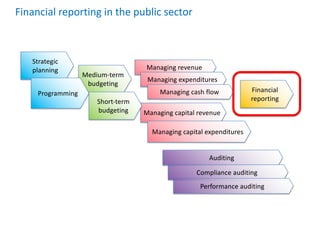

This document discusses accounting in the public sector. It covers topics such as financial reporting, managing revenue and expenditures, accounting standards, and accounting systems. Specifically, it discusses:

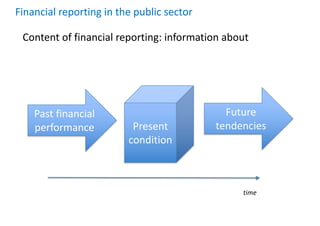

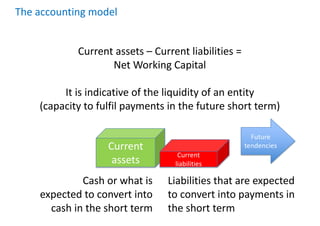

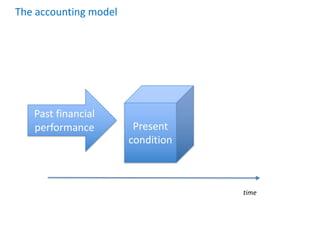

- The content of financial reporting in the public sector, which provides information about the present condition, past financial performance, and future tendencies.

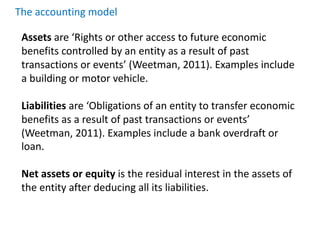

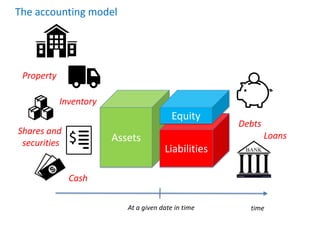

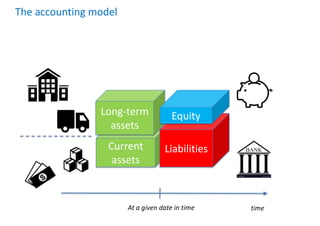

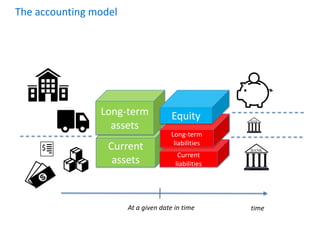

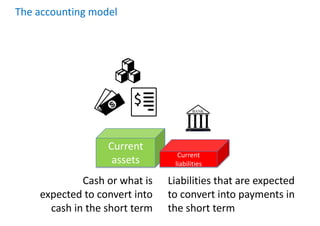

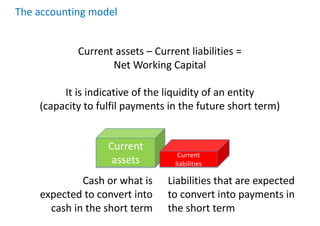

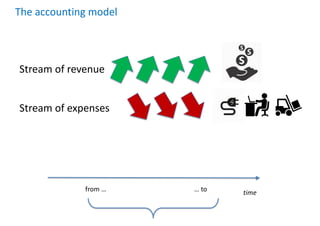

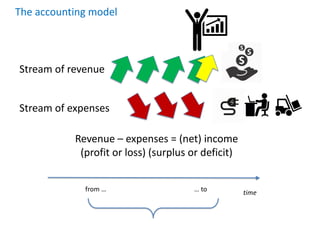

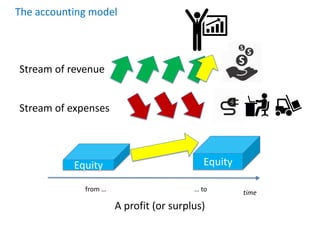

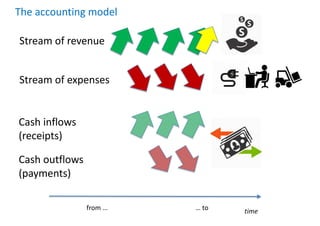

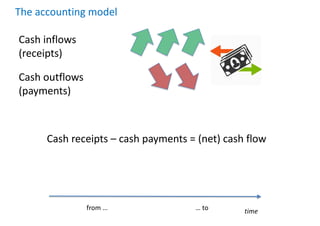

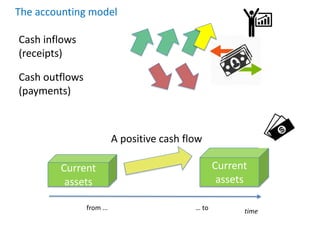

- The accounting model, which shows assets, liabilities, and equity over time and how revenue, expenses, and cash flows impact these categories.

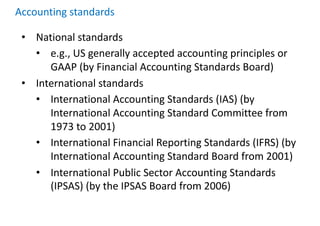

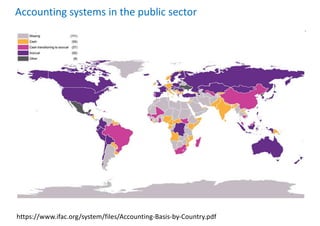

- The main accounting standards used in public sector accounting, including national standards like GAAP and international standards like IPSAS.

- The key difference between cash accounting, which recognizes events based on cash transactions, and accrual accounting, which recognizes events