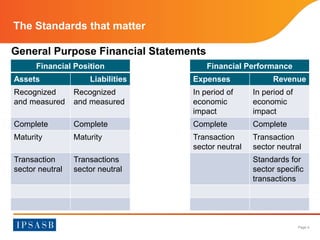

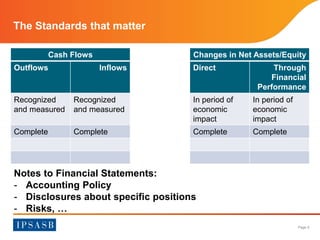

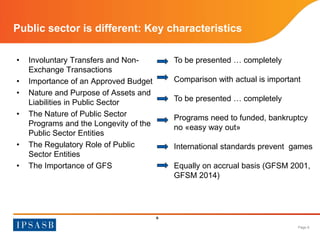

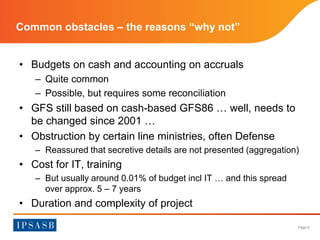

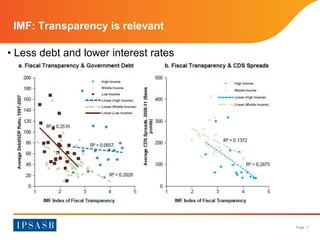

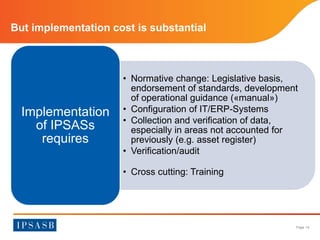

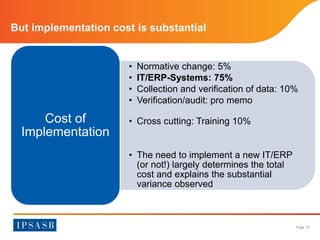

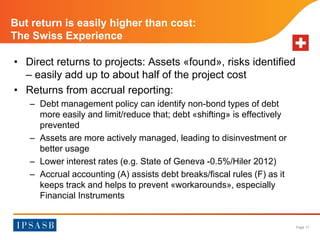

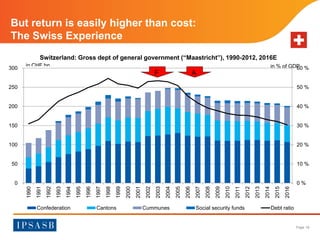

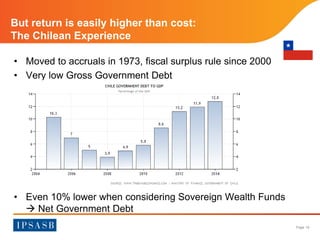

Accrual-based financial reporting in the public sector is essential for transparency, accountability, and effective fiscal management, especially in light of rising debt levels and economic uncertainty. The transition to accrual accounting over cash-based systems can address significant liabilities and improve asset and liability management, ultimately benefiting government financial health and market perceptions. While implementation may incur substantial costs, the long-term economic benefits and improved financial outcomes greatly outweigh these initial investments.