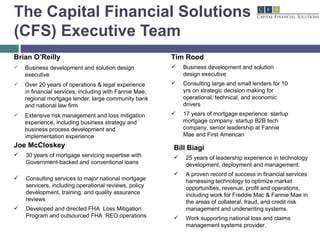

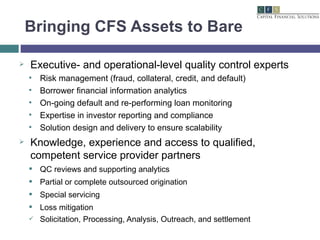

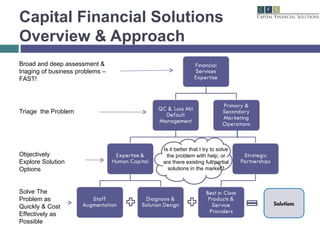

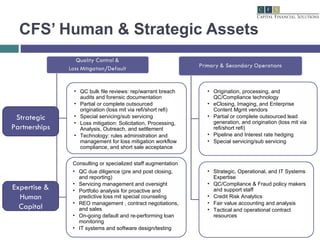

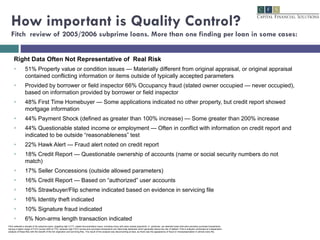

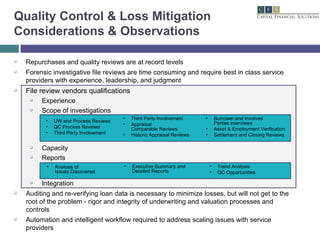

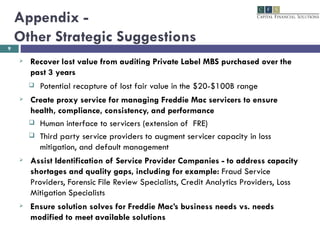

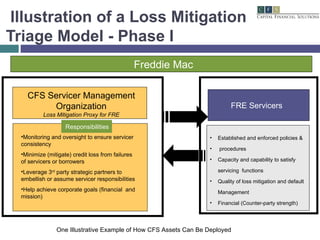

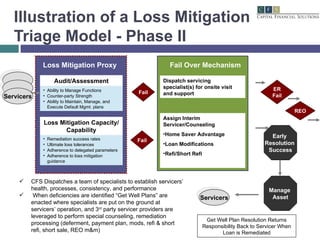

The document discusses Capital Financial Solutions' (CFS) expertise that could help Freddie Mac address quality control issues. CFS offers strategic consulting services utilizing decades of mortgage industry experience. CFS experts can perform quality control file reviews, loss mitigation programs, and technology solutions to help optimize Freddie Mac's operations and minimize losses. The document also provides an example model for how CFS could help triage and resolve issues with Freddie Mac servicers.