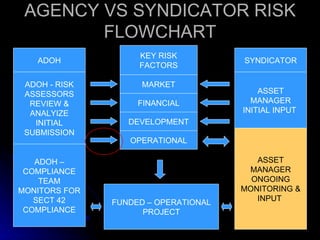

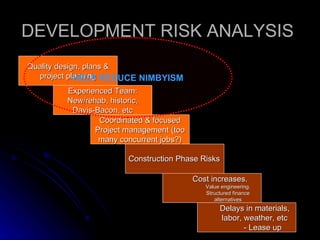

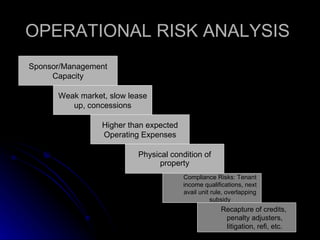

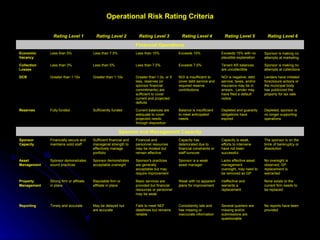

This document discusses risk analysis and asset management for affordable housing projects. It outlines key risk factors like market, financial, development, and operational risks. It also provides a risk rating criteria that analyzes factors such as debt coverage ratio, economic vacancy rates, compliance issues, and physical condition to assess operational risk levels from 1 to 6.