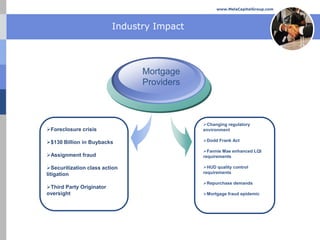

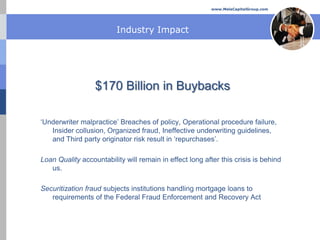

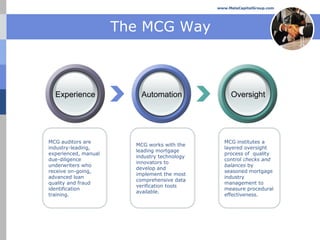

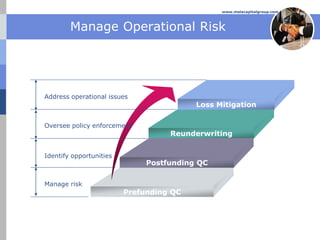

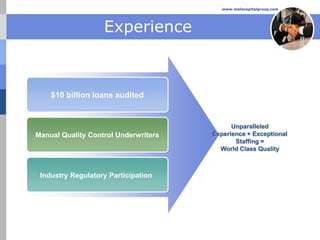

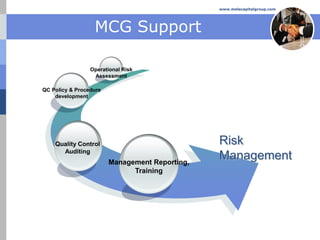

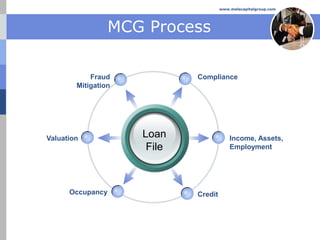

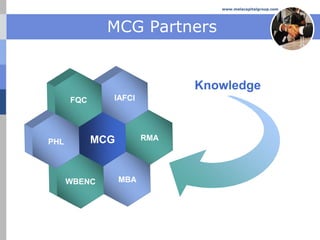

Mela Capital Group provides mortgage quality control and risk mitigation services. They help clients address regulatory issues, litigation risks, and operational deficiencies to avoid costly buybacks and legal exposure. Their services include pre-funding and post-funding audits, fraud detection, compliance oversight, training, and customized quality control programs. With extensive experience auditing loans and assisting in litigation and regulatory matters, Mela Capital Group offers clients a full suite of solutions to manage mortgage risk.