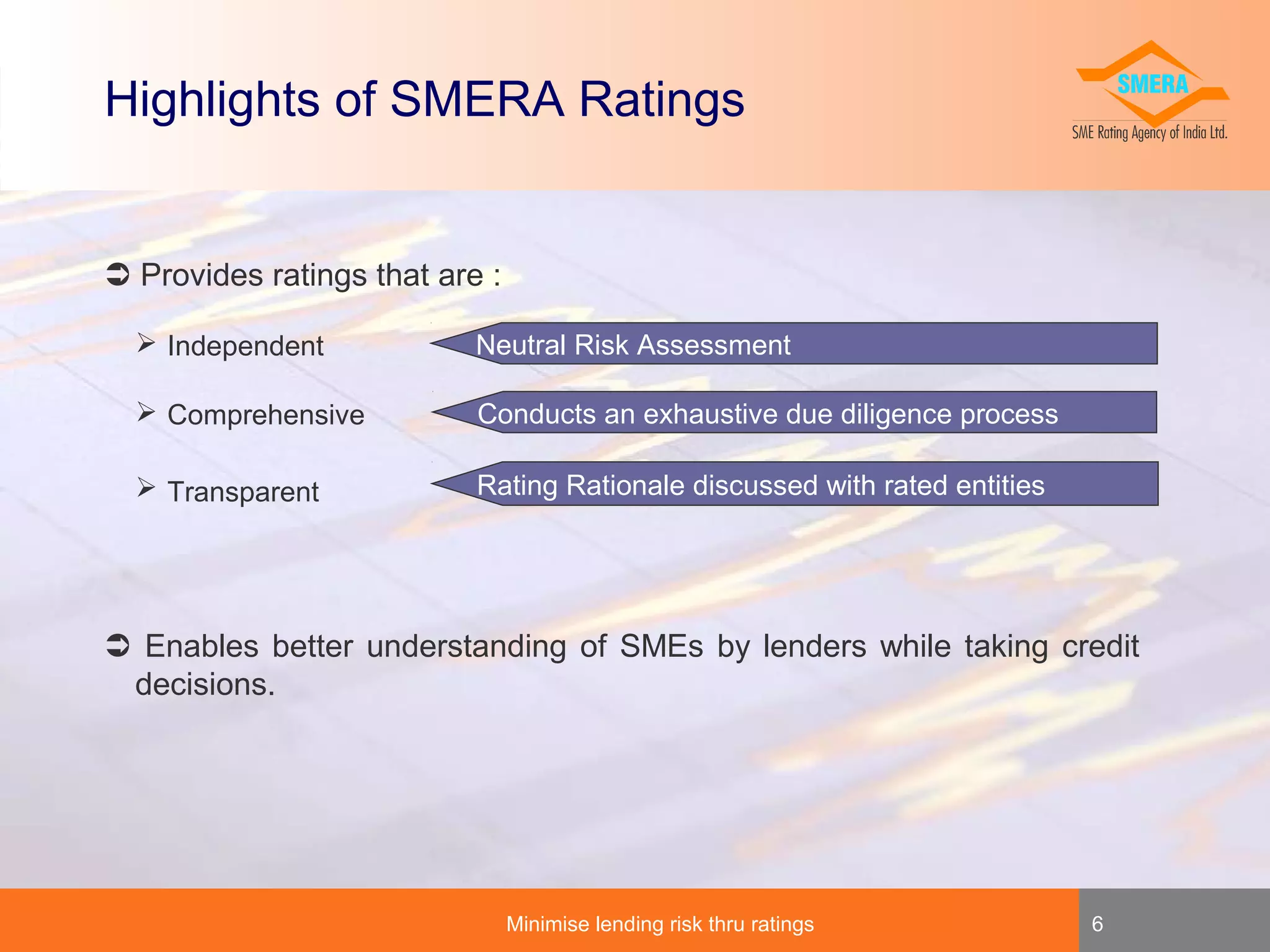

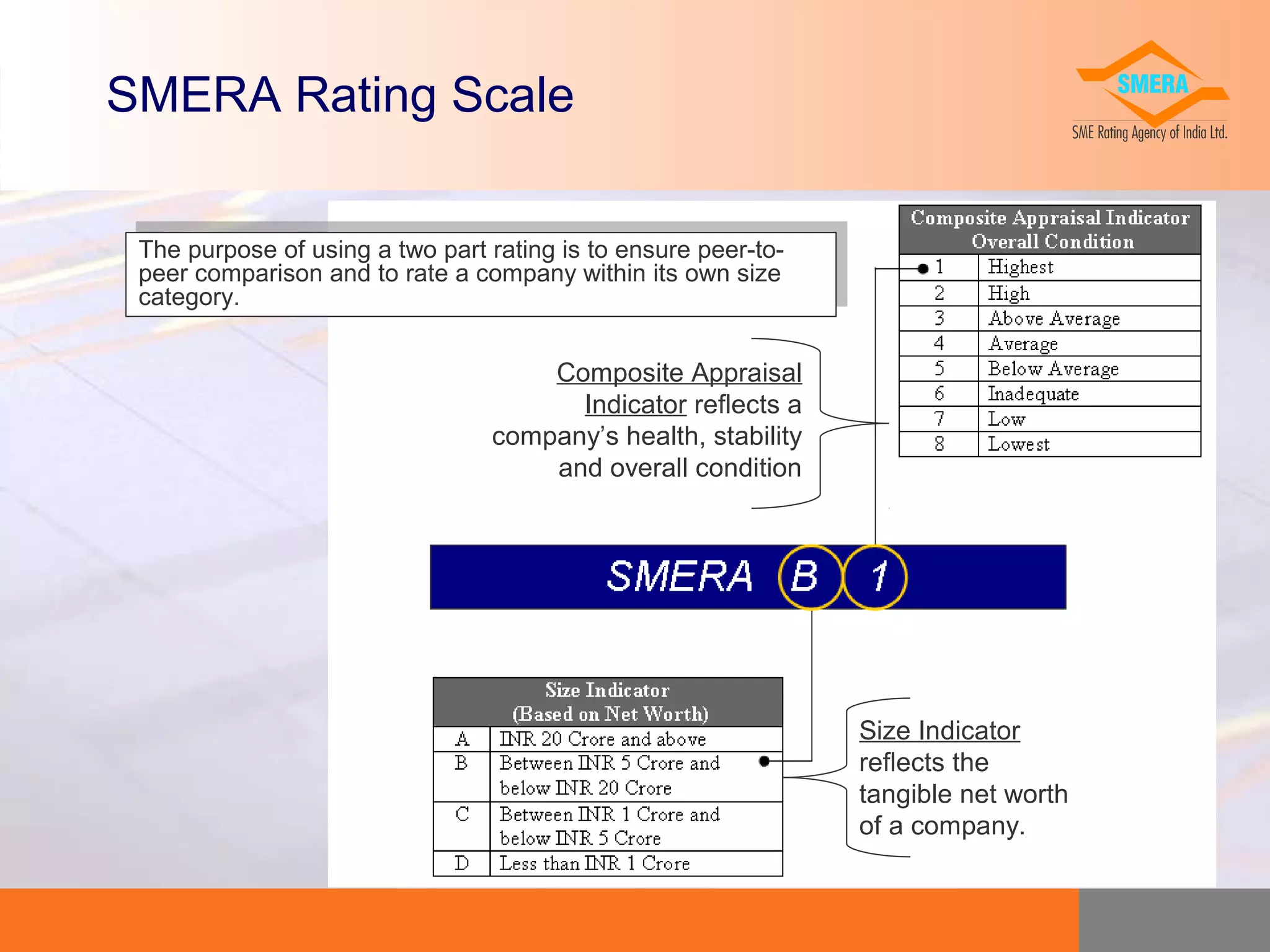

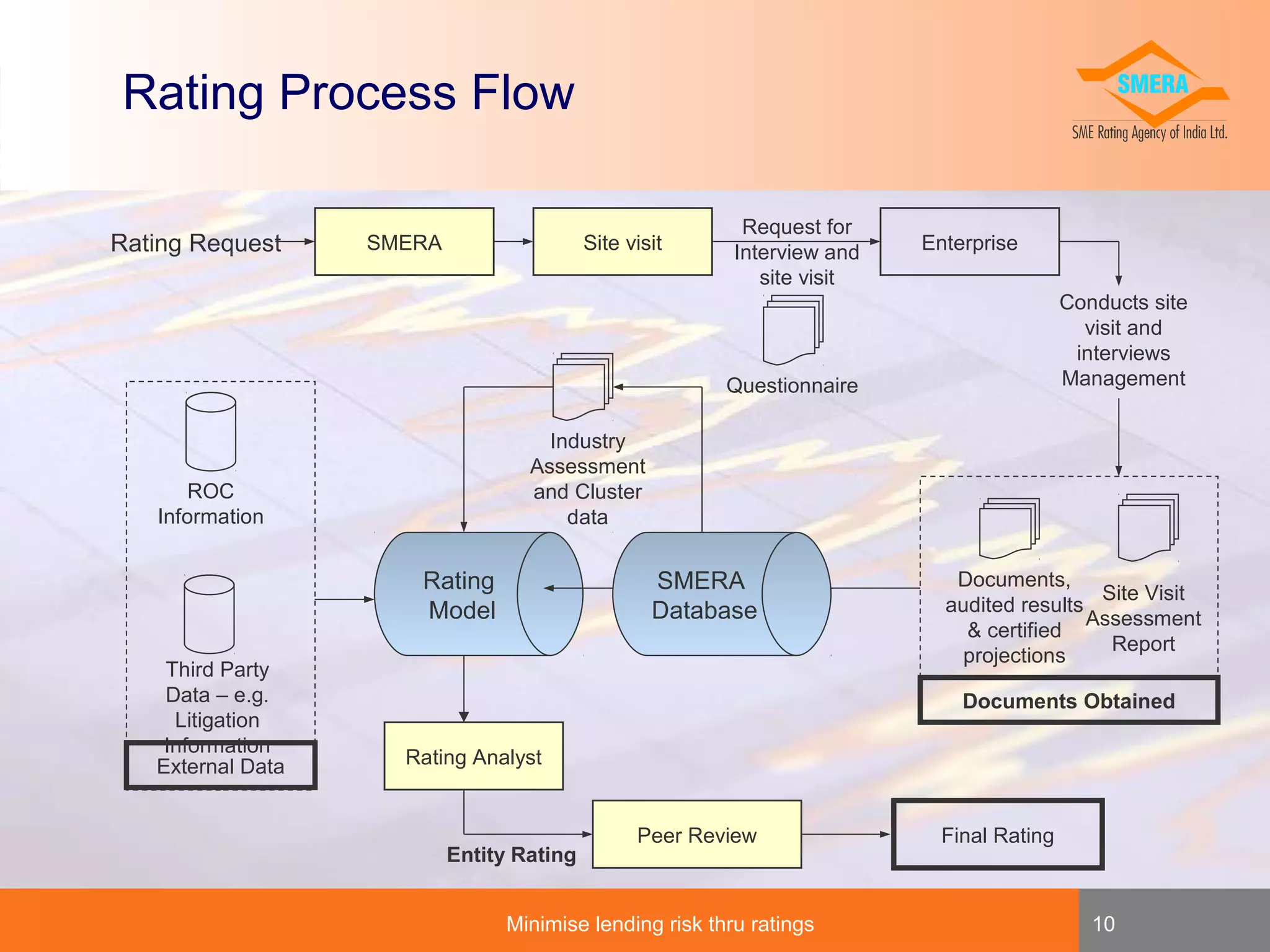

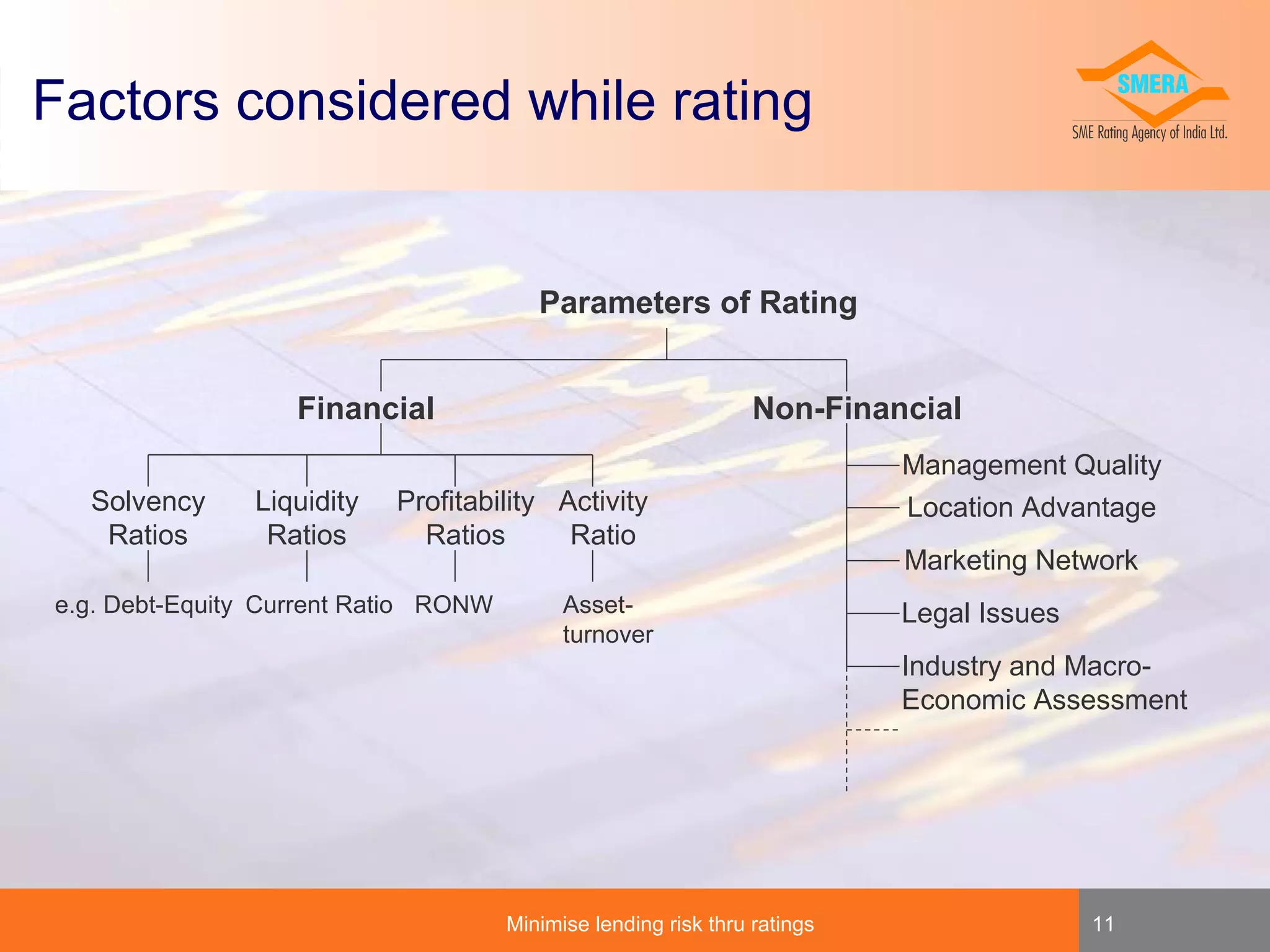

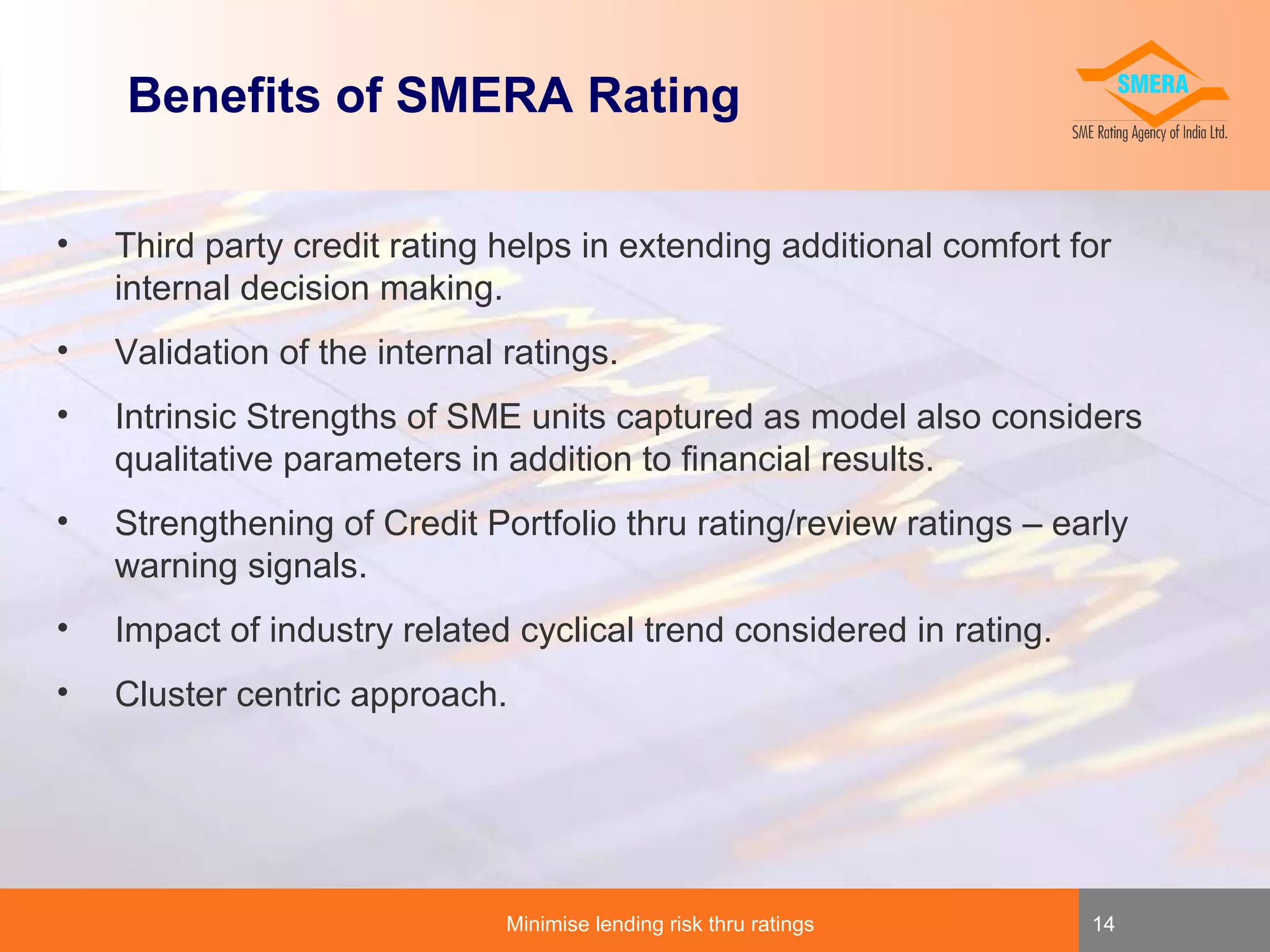

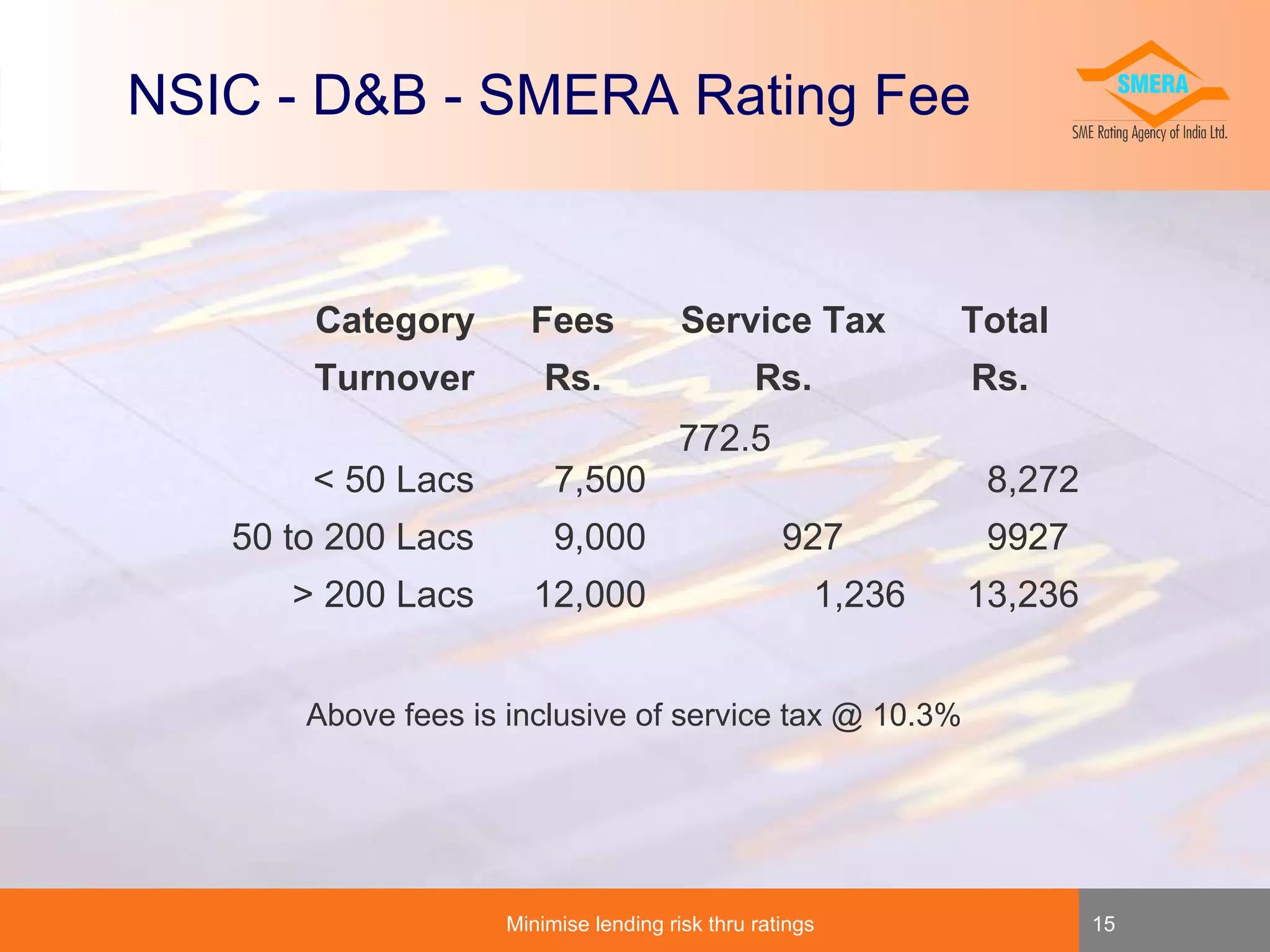

SME Rating Agency of India Ltd (SMERA) provides credit ratings for small and medium enterprises (SMEs) in order to help lending institutions minimize lending risks. SMERA was launched in 2005 as a joint initiative between SIDBI, Dun & Bradstreet, and several leading banks. It offers qualitative rating services at competitive prices with a focused approach on SMEs. SMERA ratings are independent, comprehensive, and transparent assessments that help lenders better understand SMEs and make credit decisions. The rating process involves collecting documentation, site visits, interviews, and considering both financial and non-financial parameters to provide ratings within SMERA's own scales.