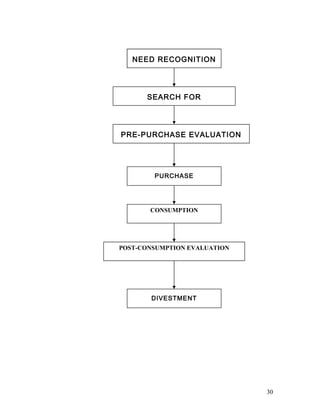

This document provides an overview of the casual wear market in India and the consumer decision making process for casual wear purchases. It discusses the objectives of the research project, which are to study the consumer decision making process and factors influencing purchase decisions for casual wear among 15-25 year olds in Delhi. It then provides context on the size and growth of the casual wear market in India. The document summarizes the various types of casual wear, and outlines the current market scenario, including competitive and fashion trends that influence consumers. It also gives a brief overview of the textiles industry in India.