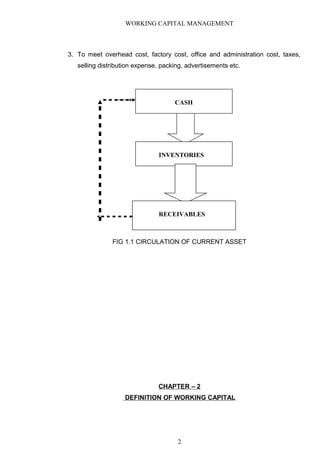

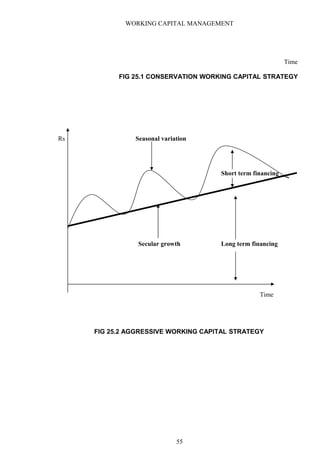

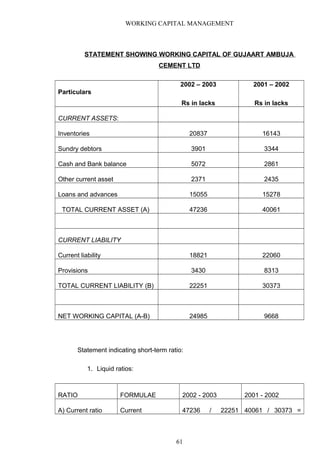

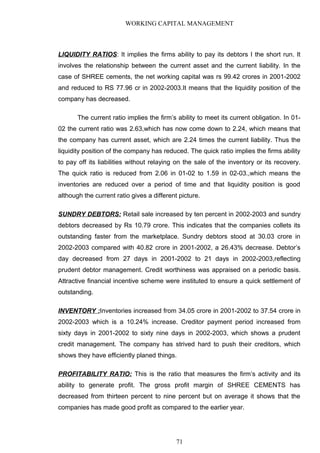

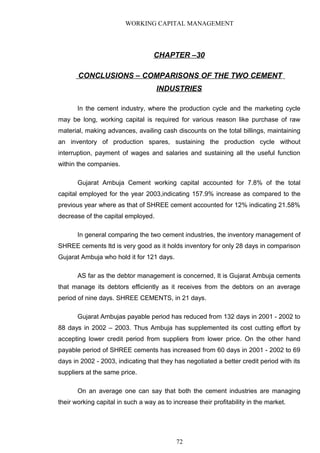

Working capital management is important for short-term financial decisions and liquidity. It involves managing current assets like cash, inventory, and receivables, as well as current liabilities. Inadequate working capital can cause business failure, while excessive working capital leads to idle funds. The objectives of working capital management are to determine optimal investment levels in current assets, maintain sufficient liquidity to meet obligations, and locate appropriate short-term financing sources. Efficient working capital management is vital for business solvency and continuous operations.