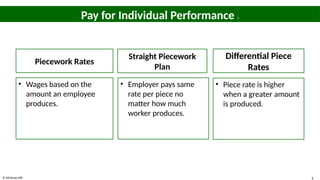

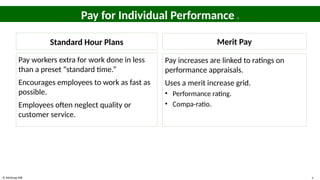

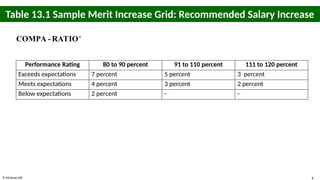

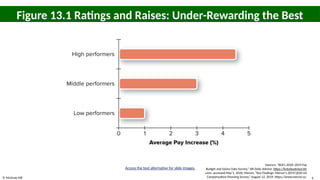

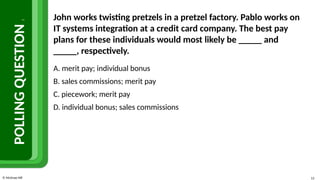

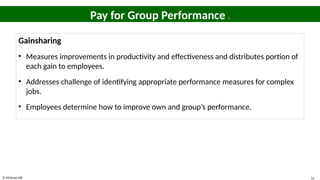

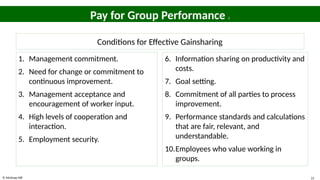

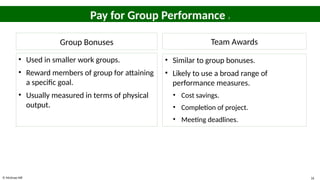

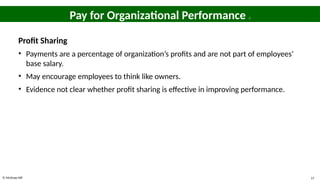

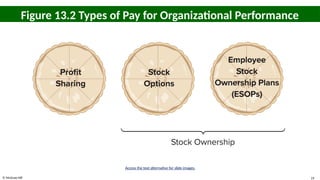

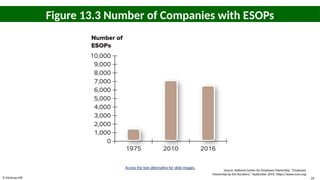

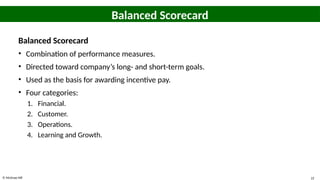

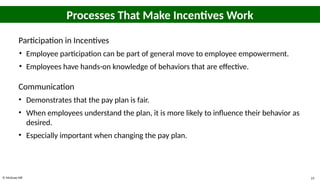

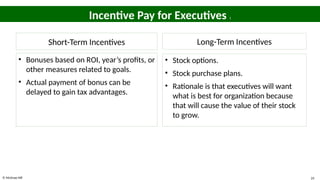

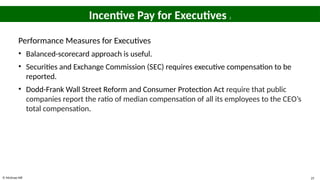

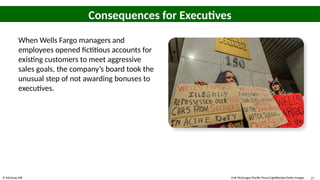

The document discusses the concept of incentive pay, which aims to improve employee performance through financial rewards linked to individual, group, and organizational achievements. It outlines different types of incentive plans, including merit pay, performance bonuses, and profit sharing, along with the requirements for effective implementation. Additionally, it addresses the importance of fair performance measurement and the ethical considerations surrounding executive compensation.