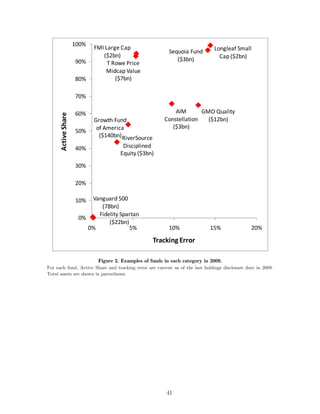

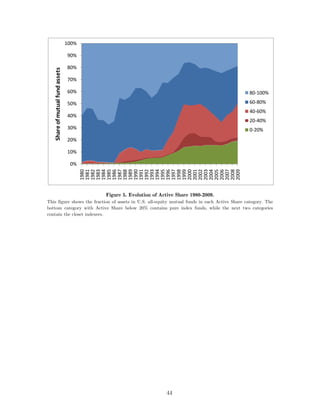

This document analyzes different categories of active mutual fund management based on measures of Active Share and tracking error. It finds that the most active stock pickers have outperformed their benchmarks after fees, while closet indexers and funds focusing on factor bets have underperformed after fees. Performance patterns were similar during the 2008-2009 financial crisis. Closet indexing has become more popular recently. Fund performance can be predicted by cross-sectional stock return dispersion, favoring active stock pickers when dispersion is higher.

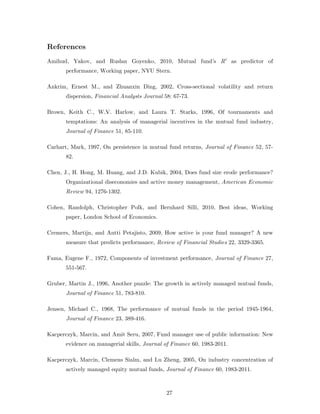

![Table X. Fund Performance and Cross-Sectional Dispersion.

The dependent variable is the cumulative net return (after all expenses) in excess of the benchmark index

return in month t. The only funds included are stock pickers as defined in Table IV. CrossVol is the monthly

cross-sectional dispersion for all U.S. equities computed by Russell. The variable Et-1[CrossVol(t)] is the

predicted value of CrossVol(t) based on information available at t – 1., whereas εCrossVol(t) is the shock to

CrossVol(t) at time t, defined as CrossVol(t) – Et-1[CrossVol(t)]. The sample period is 7/1996–12/2009. The

t-statistics (in parentheses) are based on White’s standard errors. *, **, and *** indicate significance at the

10%, 5%, and 1% level, respectively.

Stock pickers All funds

(1) (2) (3) (4) (5) (6) (7)

CrossVol(t+1) 0.0248 0.0382

(0.65) (1.52)

CrossVol(t) 0.0216 -0.1742*** -0.0434

(0.53) (-3.30) (-1.08)

CrossVol(t-1) 0.0970*** 0.1378*** 0.0040

(3.05) (2.63) (0.13)

CrossVol(t-2) -0.0242 0.0302

(-0.58) (1.09)

CrossVol(t-3) 0.1426*** 0.0325

(3.27) (1.13)

CrossVol(t-4) -0.0183 -0.0112

(-0.53) (-0.50)

Et-1[CrossVol(t)] 0.1205*** 0.1195*** 0.0562***

(3.10) (3.36) (2.66)

ε CrossVol(t) -0.1637*** -0.0284

(-3.13) (-0.78)

N 162 161 158 159 159 158 159

R 2 0.6% 12.3% 29.4% 12.4% 24.7% 8.5% 6.5%

38](https://image.slidesharecdn.com/ssrn-id1685942-120406094952-phpapp01/85/Ssrn-id1685942-39-320.jpg)