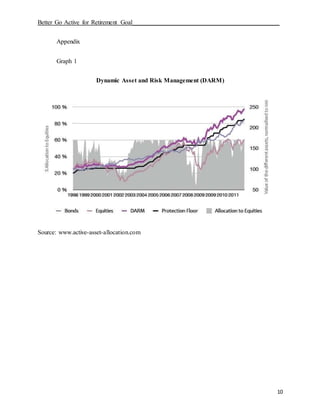

Active asset management has advantages over passive strategies for retirement investing. It requires a dynamic approach to adjust the portfolio in response to market fluctuations, keeping assets properly allocated to reduce risk. Studies show people with financial plans accumulate 250% more savings than those without. Active management can generate 1.82% higher annual returns, increasing retirement wealth by 29%. While riskier than passive strategies, active management allows harvesting higher returns from risky assets when the market is strong and selling those that weaken, potentially achieving better performance than a single asset type, especially for long-term investors.