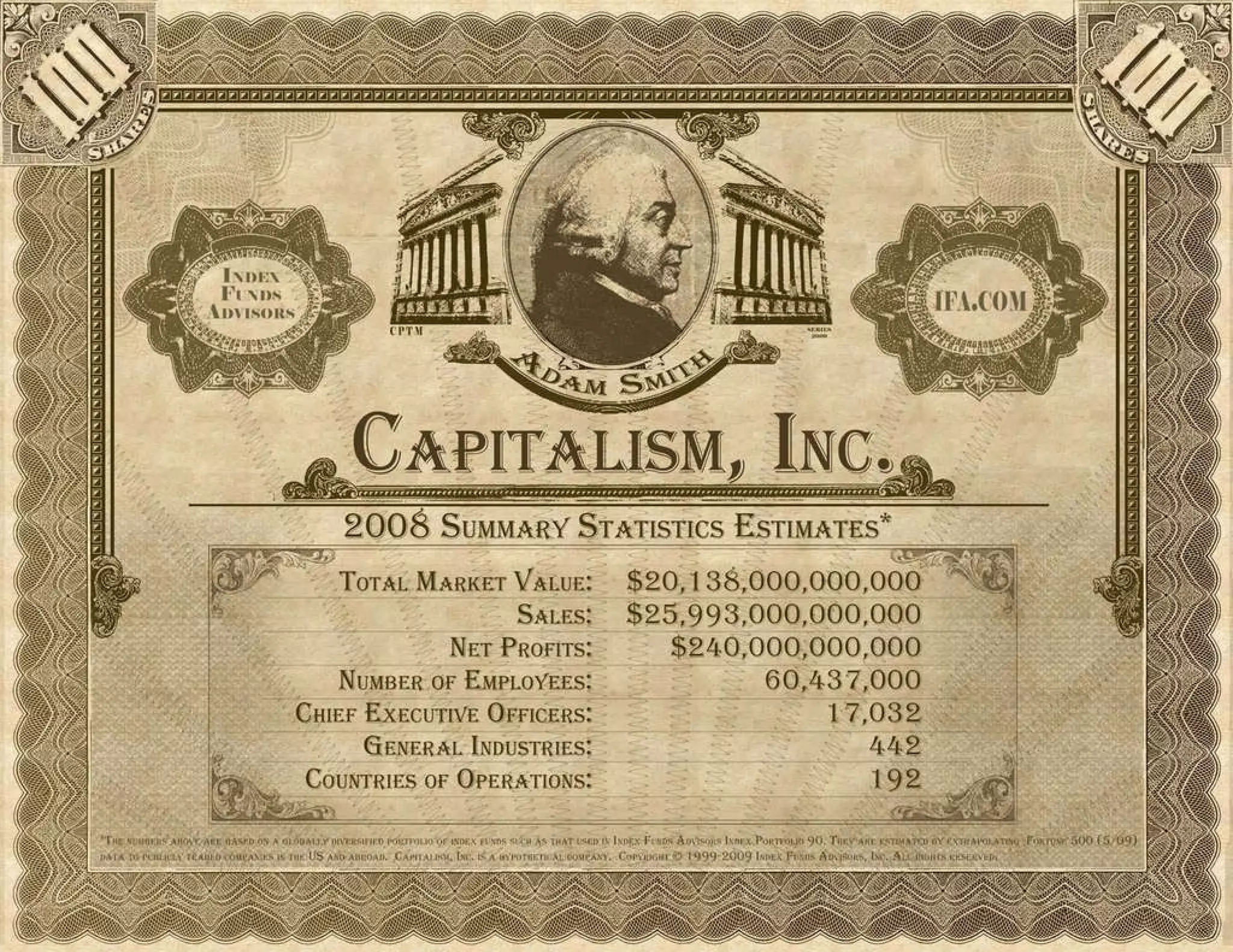

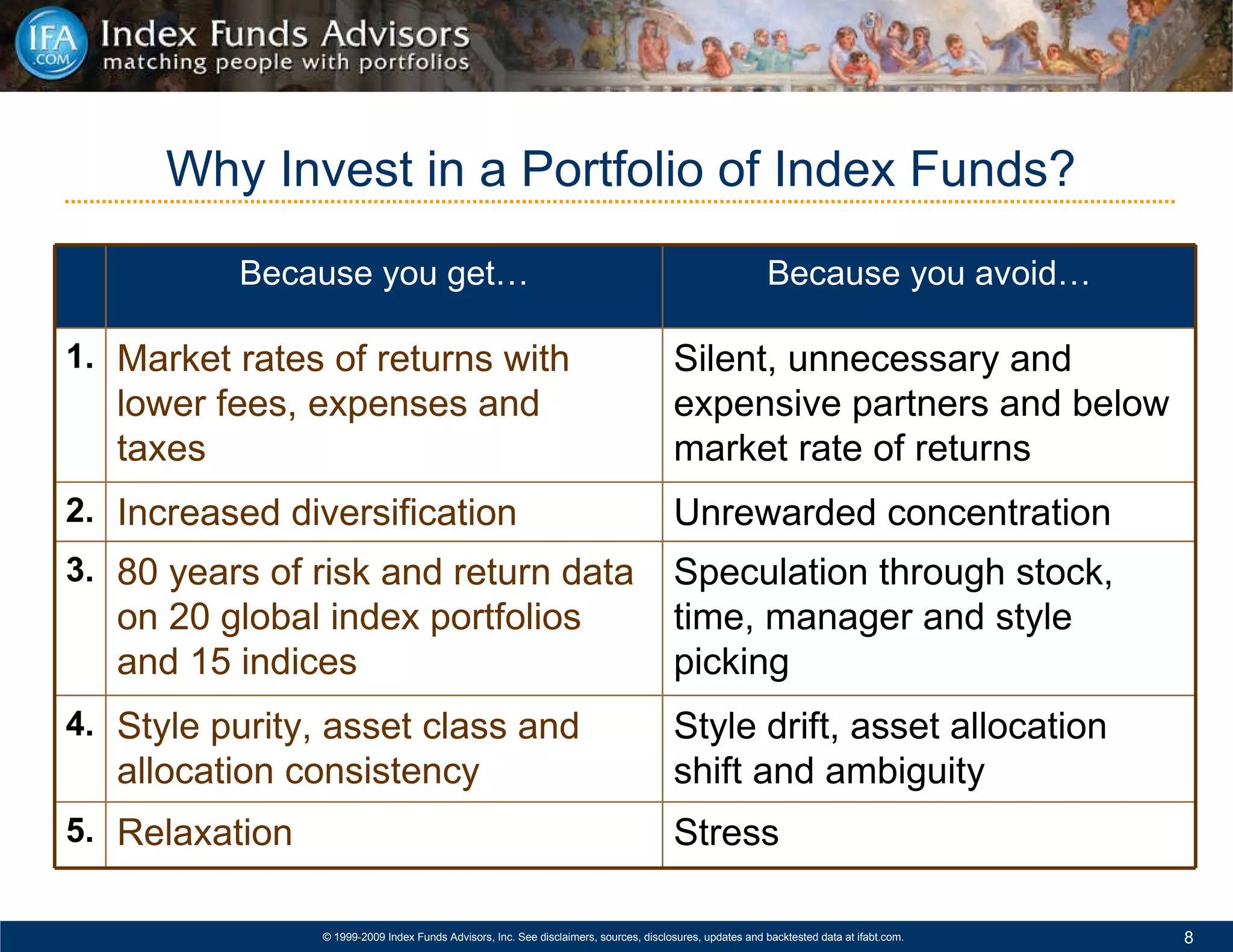

The document provides an abbreviated disclosure for backtested performance information on simulated index strategies and index portfolios from Index Funds Advisors, Inc. It discusses that IFA was incorporated in 1999 and placed its first client investments in 2000, and the performance information presented is based on backtested data from 1928 to the period ending date using an annual rebalancing strategy. It notes that prior to 1999, IFA did not manage client assets and the index portfolios were not available. The disclosure also mentions that index portfolios provide global diversification across approximately 15,000 companies to reduce risk.

![888.643.3133 Local: 608.227.6000 [email_address] 19200 Von Karman Ave. Suite 150 Irvine, CA 92612](https://image.slidesharecdn.com/12stepprogramforactiveinvestors-1253035611256-phpapp03/75/The-12-Step-Program-For-Active-Investors-2-2048.jpg)

![1. “..the best way to own common stocks is through index funds... Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals. - Warren Buffett, Berkshire Hathaway Inc. 1996 Shareholder Letter 2. “Additionally, those index funds that are very low-cost … are the best selection for most of those who wish to own equities.” - Warren Buffett, Berkshire Hathaway Inc. 2002 Shareholder Letter 3. “All [investors] had to do was piggyback Corporate America in a diversified, low-expense way. An index fund that they never touched would have done the job. Instead many investors have had experiences ranging from mediocre to disastrous.” - Warren Buffett, Berkshire Hathaway Inc. 2003 Shareholder Letter 4. "The active investors will have their returns diminished by a far greater percentage than will their inactive brethren. That means that the passive group – the “know-nothings” – must win." - Warren Buffett, Berkshire Hathaway Inc. 2007 Shareholder Letter Buffett’s Smart Bet](https://image.slidesharecdn.com/12stepprogramforactiveinvestors-1253035611256-phpapp03/75/The-12-Step-Program-For-Active-Investors-28-2048.jpg)