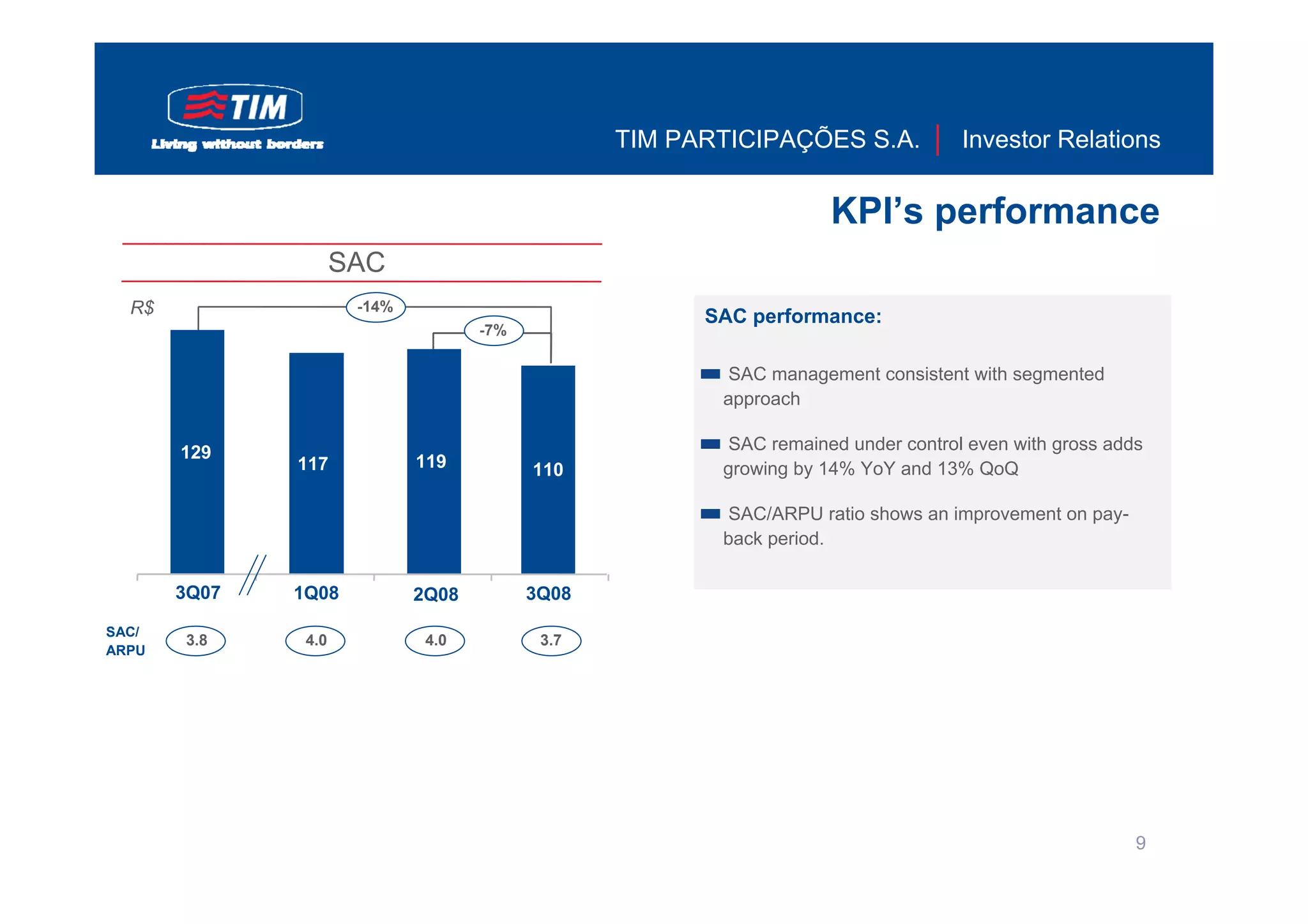

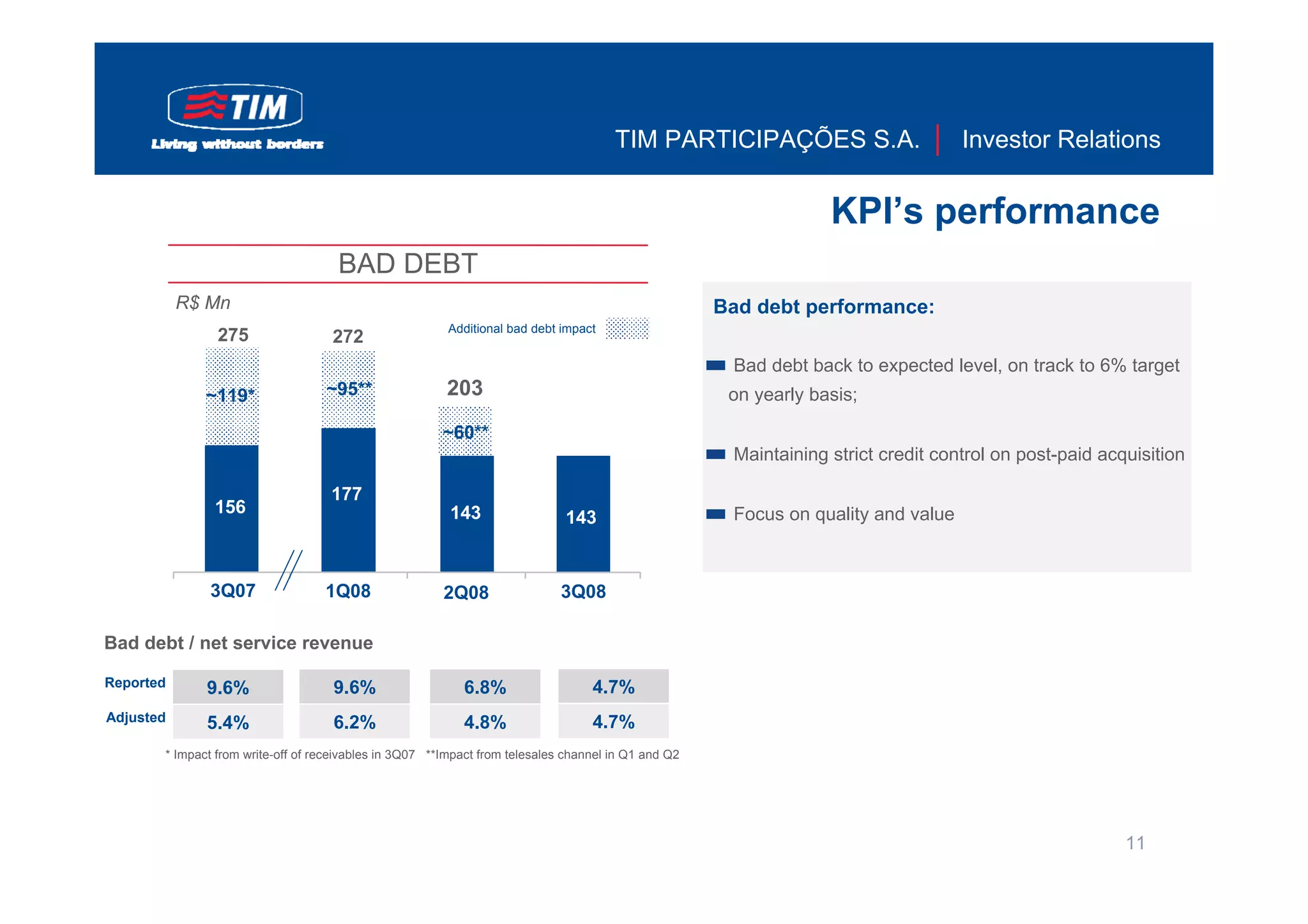

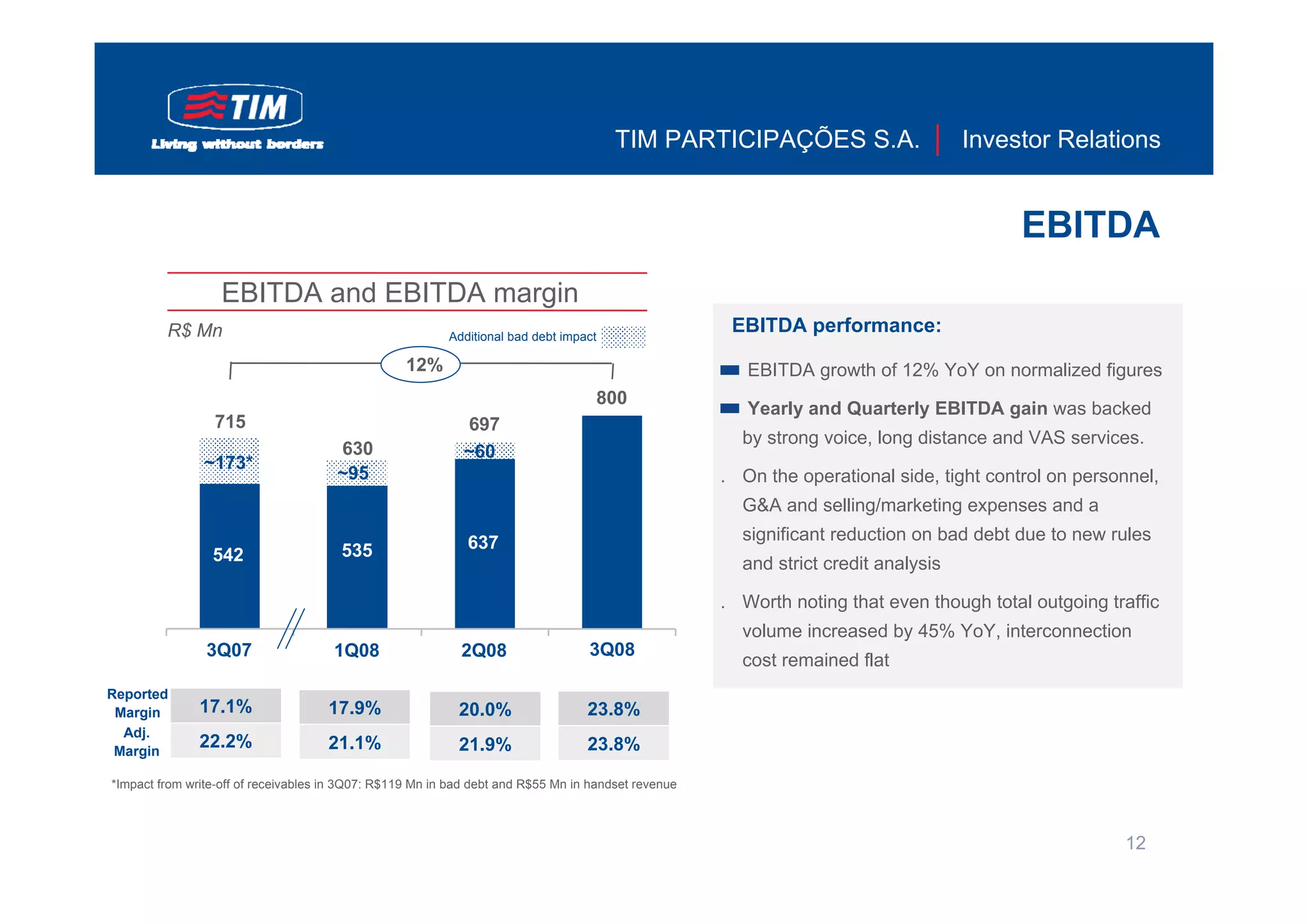

Tim Participacoes reported its 3Q08 results. Key highlights included growing the subscriber base 20.7% YoY to 35.2 million users, stabilizing ARPU at R$29.7, and increasing EBITDA 47.5% YoY to R$799.8 million through tight expense control and lower bad debt. The company launched new convergent offers like TIM Fixo wireline telephony and expanded its 3G broadband portfolio. Operational improvements and financial discipline helped deliver on commitments to improve profitability.