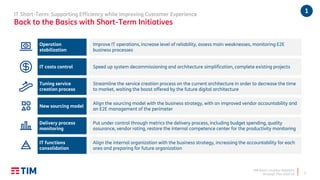

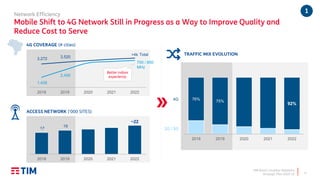

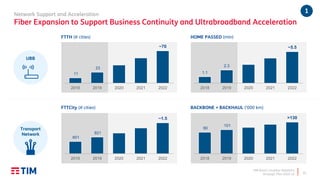

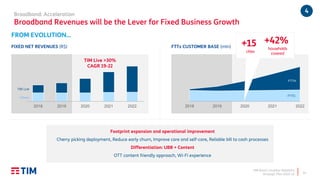

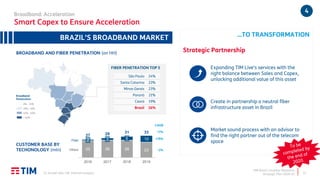

This document provides a summary of TIM Brasil's strategic plan for 2020-2022. The strategic plan has two pillars - evolve and transform. Under evolve, TIM aims to move from volume to value in mobile business and grow broadband with financial discipline. Under transform, TIM aims to implement new operating models, drive additional growth through adjacent markets, and focus on infrastructure, disruptive efficiency, mobile, UBB, new revenue sources, and ESG. The plan outlines initiatives across these areas around network expansion, IT transformation, efficiency improvements, and leveraging assets in new business areas like IoT and mobile advertising.