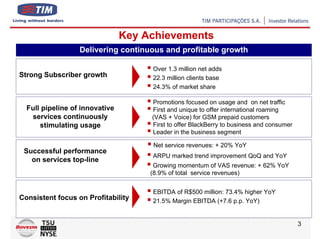

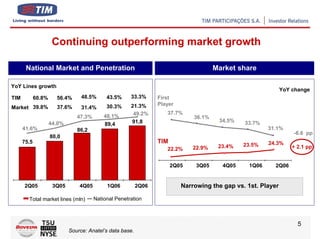

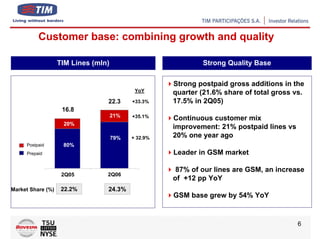

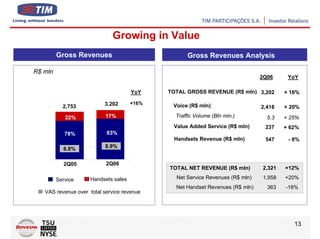

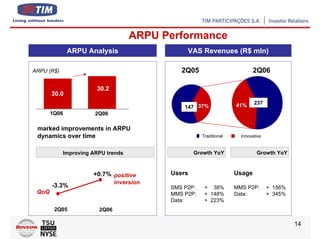

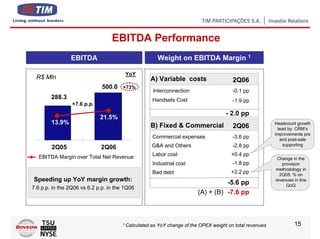

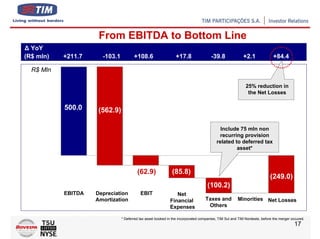

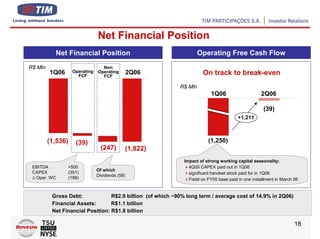

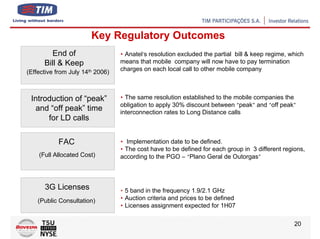

TIM Participações S.A. reported strong results for 2Q06, with over 1.3 million net subscriber additions reaching a base of 22.3 million. Financial performance was also positive, with net service revenues growing 20% year-over-year and EBITDA increasing 73.4% to R$500 million. Key regulatory outcomes included the exclusion of partial bill and keep interconnection rates and the introduction of peak and off-peak rates for long distance calls, while Anatel will define costs and implementation for number portability and 3G licenses.