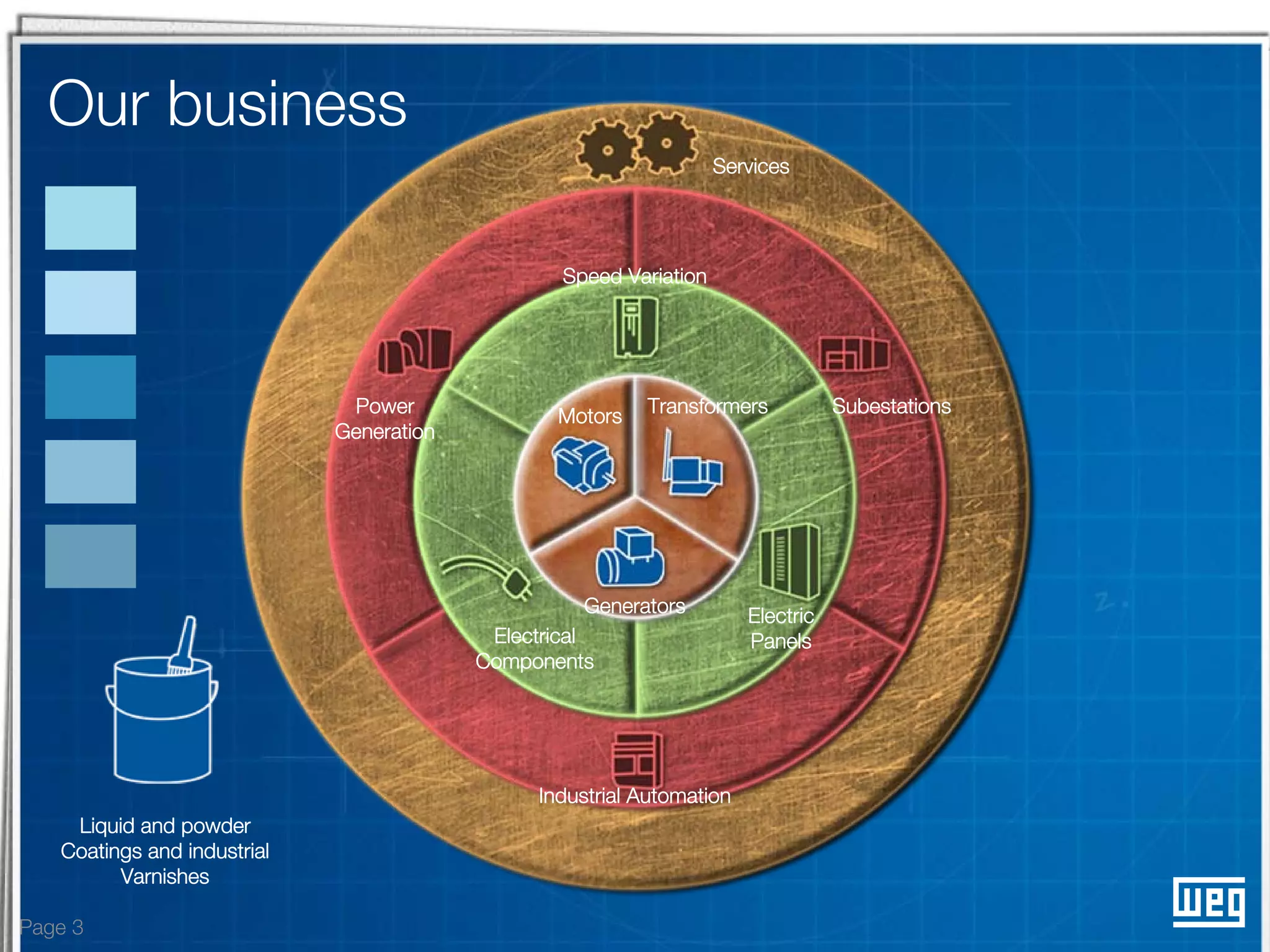

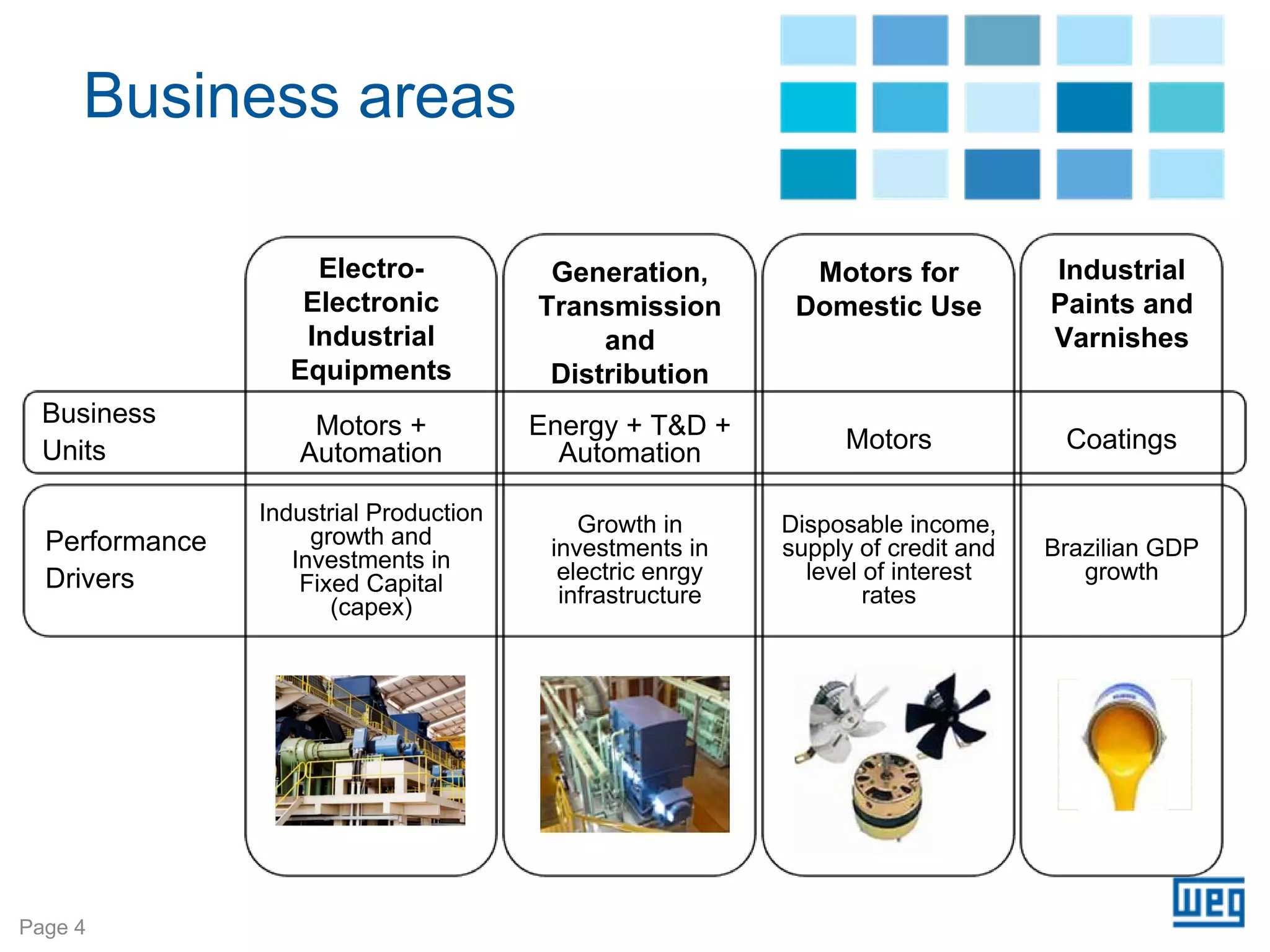

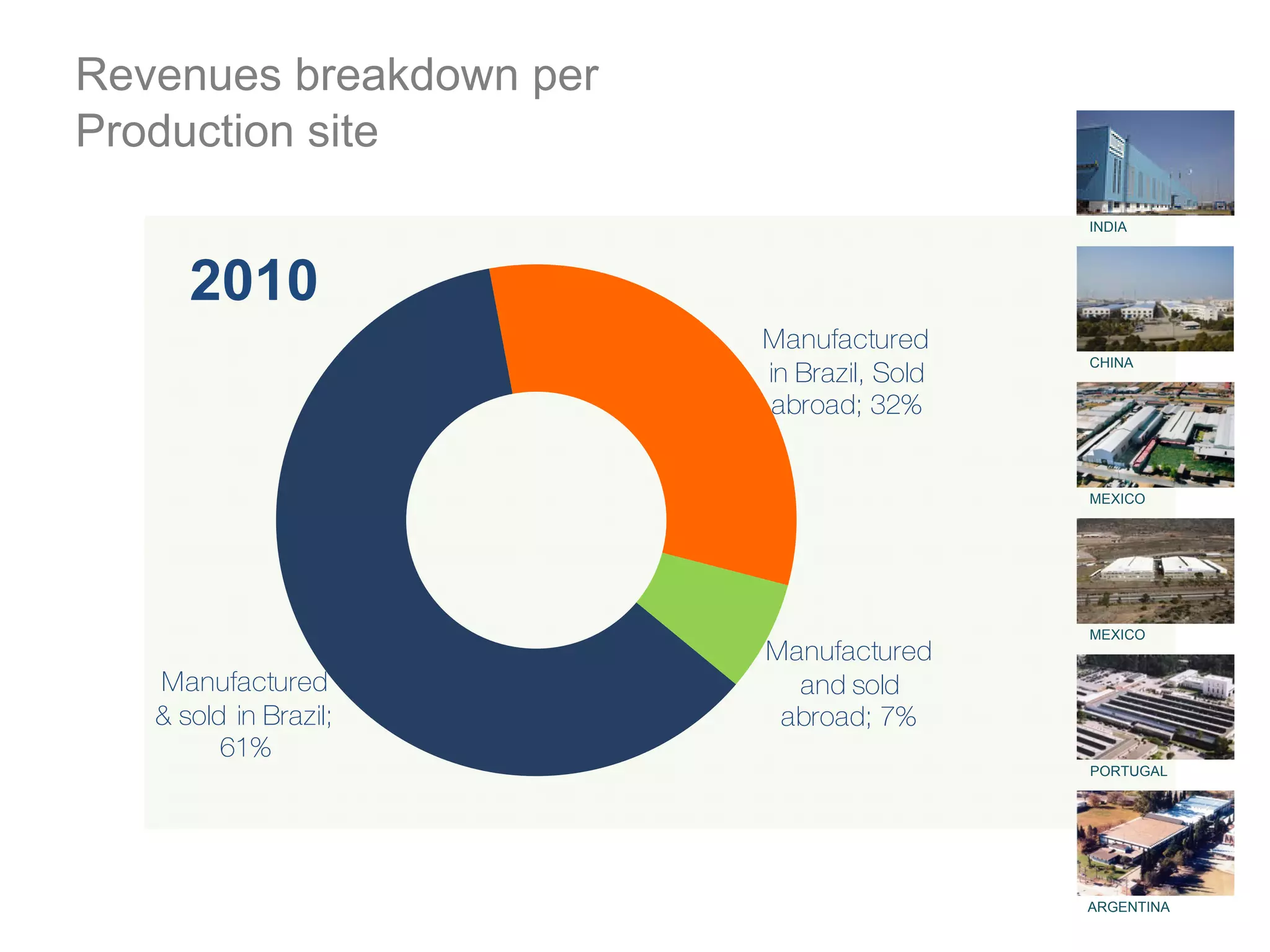

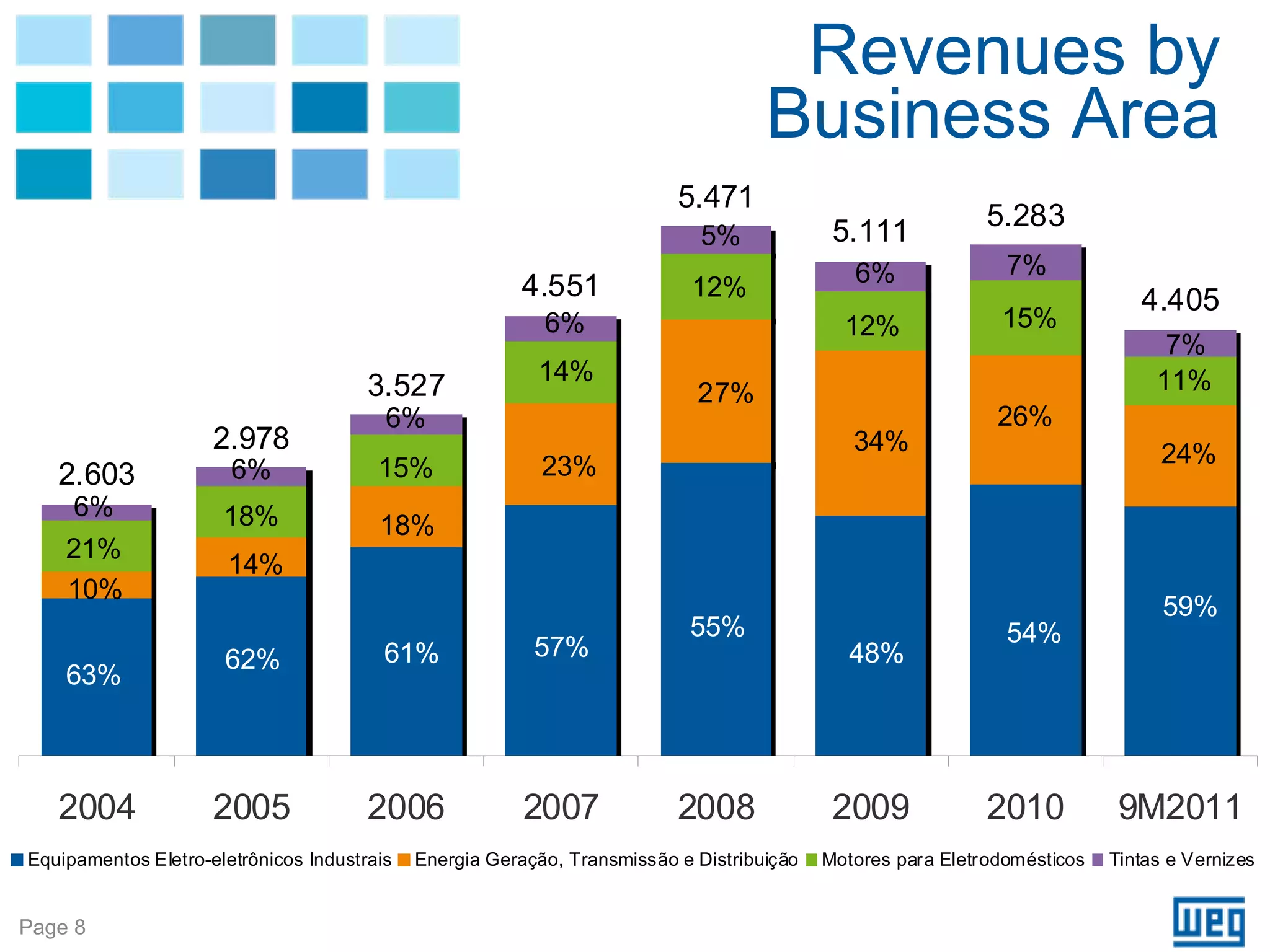

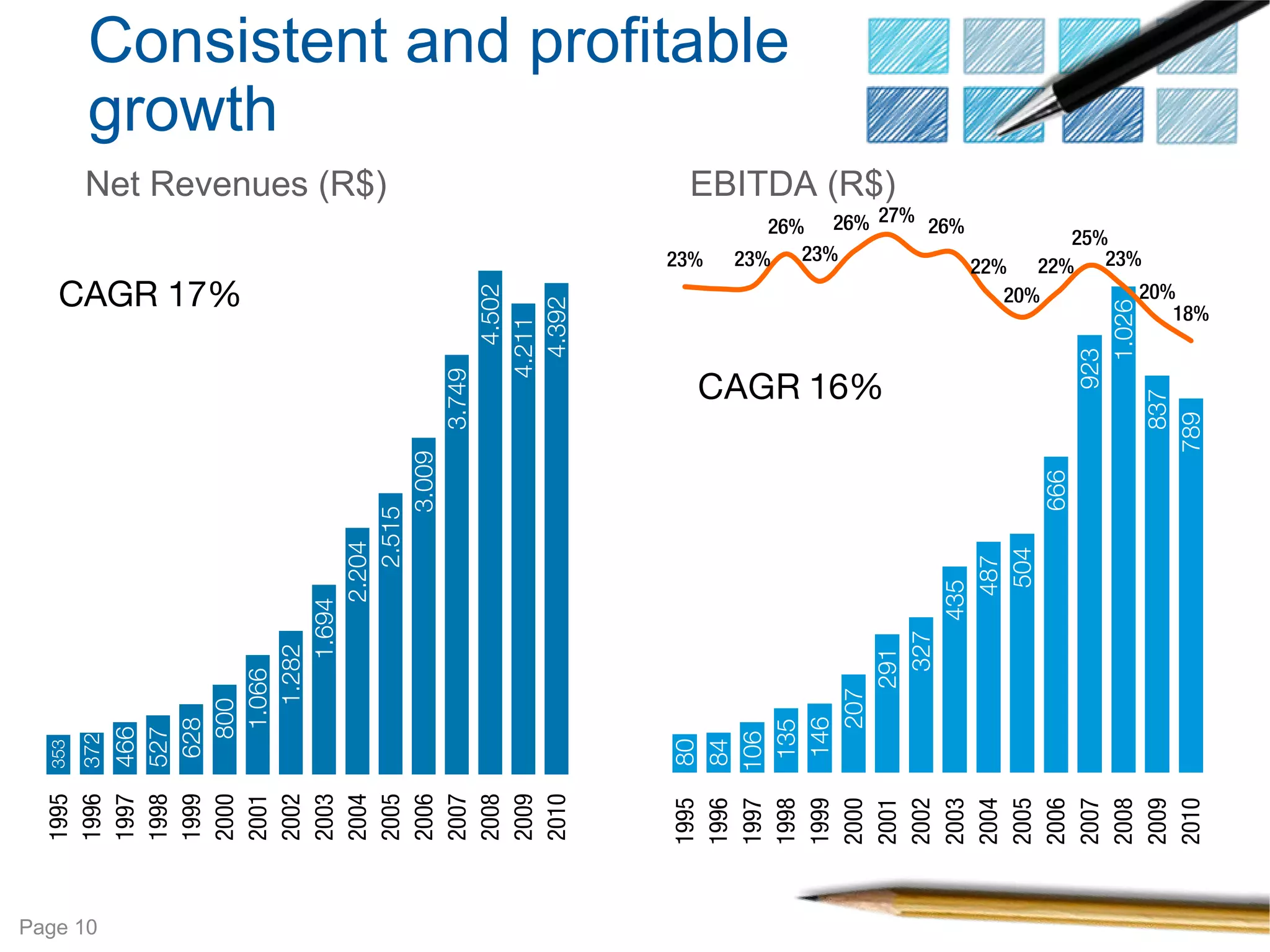

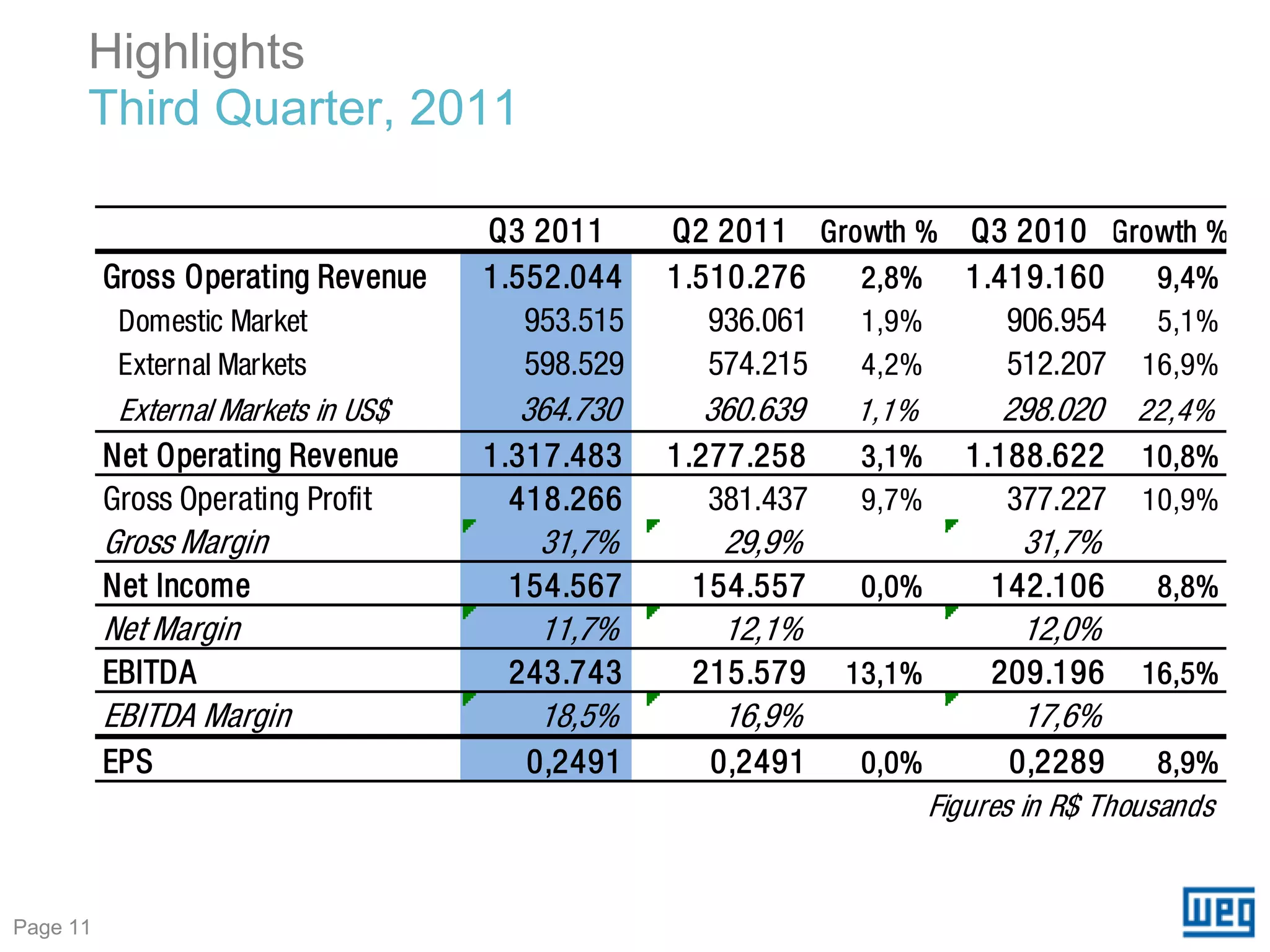

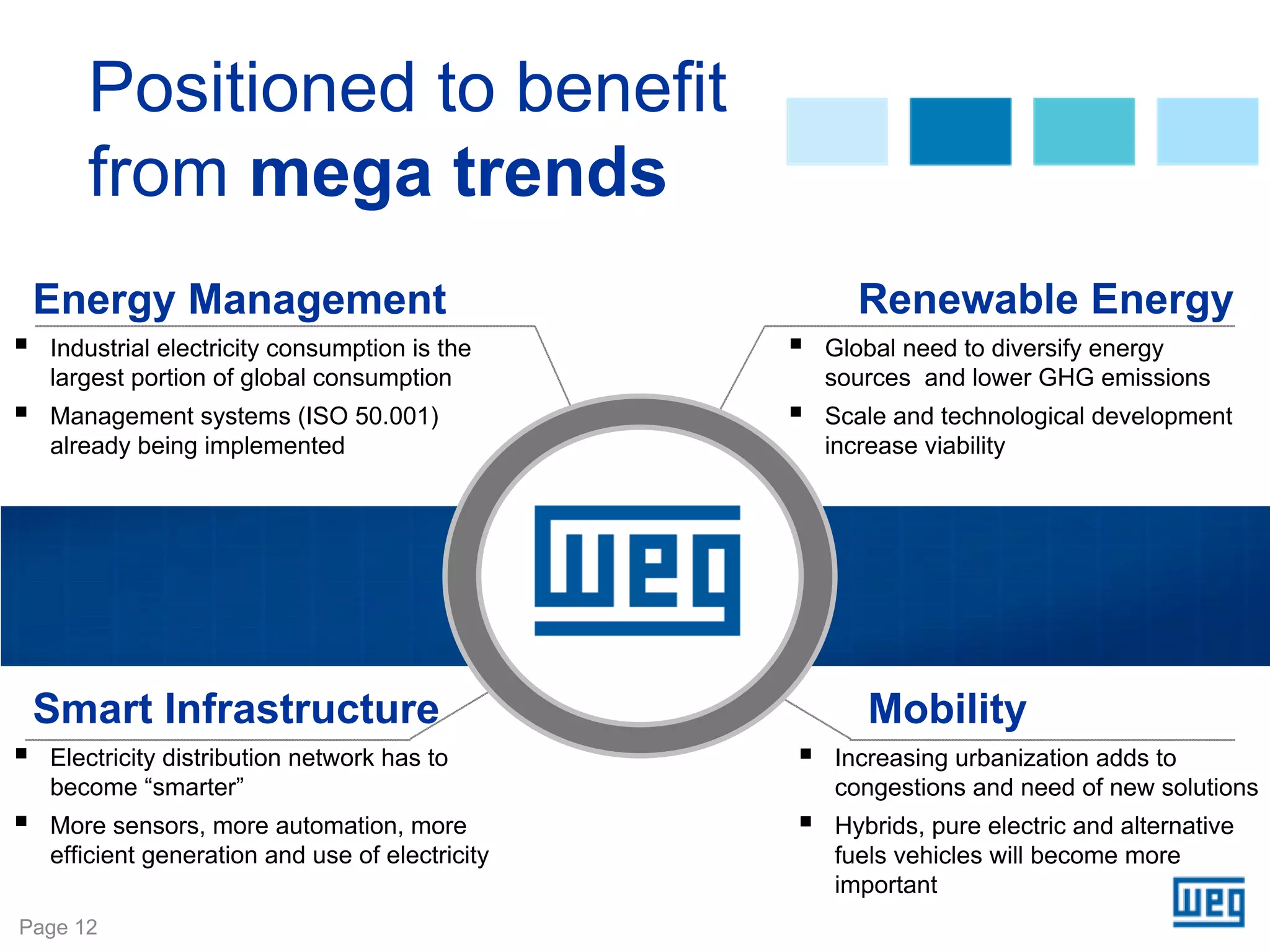

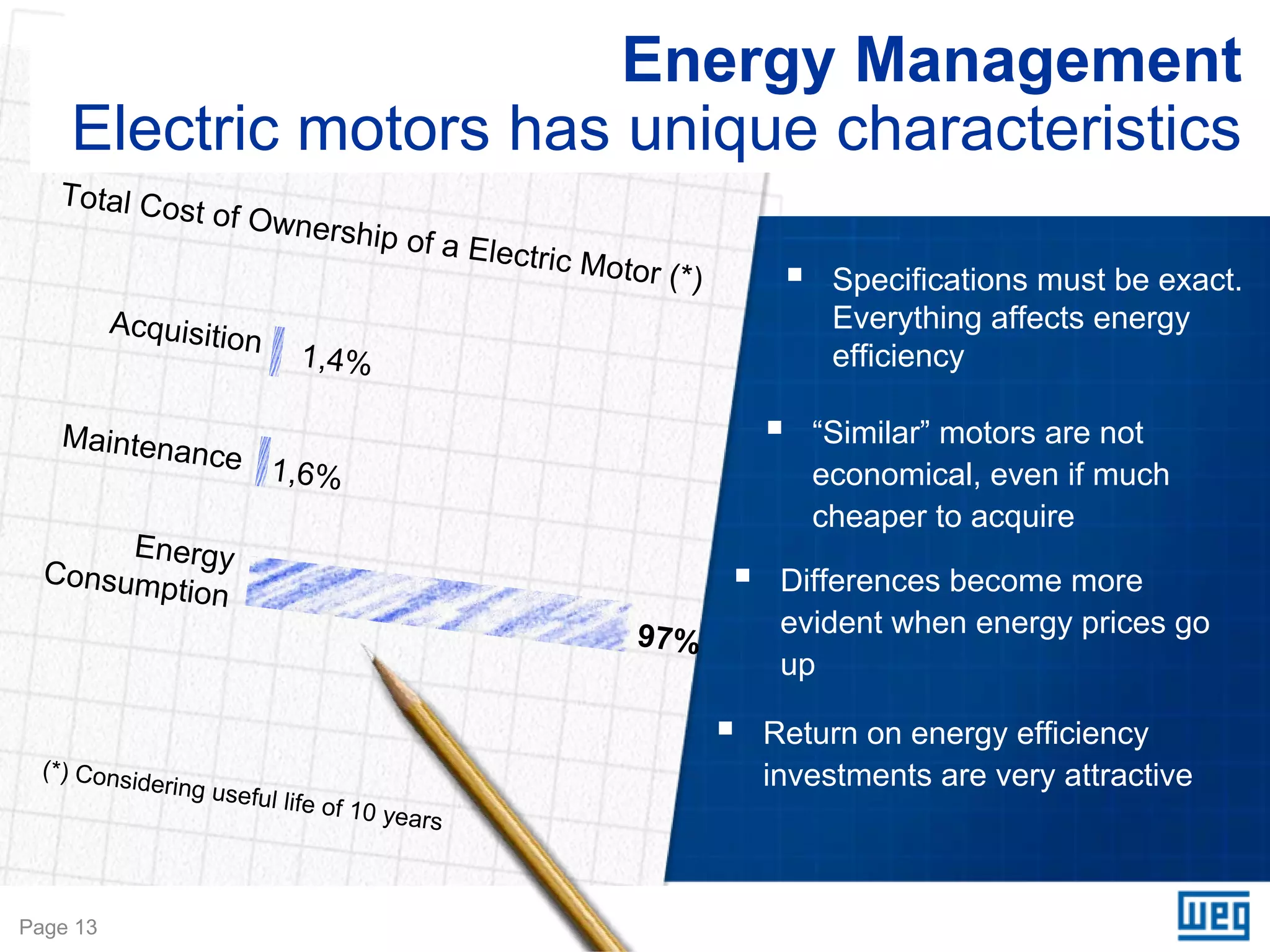

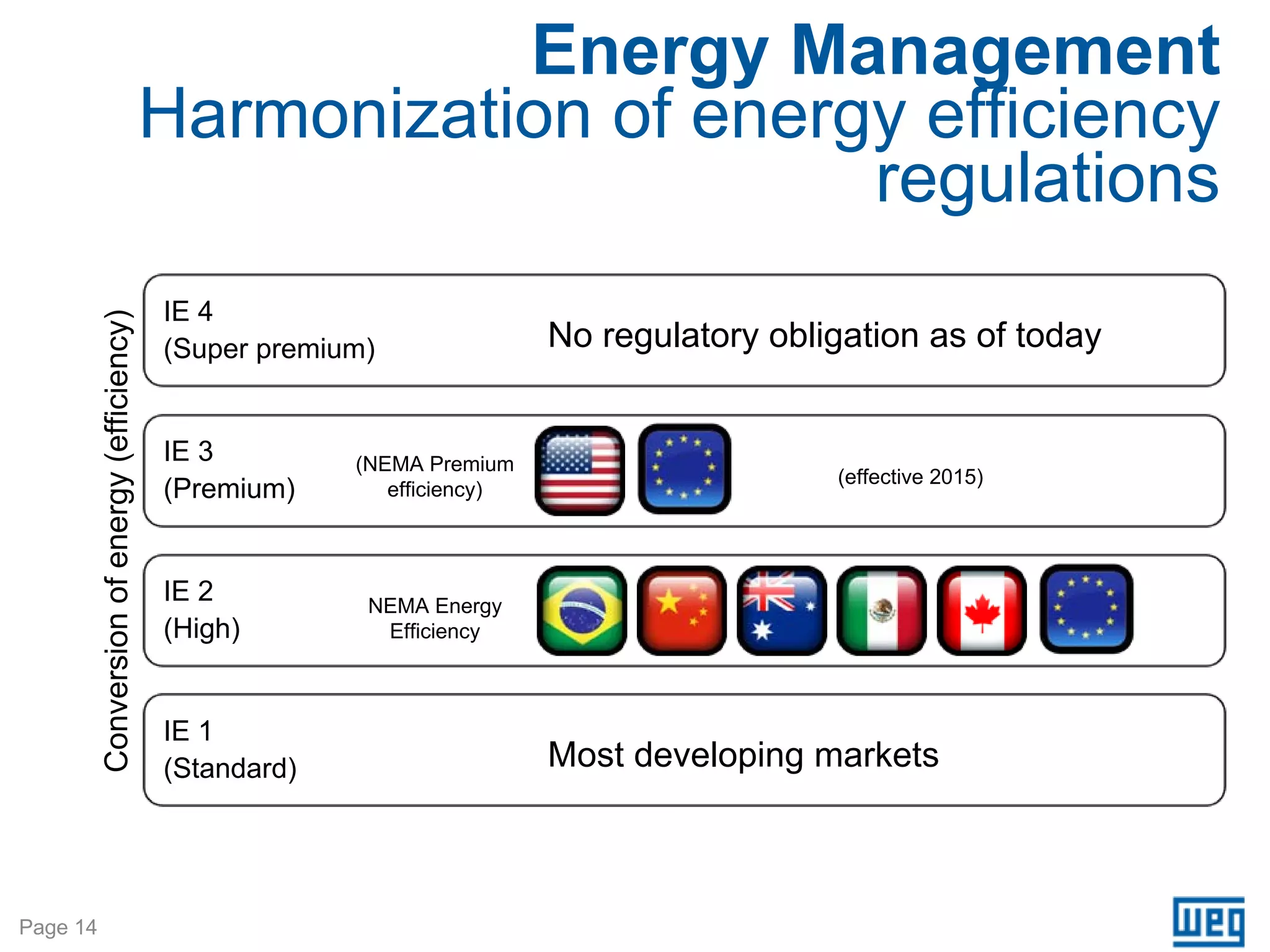

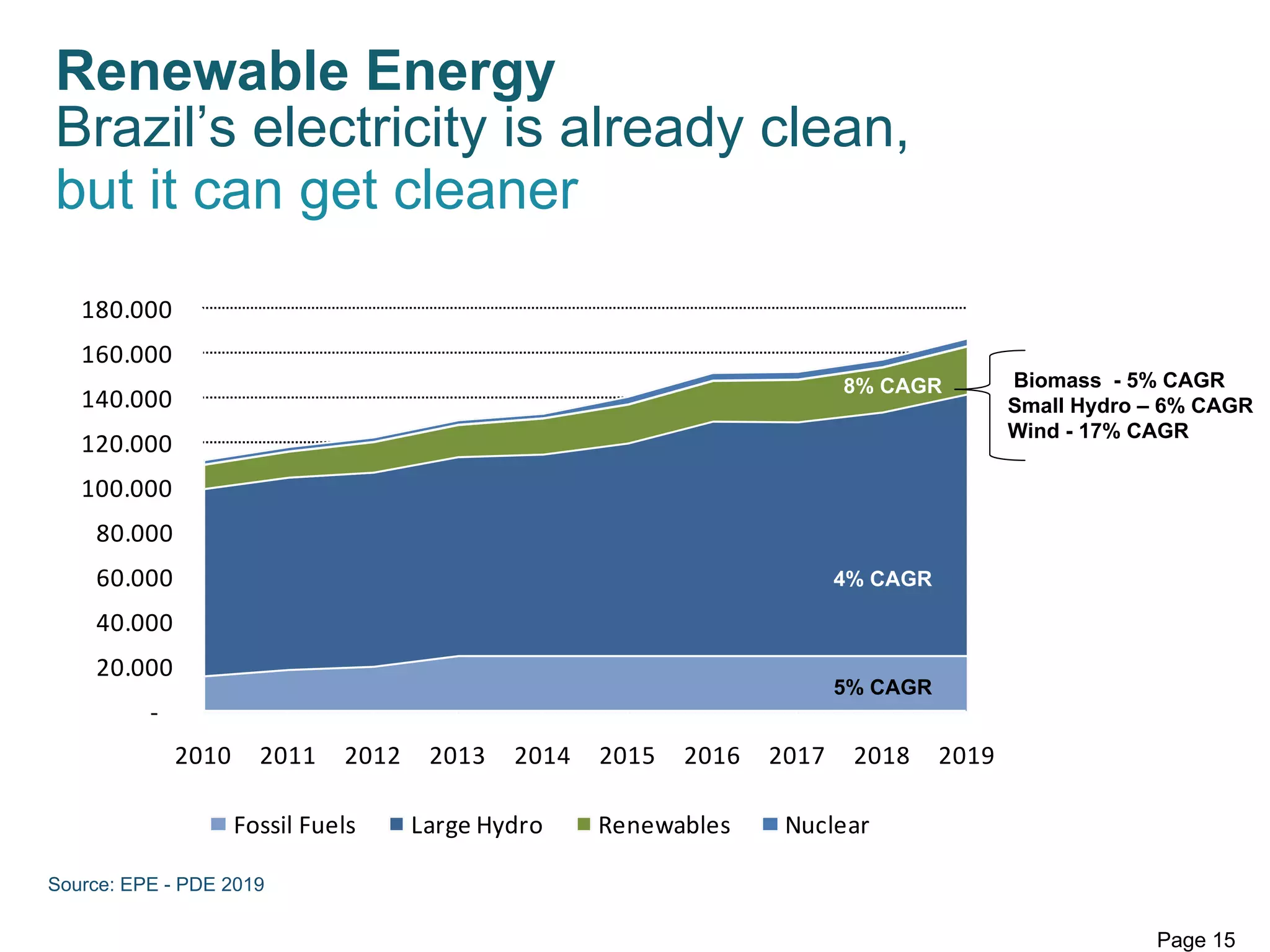

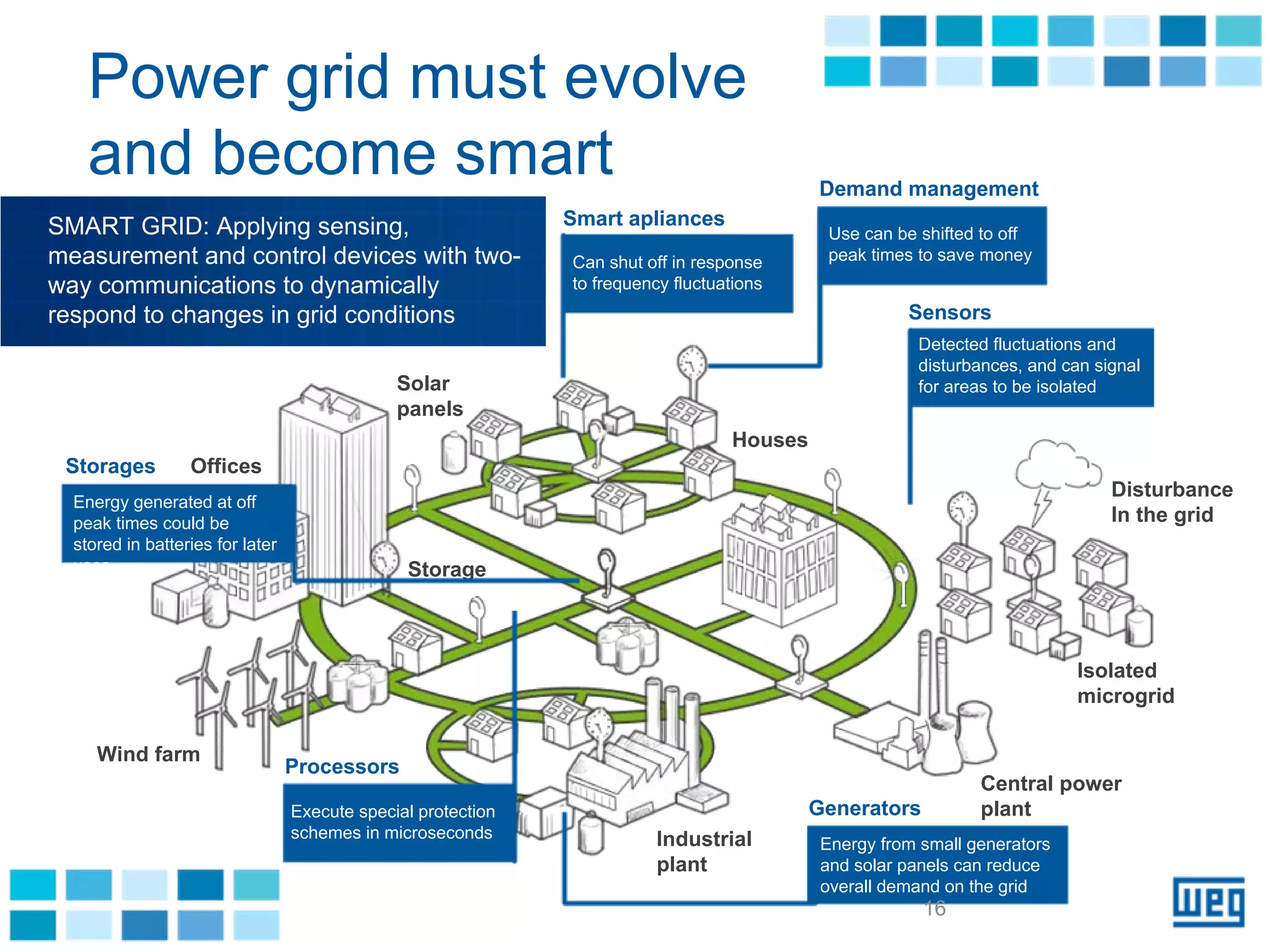

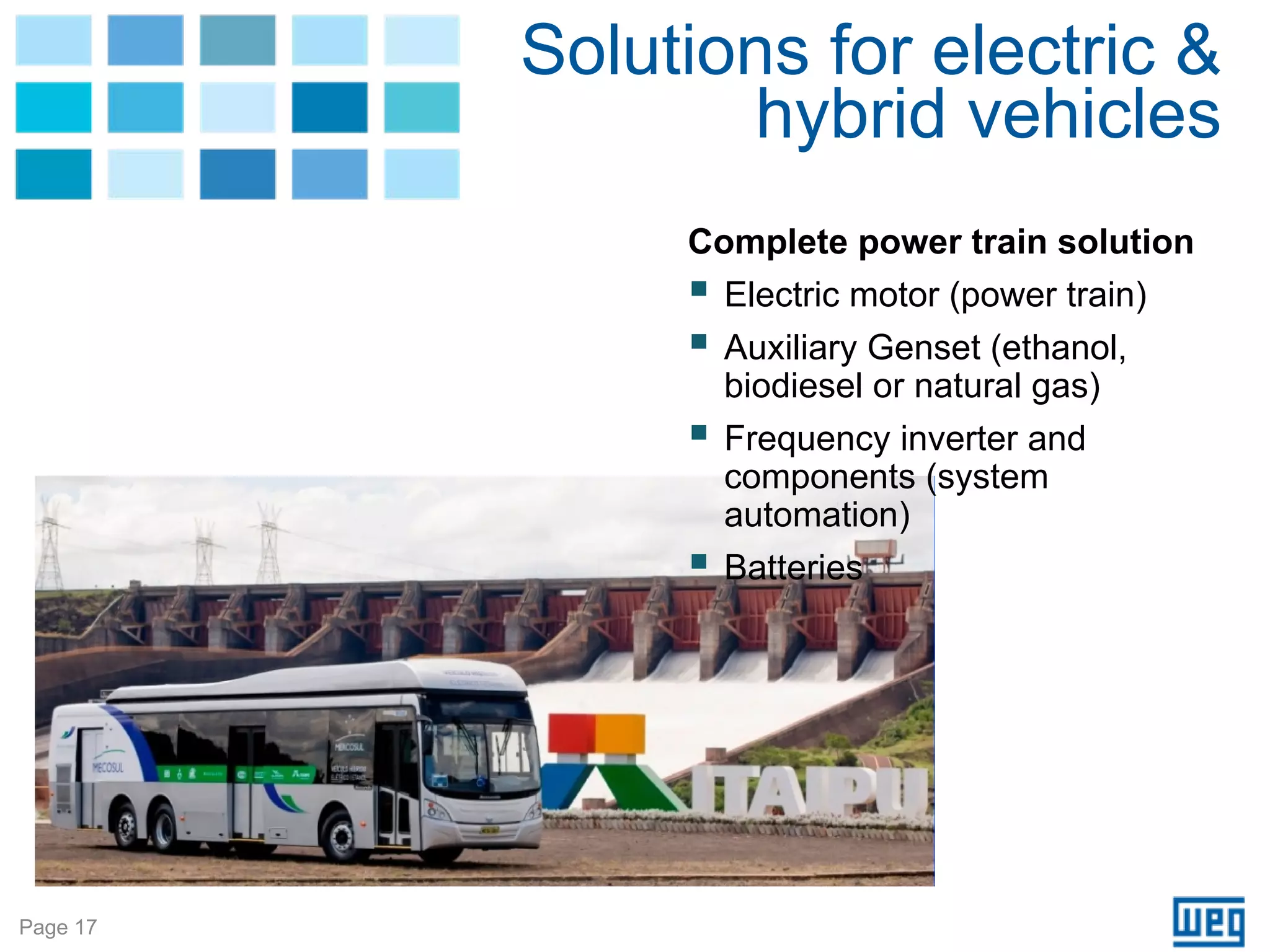

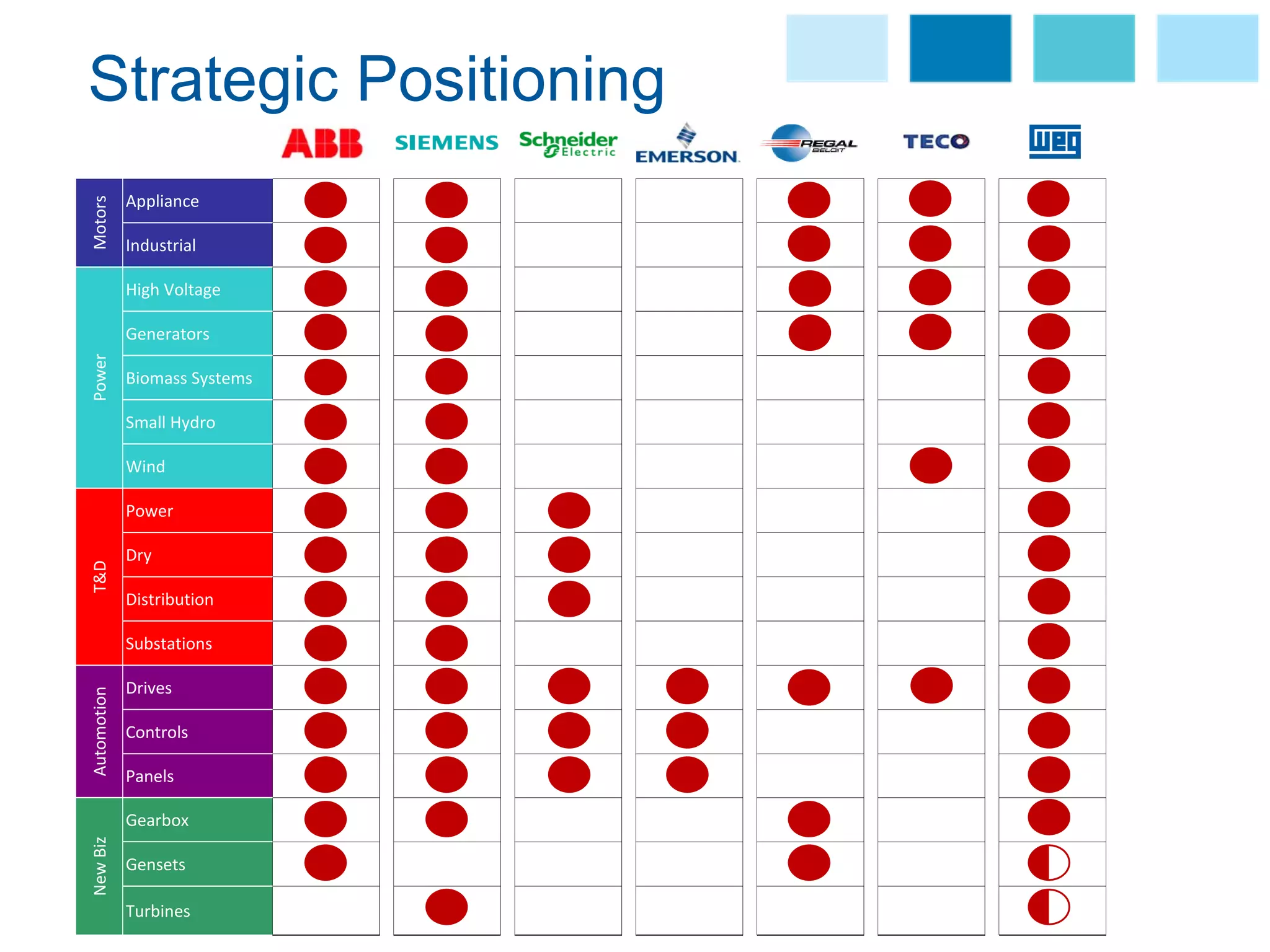

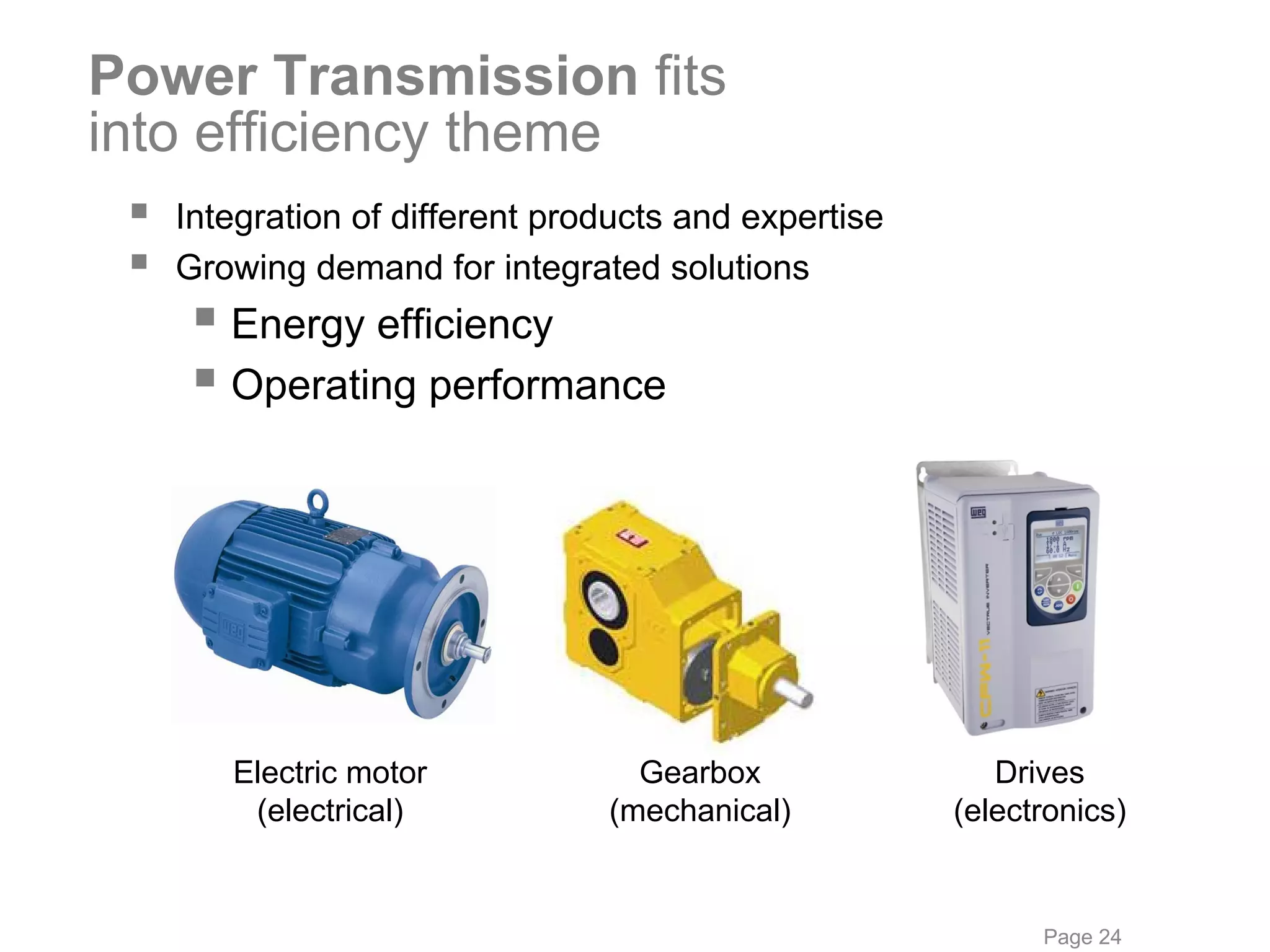

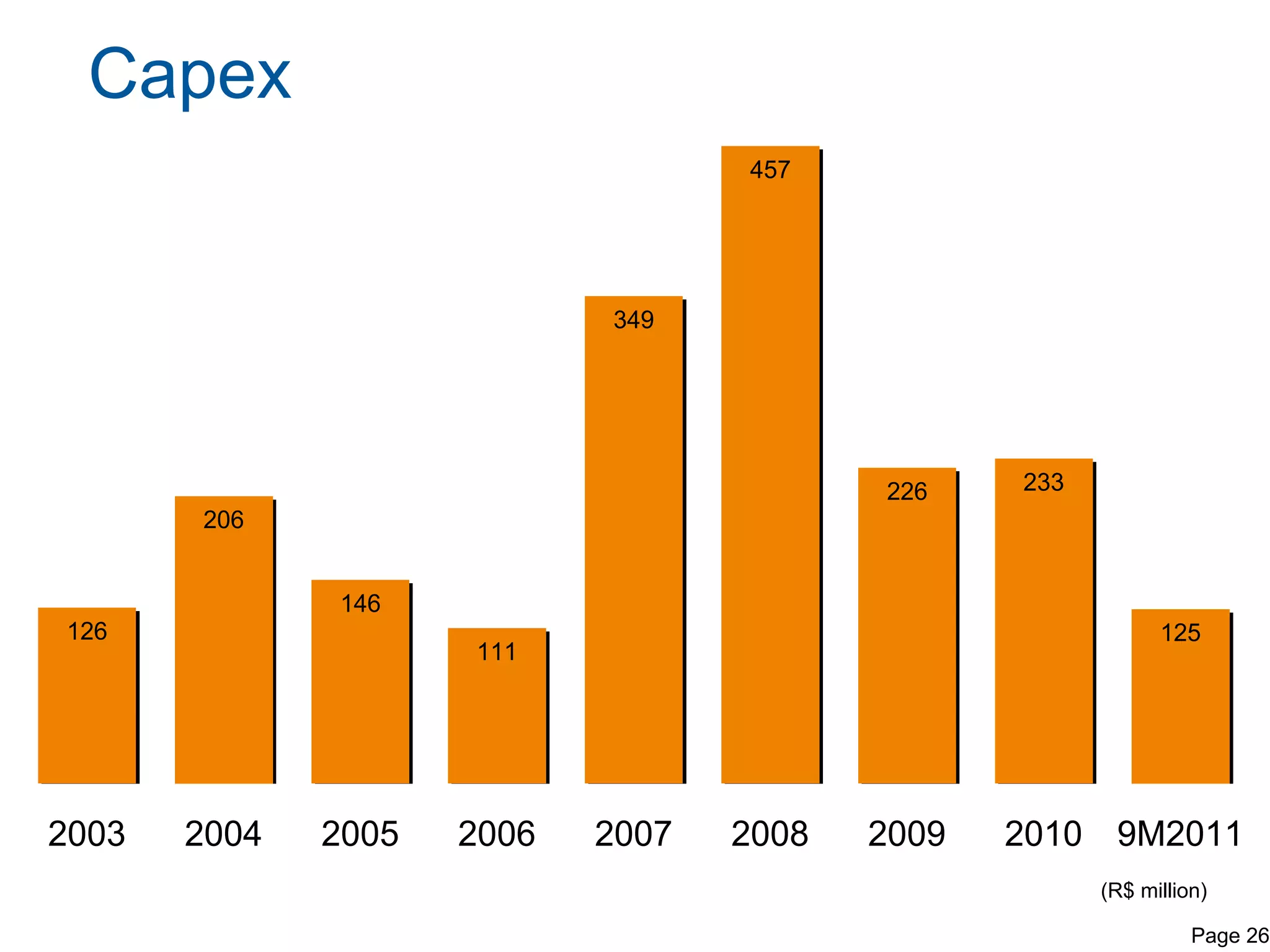

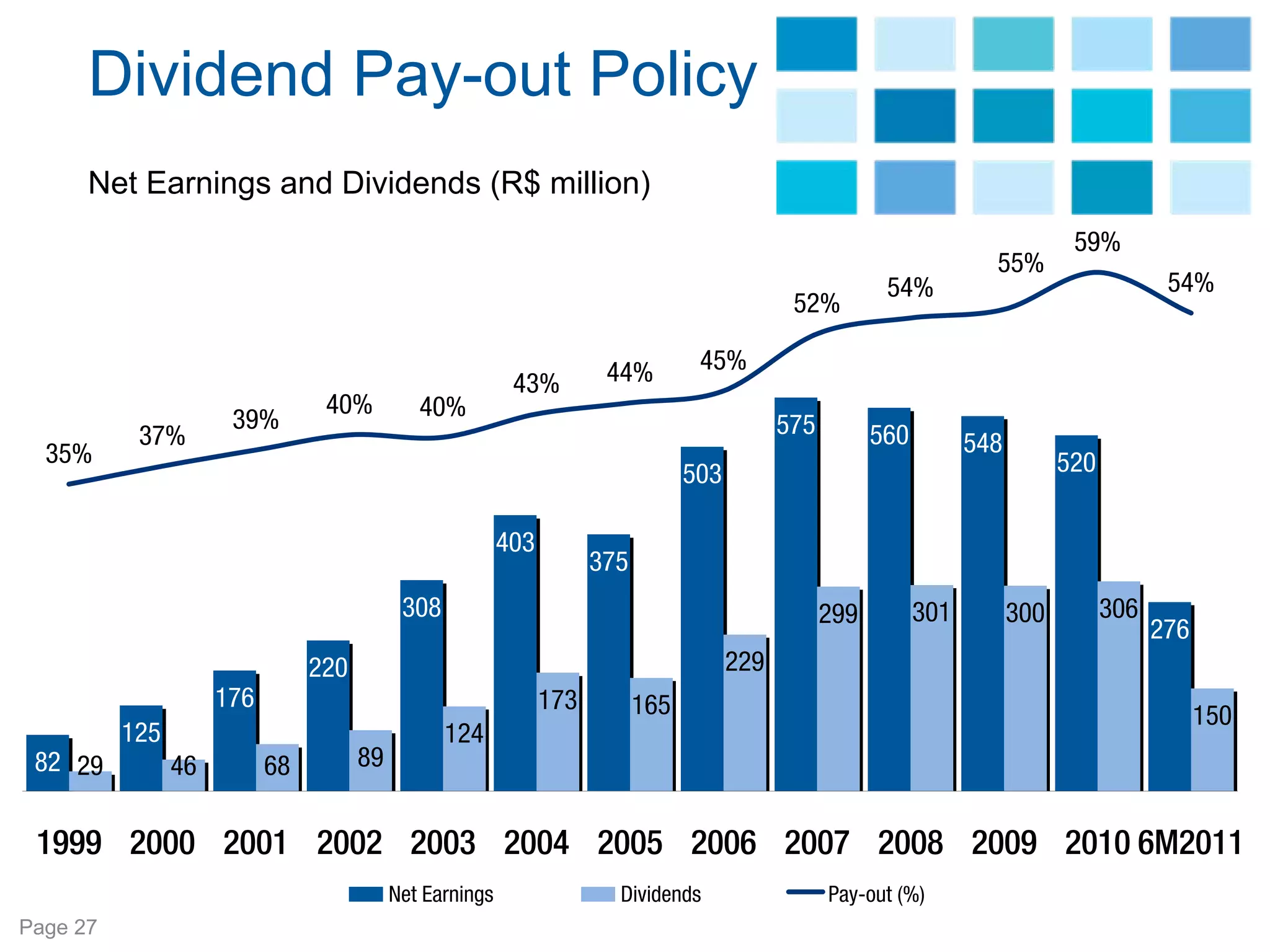

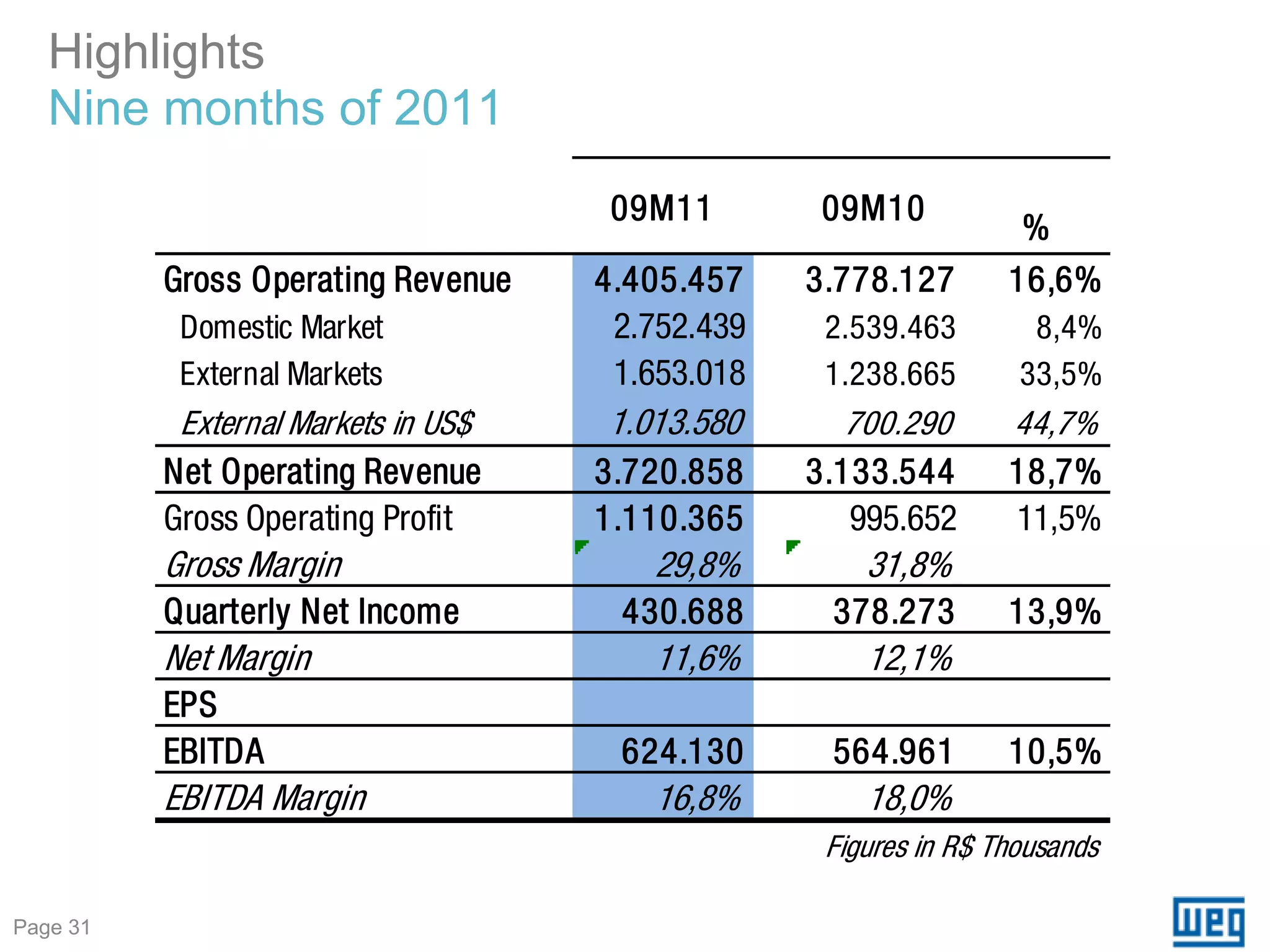

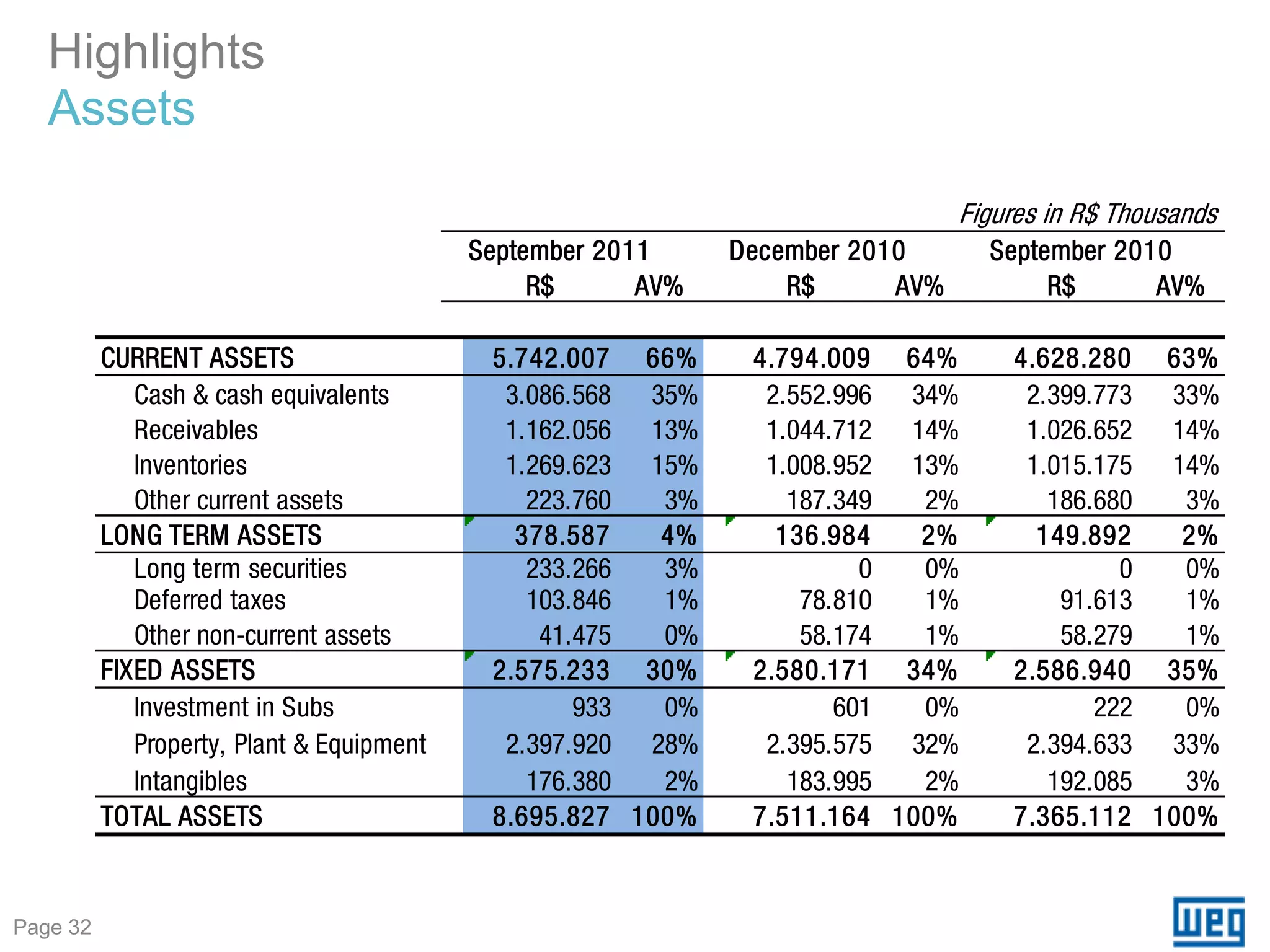

The document discusses WEG S.A., a Brazilian manufacturer of electric motors, generators, transformers, and gearboxes. It provides an overview of WEG's business units and key markets. It also summarizes the company's financial performance between 2004-2010, with revenues growing at a CAGR of 17% and EBITDA growing at 16%. The document highlights opportunities for WEG in areas like energy management, renewable energy, smart infrastructure, and electric vehicles.