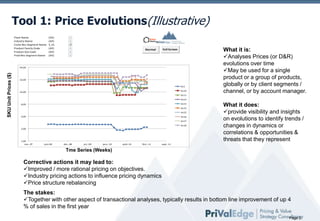

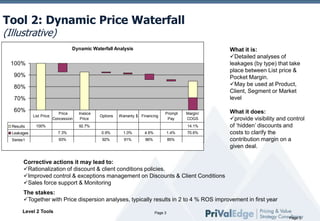

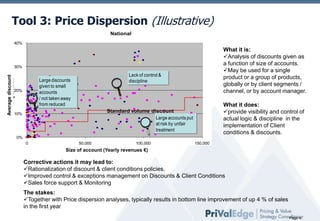

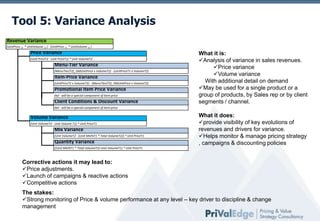

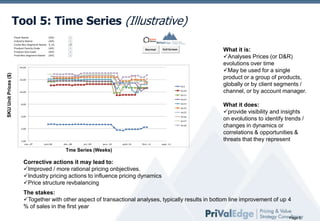

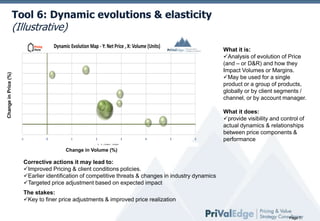

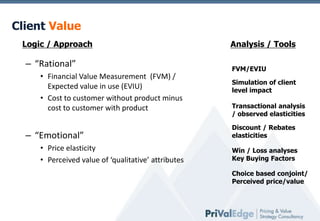

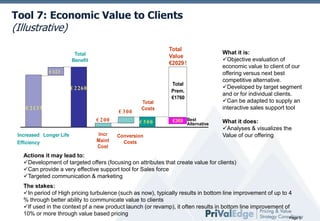

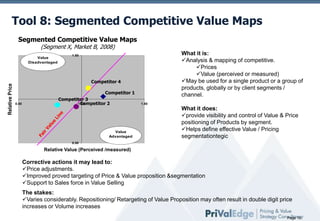

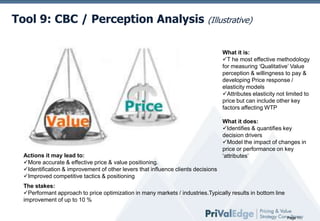

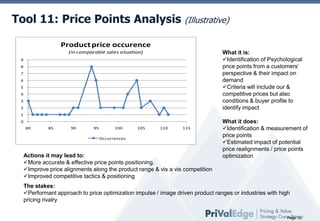

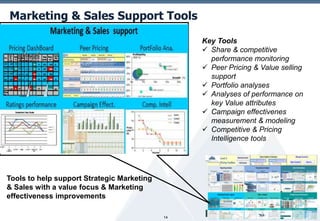

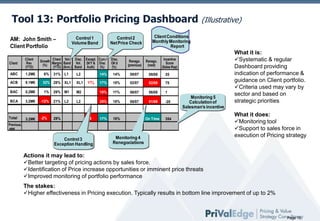

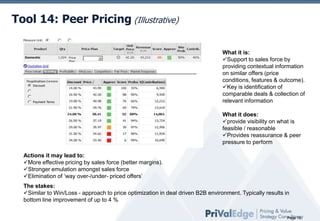

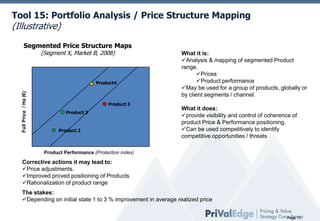

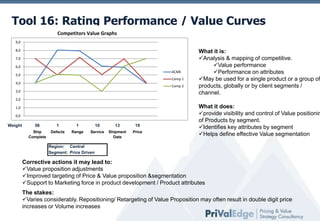

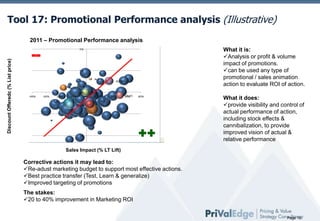

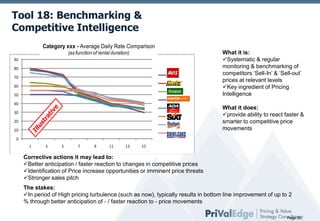

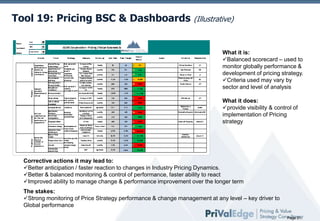

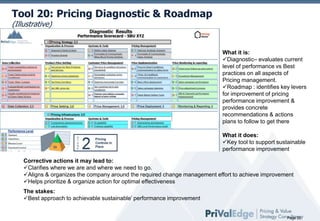

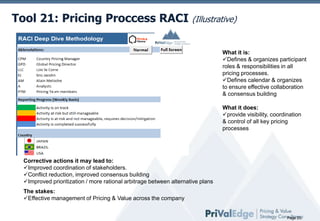

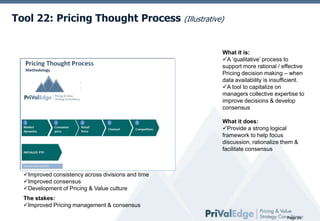

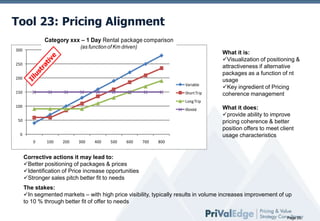

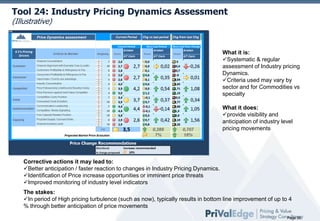

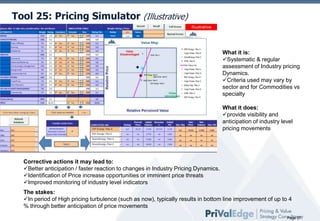

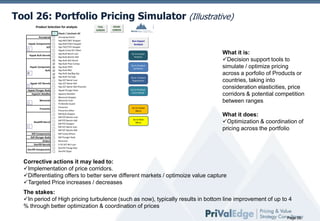

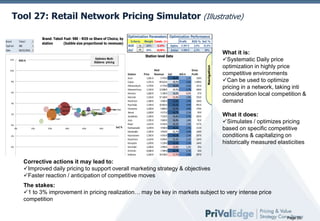

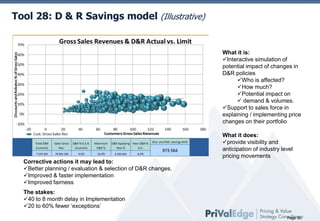

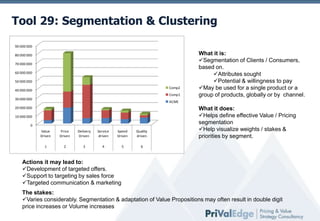

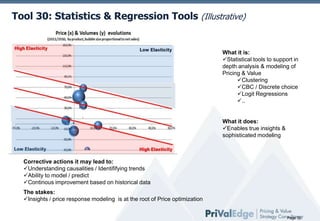

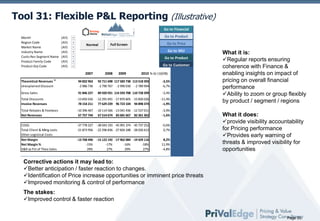

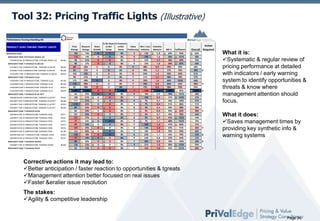

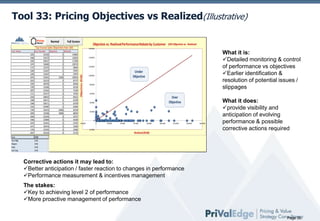

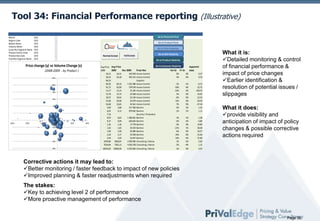

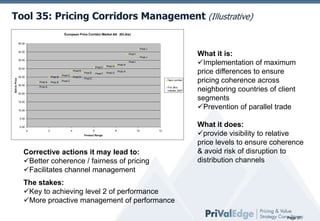

The document outlines various pricing tools designed to improve pricing strategies and profitability. It includes analyses such as price evolutions, dynamic price waterfalls, price dispersion, and revenue variance to identify trends and control pricing dynamics. Implementing these tools is projected to enhance sales by up to 4% in the first year through improved pricing and clearer communication of client value.