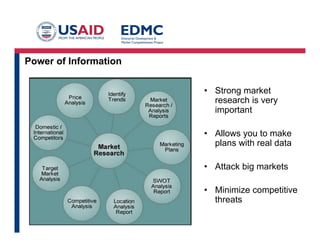

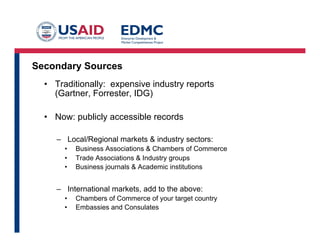

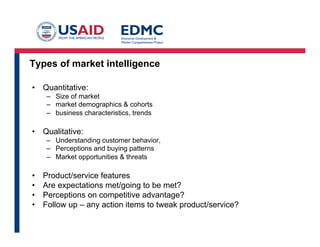

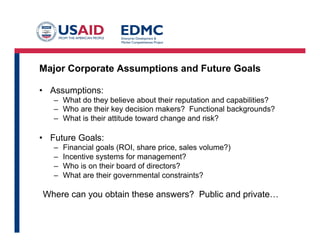

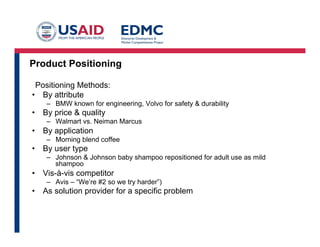

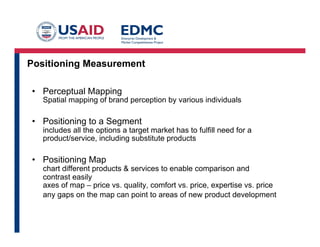

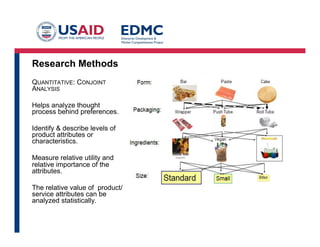

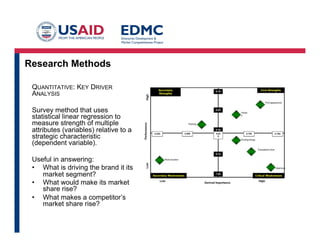

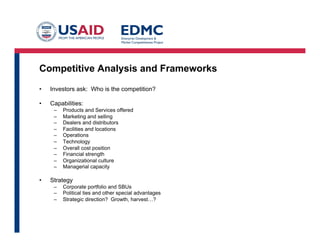

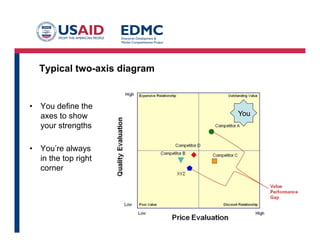

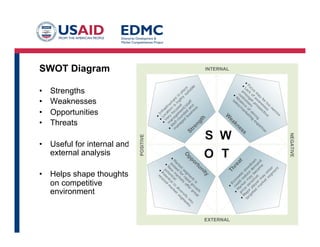

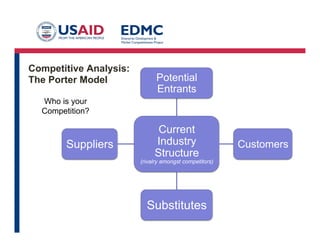

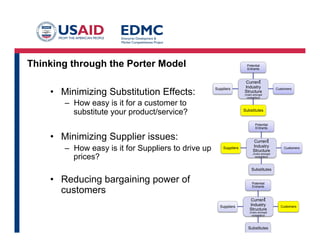

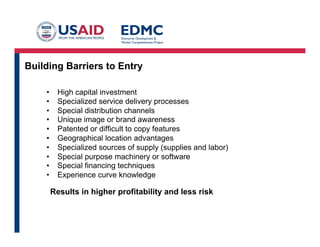

This document emphasizes the importance of market research and intelligence for successful business planning, highlighting various methods and sources for gathering data. It outlines the significance of both quantitative and qualitative intelligence in understanding market dynamics, customer behavior, and positioning strategies. Additionally, it discusses competitive analysis frameworks and the necessity of comprehending industry structures and competitive environments to mitigate risks and enhance profitability.