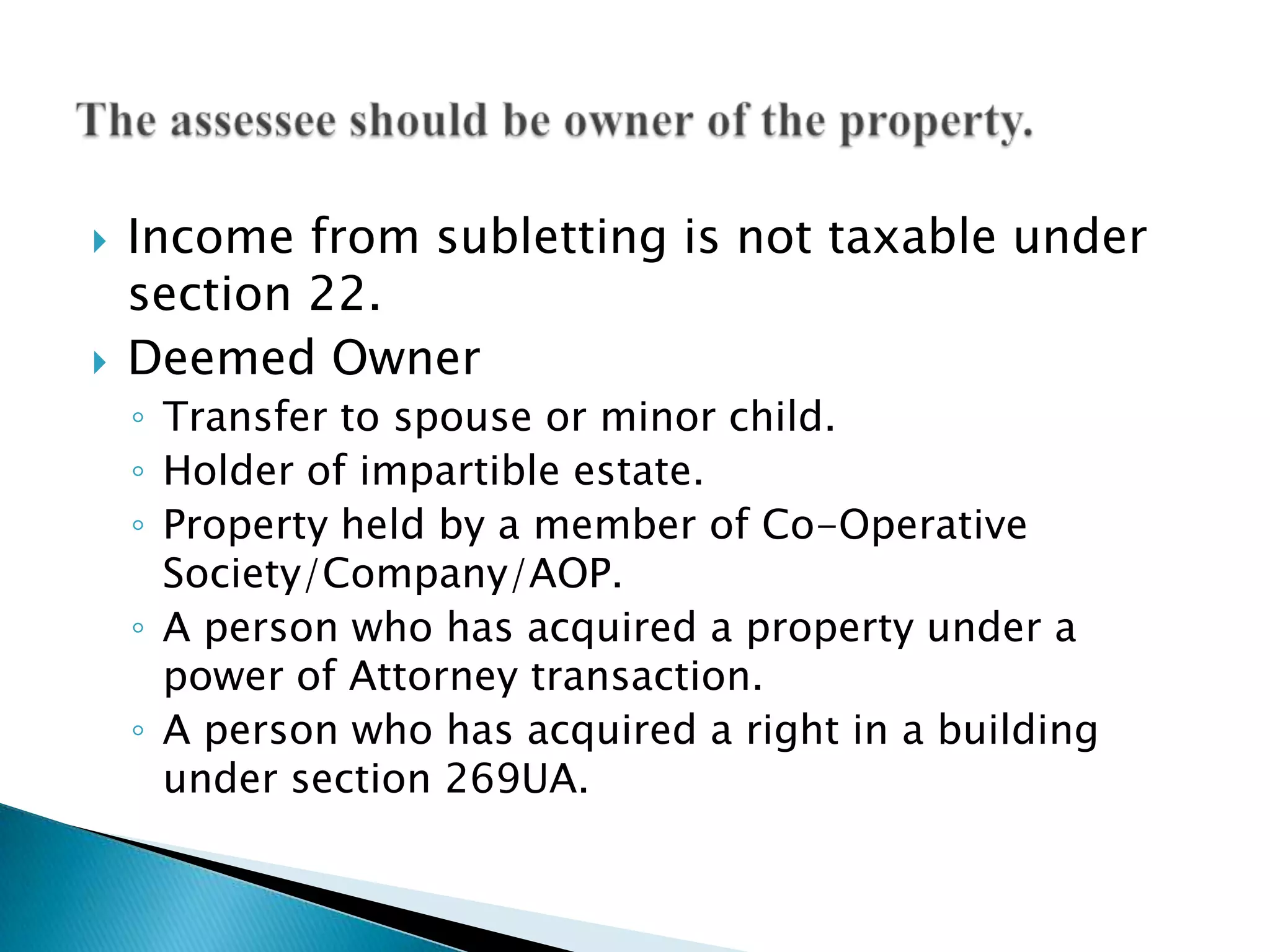

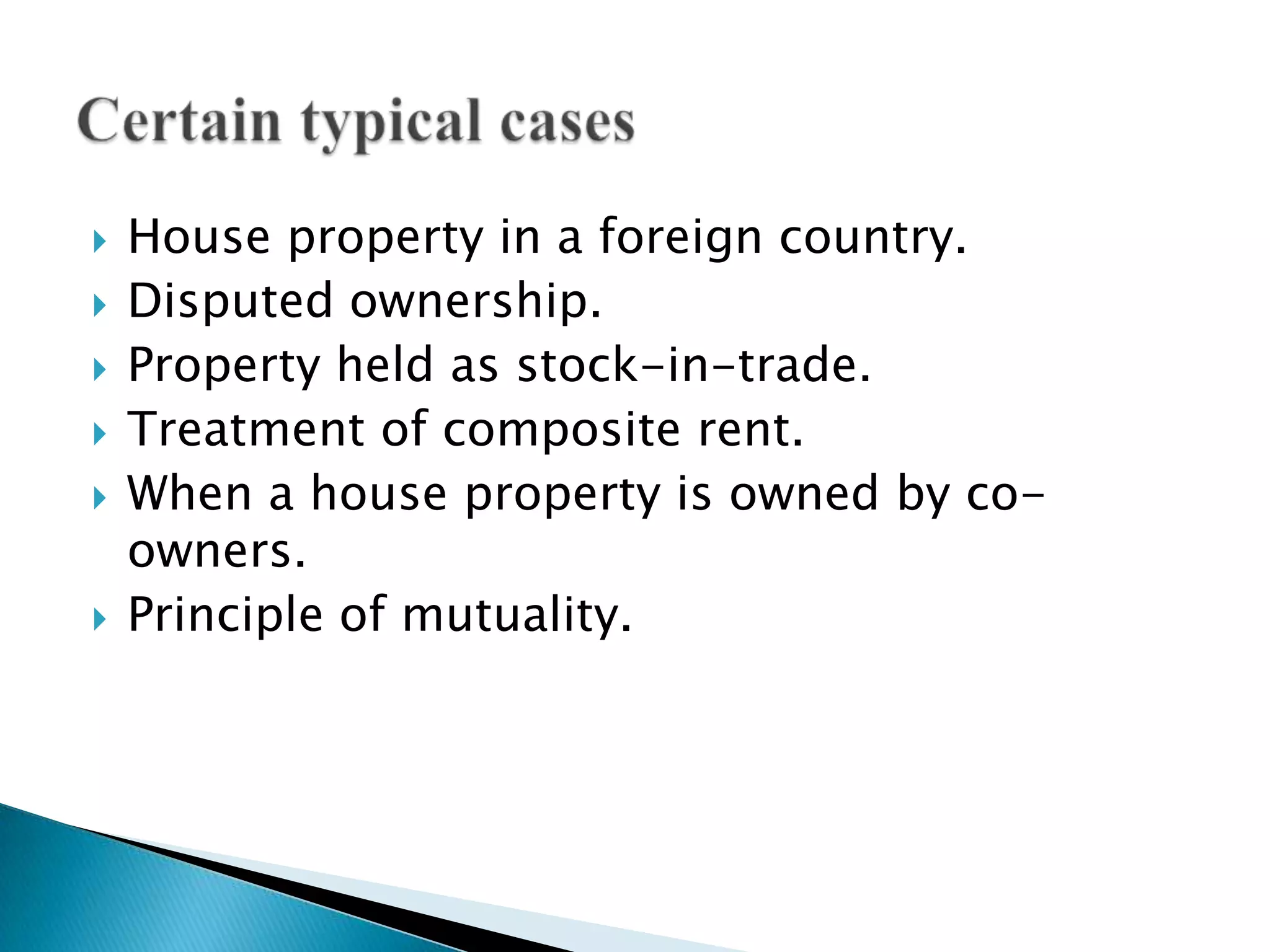

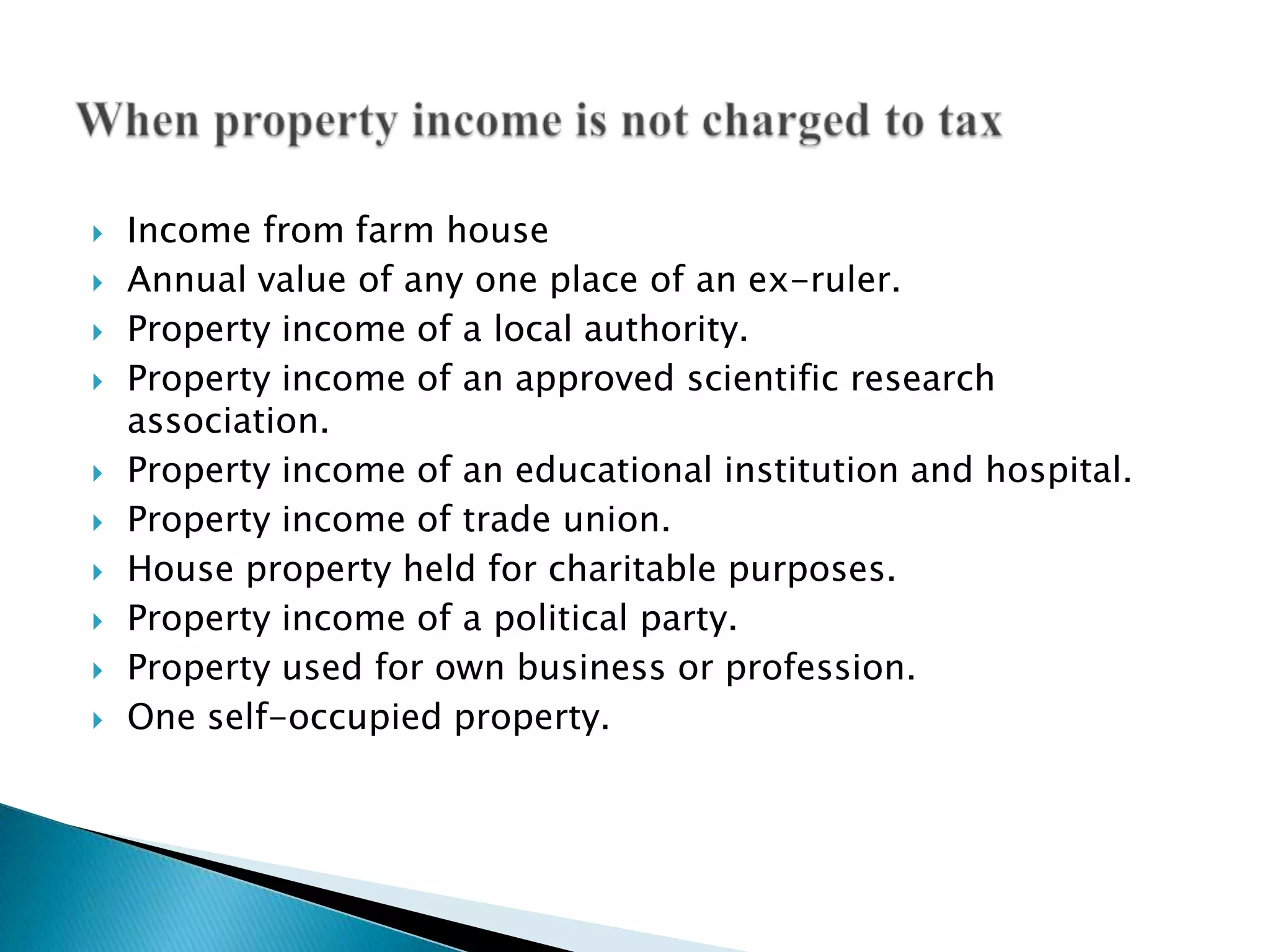

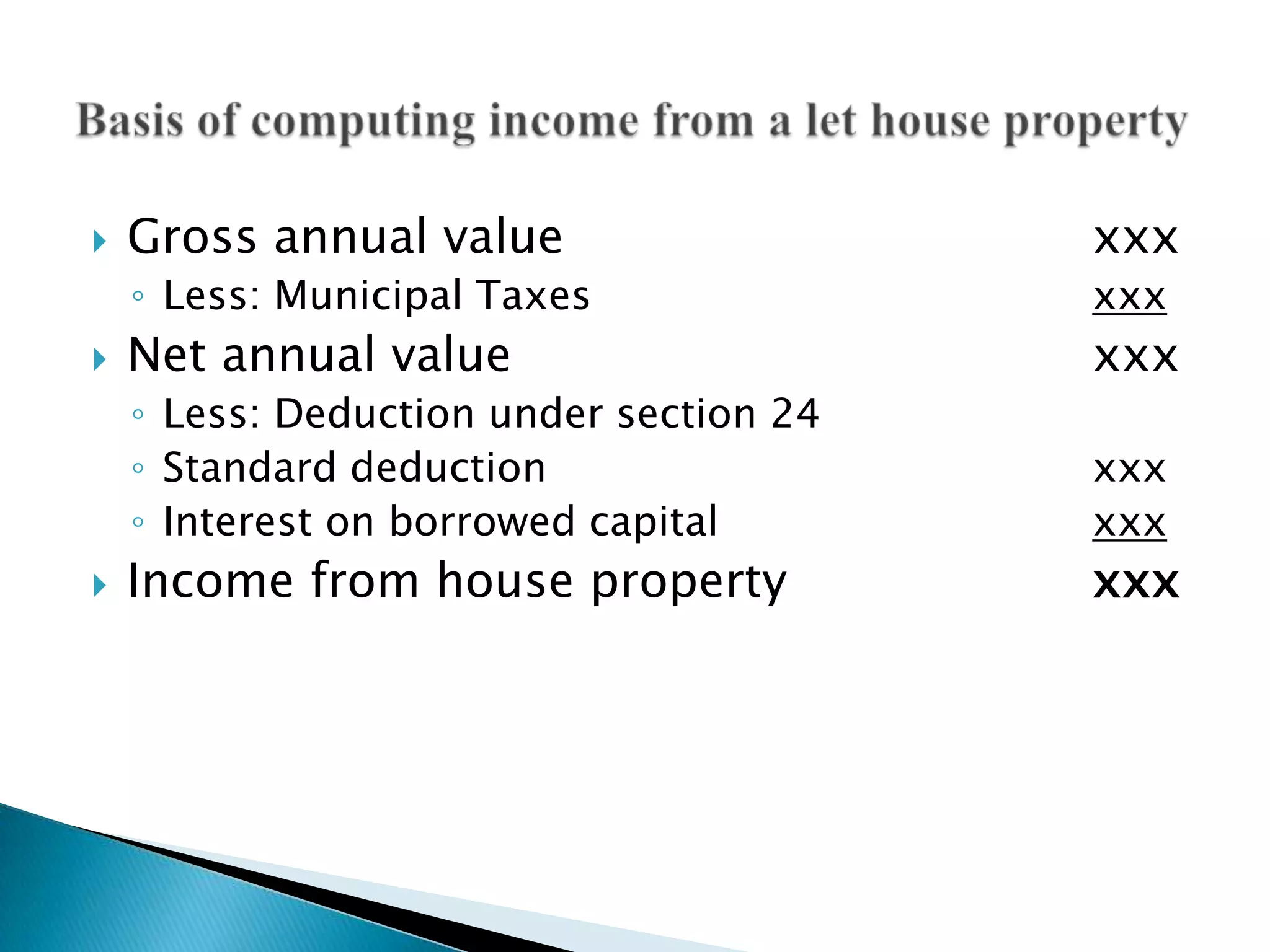

The document discusses the taxation of income from house property in India. [1] It outlines the conditions that must be met for a property to be considered a house property under the Income Tax Act, including that the assessee must own the property and not use it for business purposes. [2] It then discusses various scenarios where income from a house property may be taxable or exempt from taxation. [3] Key considerations around the calculation of income from house property such as the gross annual value, deductions, and net annual income are also summarized.