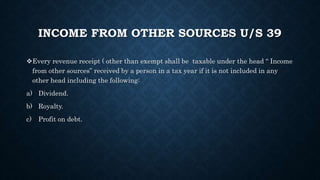

This document discusses income from other sources as defined by the Income Tax Ordinance of 2001 in Pakistan. It states that income from other sources includes dividend, royalty, and profit on debt if not covered under other income categories. It provides details on definitions and tax treatment of these types of other income according to the relevant sections of the Ordinance. Admissible deductions for expenses related to deriving the income are also mentioned.

![INCOME FROM OTHER SOURCES U/S 39

Dividend:

Defined in sec. 2(19) and includes distribution of “accumulated profit [sec.2(1)]” to

shareholders of shares and debentures etc.;

Taxable under Final Tax Regime in respect of all taxpayers;

Various dividends are exempt from levy of tax under part I of second schedule that

include the following:

Distribution received from Mutual Trust Funds [Clause (103)];

Inter-Corporate Dividend [Clause (103-A)];](https://image.slidesharecdn.com/incomeothersources-180206135238/85/Income-other-sources-6-320.jpg)