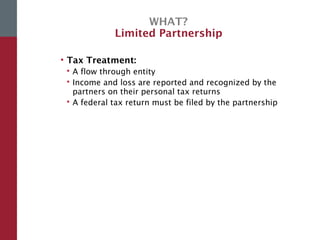

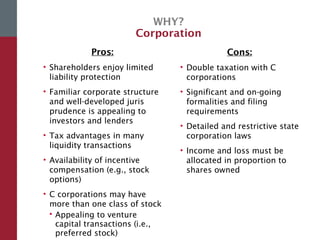

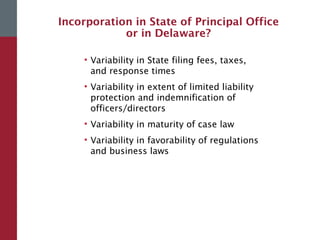

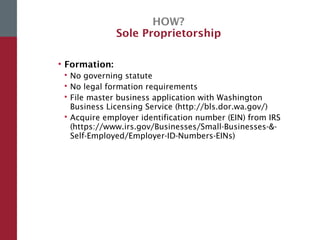

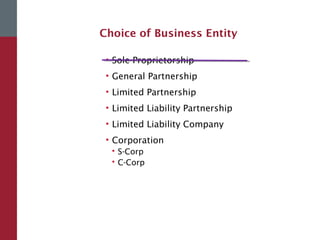

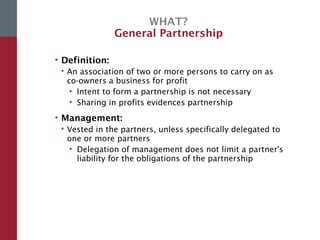

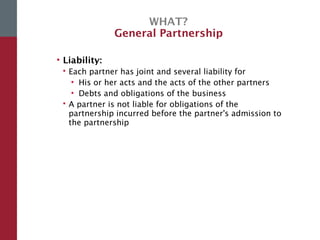

This document provides an overview of different corporate structures for startups, including sole proprietorships, general partnerships, limited partnerships, limited liability partnerships, limited liability companies, and corporations (S-Corps and C-Corps). It discusses the key aspects of each structure such as liability, taxation, formation process, and pros and cons. The document recommends that for startups, the primary choices for corporate structure are limited liability companies, S-corporations, and C-corporations, and that the choice depends on factors like financing plans and investment levels. It also discusses considerations around incorporating in the state of the principal office or in Delaware.

![WHAT?

Limited Partnership

• Definition:

A partnership comprising

• one or more general partners who manage [the]

business and who are personally liable for

partnership debts, and

• one or more limited partners who contribute capital

and share in profits but who take no part in running

[the] business and incur no liability with respect to

partnership obligations beyond contribution](https://image.slidesharecdn.com/2a4e9767-b680-45dd-813d-90ac0421109f-151120203818-lva1-app6891/85/2015-11-4_WSU_Corp-Structure-Formation-for-Start-ups-15-320.jpg)