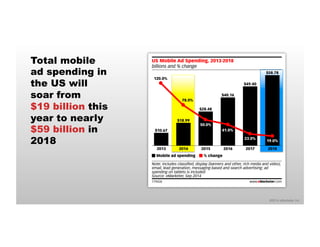

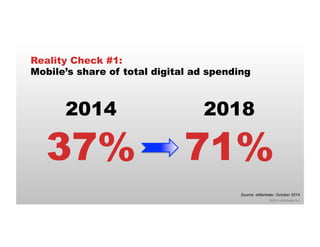

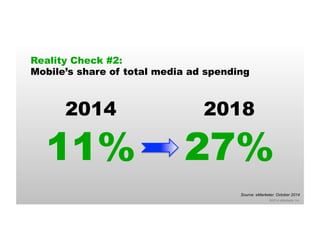

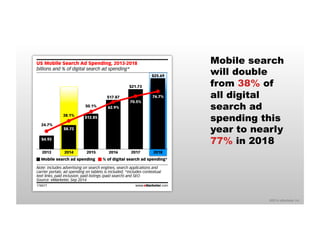

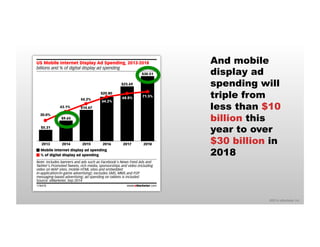

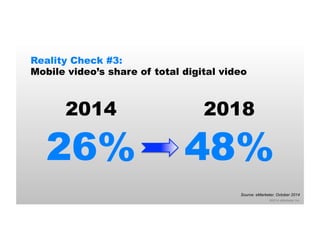

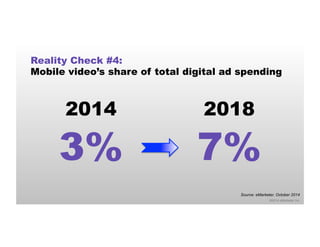

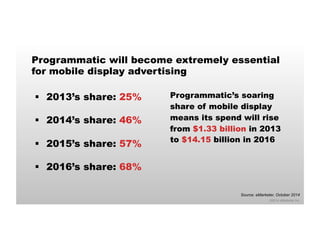

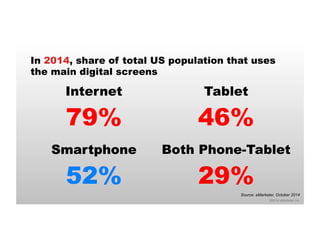

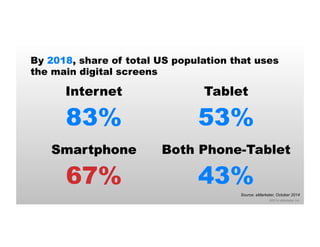

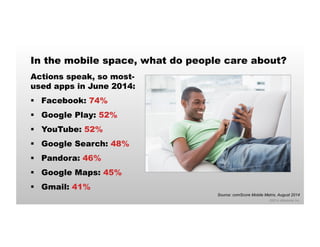

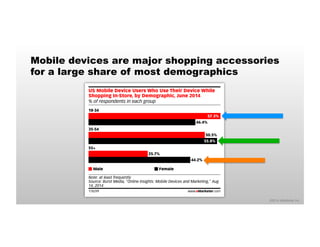

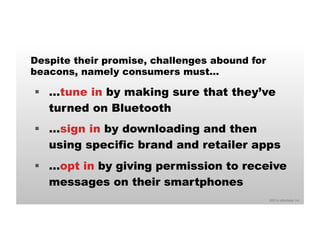

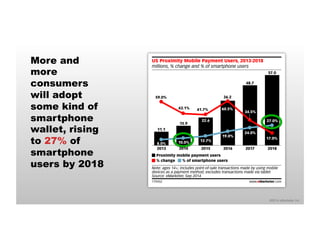

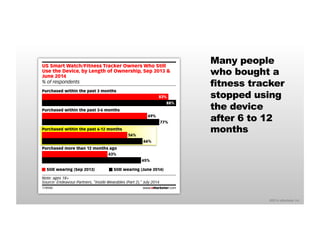

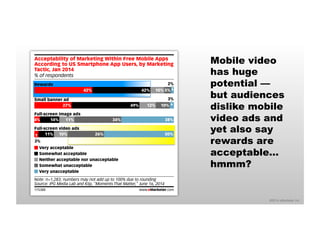

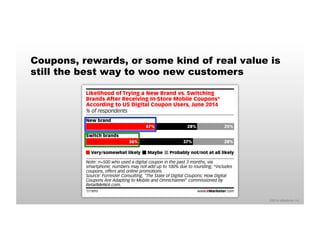

This document summarizes key insights from a presentation on mobile marketing given by David Hallerman of eMarketer. It discusses the rapid growth of mobile advertising spending expected through 2018, with mobile's share of total digital and media ad spending increasing significantly. The growing importance of mobile search, display, and video advertising is also covered. The presentation examines trends in mobile device ownership and usage, as well as mobile user behaviors and attitudes. It provides commentary from industry experts on opportunities and challenges for mobile marketing tactics like beacons, wearables, and mobile wallets.