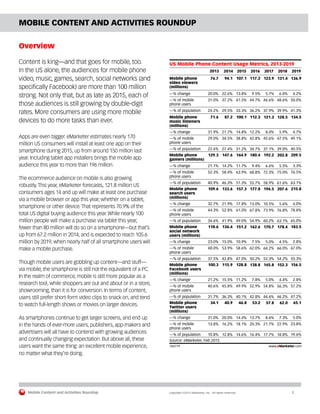

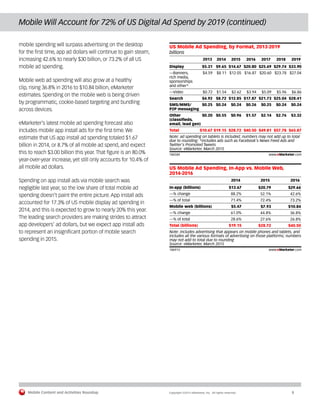

As of April 2015, over 100 million US consumers engage with mobile content, significantly driving the demand for a superior mobile experience. A report by eMarketer highlights the rapid growth in mobile activities, such as video streaming and mobile shopping, with 121.8 million consumers expected to make mobile purchases that year. While mobile is favored for research and immediate deals, it has not fully replaced PCs for all content types, emphasizing the ongoing evolution of user expectations in the mobile landscape.

![Mobile Content and Activities Roundup Copyright ©2015 eMarketer, Inc. All rights reserved. 15

Terra’s Research Points to Hispanics as Largest Mobile

Content Viewers

Soizic Sacrez

Director of Marketing

Terra

Soizic Sacrez, director of marketing for Terra, a

global digital media company, discussed with

eMarketer the findings in Terra’s latest round

of research into US Hispanics’ media usage,

revealing insights into why Hispanics are more

likely to access video content via mobile and pay

for video content.

eMarketer: Terra’s research shows that Hispanics are

accessing entertainment content on mobile at a much

higher rate than non-Hispanics. Did the research give you

some idea of why this is?

Soizic Sacrez: We’ve been seeing this trend over the

course of the past few studies—Hispanics overindex on

everything mobile. Specifically for entertainment, Hispanics

are passionate about music, entertainment and sports, and

they like to be up to date on what is going on with artists

and athletes they are following. Overall, it’s a cultural point.

eMarketer: Are you seeing this behavior across all ages?

Or is it more likely to be a millennial behavior?

Sacrez: We are seeing some differences through the

generations. For instance, looking at the data for listening

to music on smartphones, 76% of millennials said that they

were listening to music on their smartphones, vs. 68% of

Gen X and 43% of baby boomers. And some of this has to

do with technology adoption [since younger generations

are more likely to use digital technology]. But if we look at

the whole group of Hispanics, in general, they are going to

listen more to music [than non-Hispanics].

eMarketer: The research also showed that Hispanics are

more likely to pay for access to entertainment content.

When there is so much free content, why are Hispanics

paying for content?

Sacrez: It depends on the category, but much of it has to

do with watching a program live rather than after the fact.

Sports, especially, are a passion point. Boxing and soccer

are key sports among Hispanics, and they are willing to

pay to experience the game live. Especially if they follow

a specific boxer or a specific team, they are more likely

to pay.

eMarketer: The research also shows that Hispanics are

more likely to access this content on smaller screens—

smartphones, tablets—than non-Hispanics. Did you get

some indication as to why this is?

Sacrez: Hispanics overindex in everything mobile, and we

have seen that throughout our studies. We’re seeing a lot

of [video] consumption on the go. It’s primarily a comfort

level [they have with mobile devices]. In Latin America,

too, there is a lot of mobile consumption. They are more

connected to their families and friends through their

smartphones; for instance, when they are in a retail store

they will send a picture of the product to their family, more

so than the non-Hispanics. So, mobile consumption of

video is comfortable for them.

eMarketer: Is the content they are consuming more likely

to be in Spanish or English?

Sacrez: We’ve seen that millennials are more likely than

Gen X to favor some online content in Spanish. And that’s

interesting, because that shows an attachment among

the younger generation to their culture and to the Spanish

language. I think it has to do with pride in their heritage. We

do see also that Spanish-preferred Hispanics tend to be

a bit more engaged, for instance, in commenting, sharing

and participating than the English-preferred Hispanics,

and that’s true in particular for live events around sports

entertainment and music.](https://image.slidesharecdn.com/emarketermobilecontentactivitiesroundup-150413040654-conversion-gate01/85/E-marketer-mobile_content_activities_roundup-15-320.jpg)