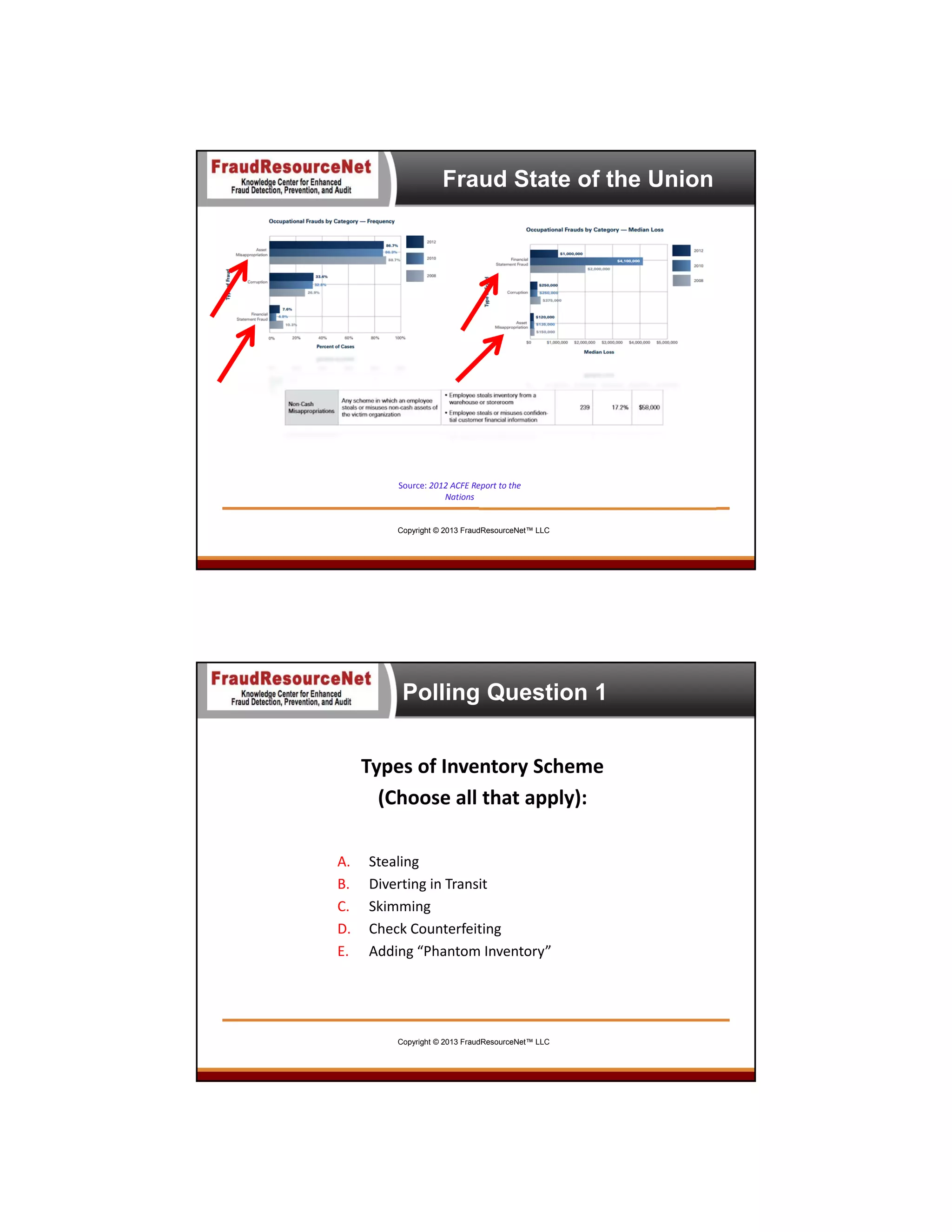

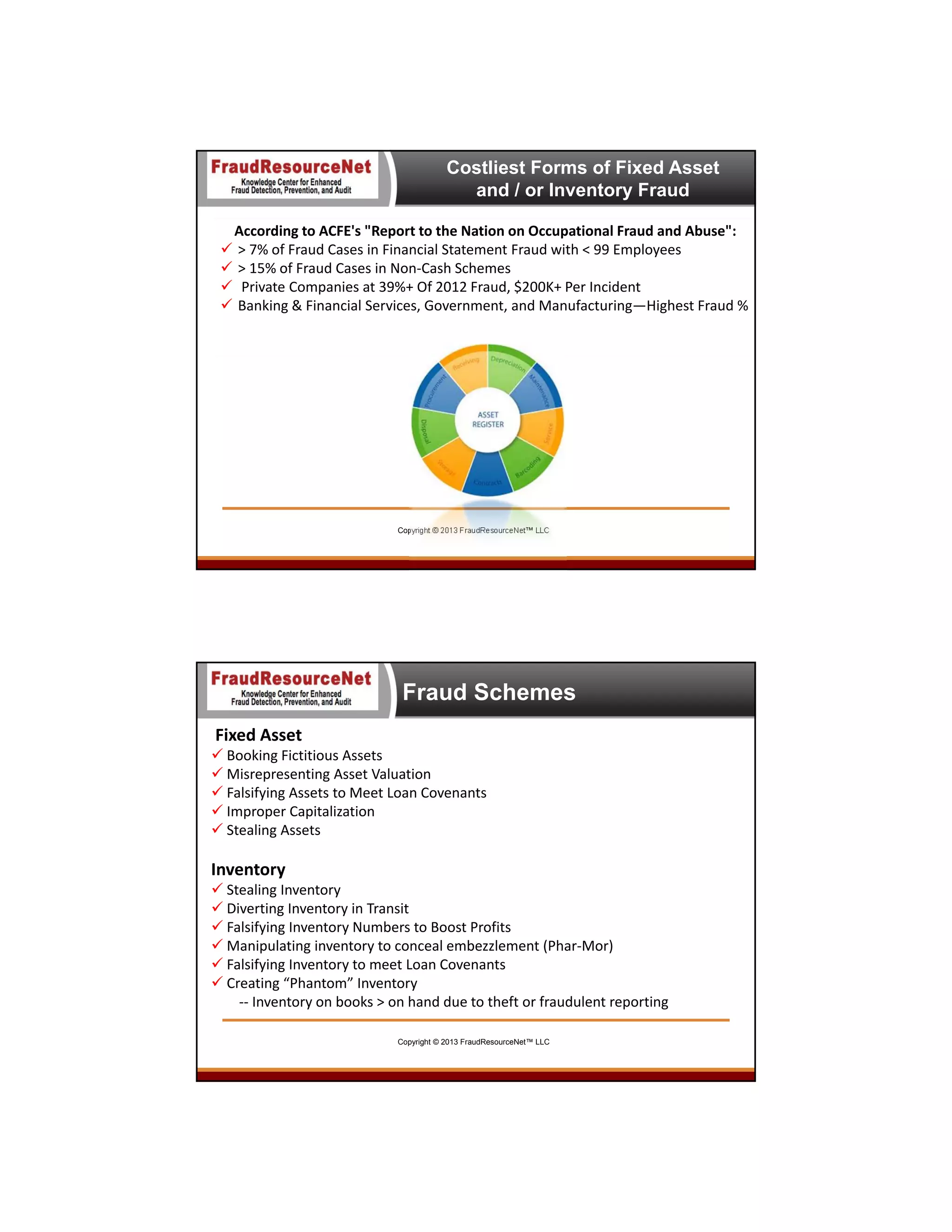

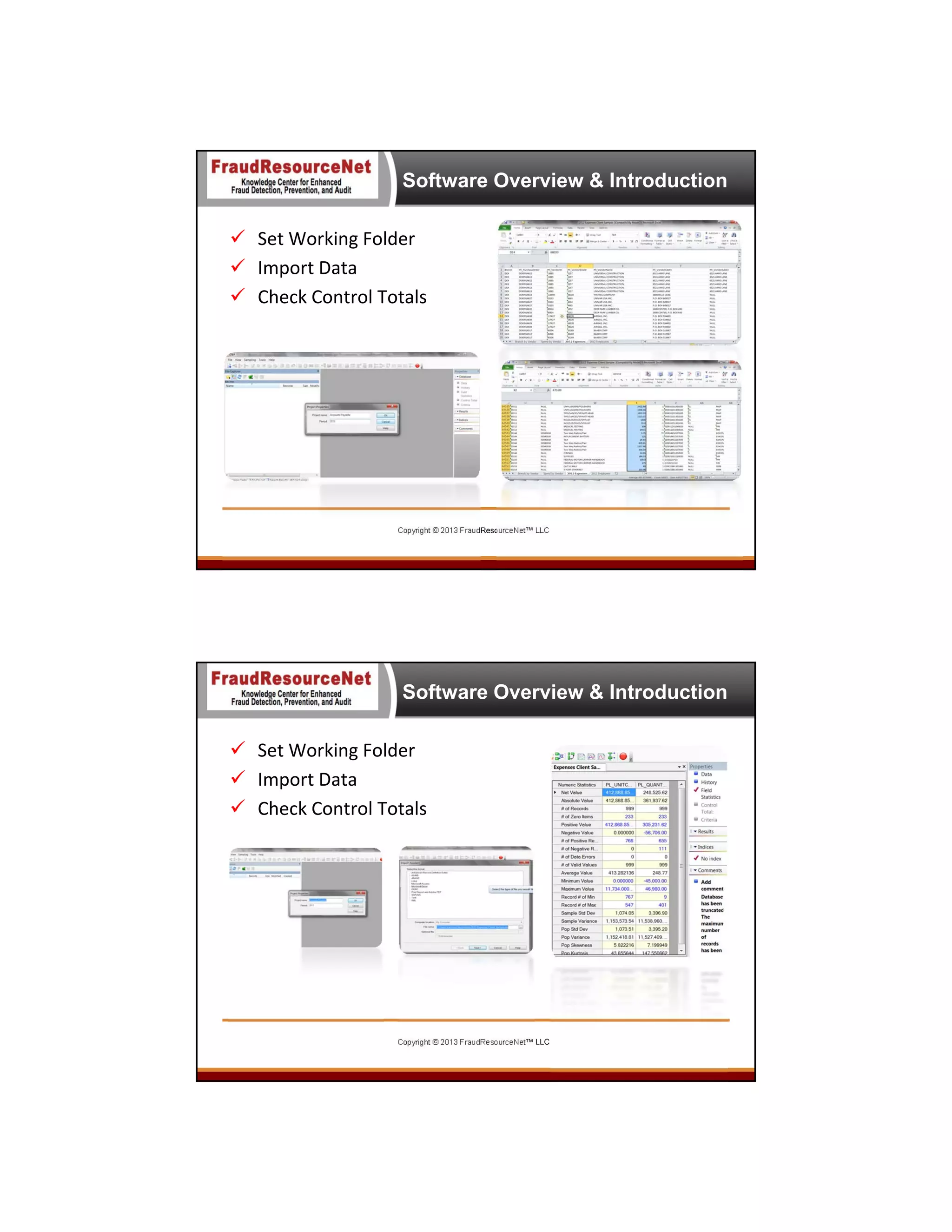

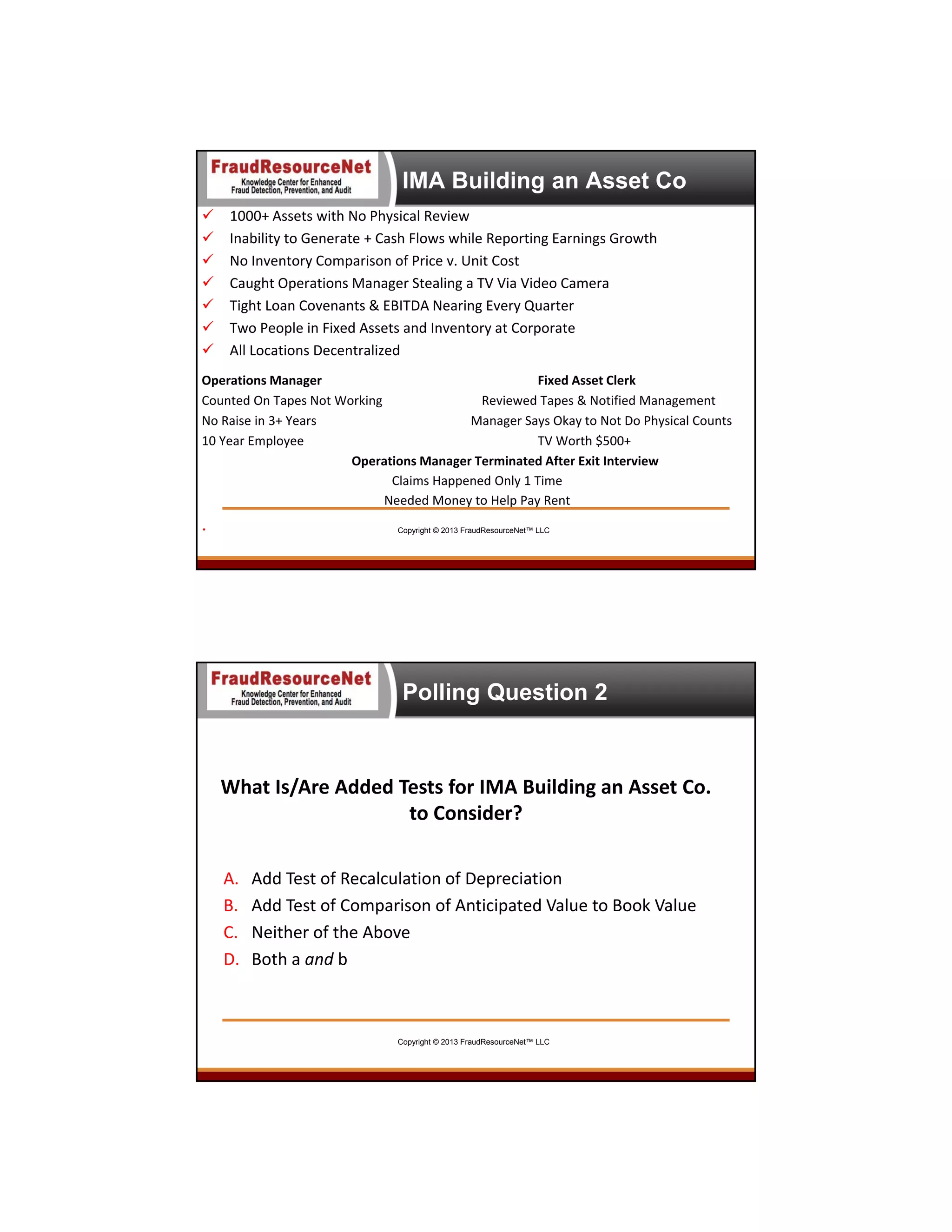

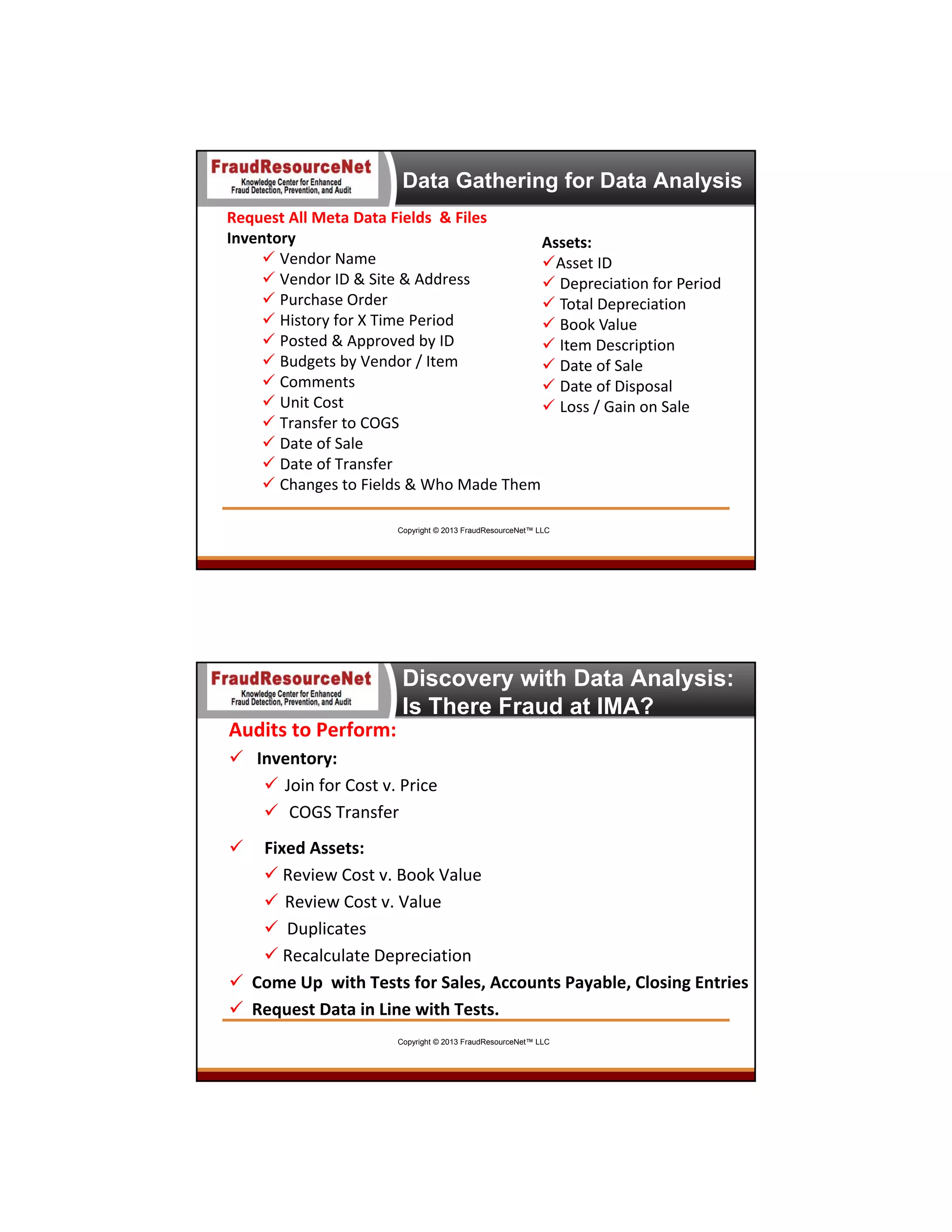

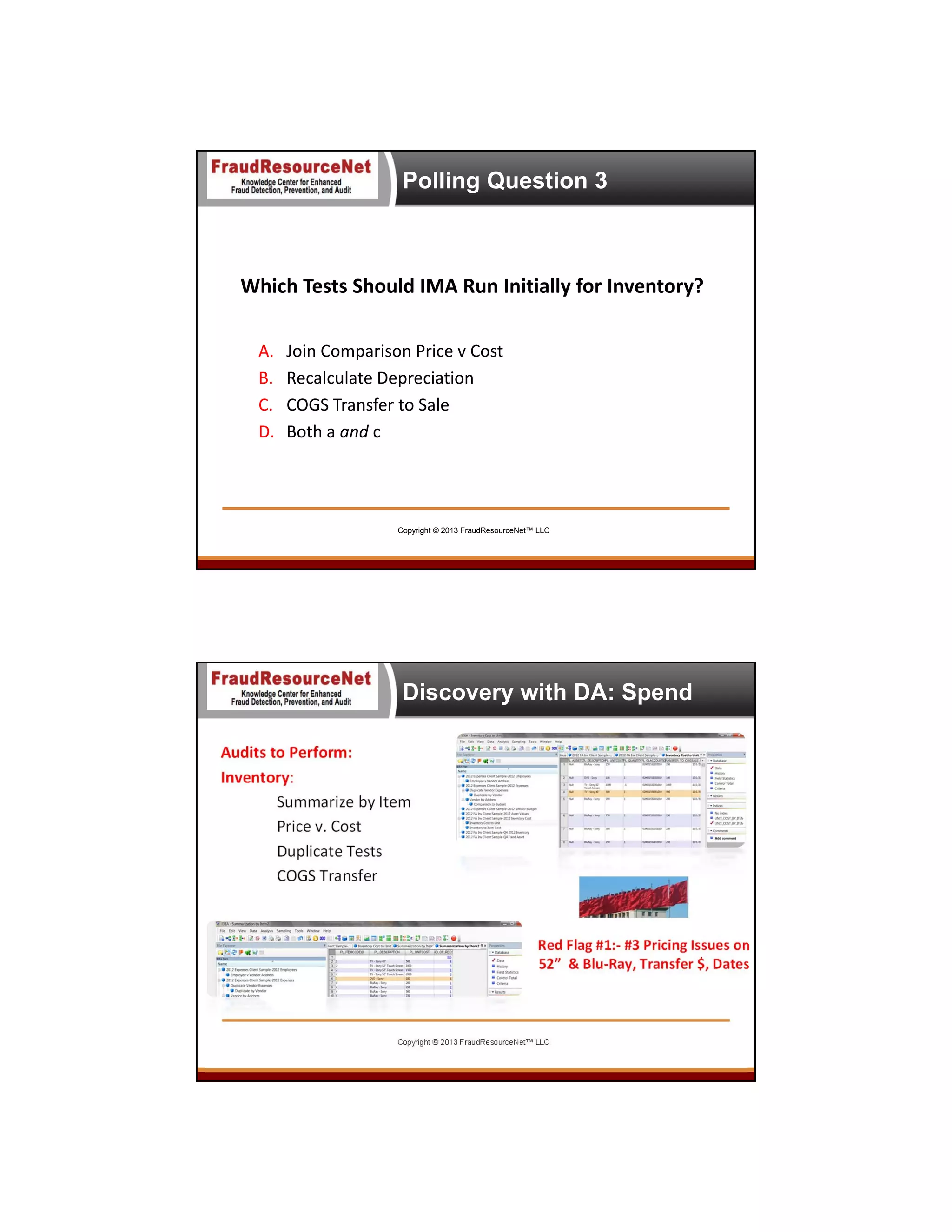

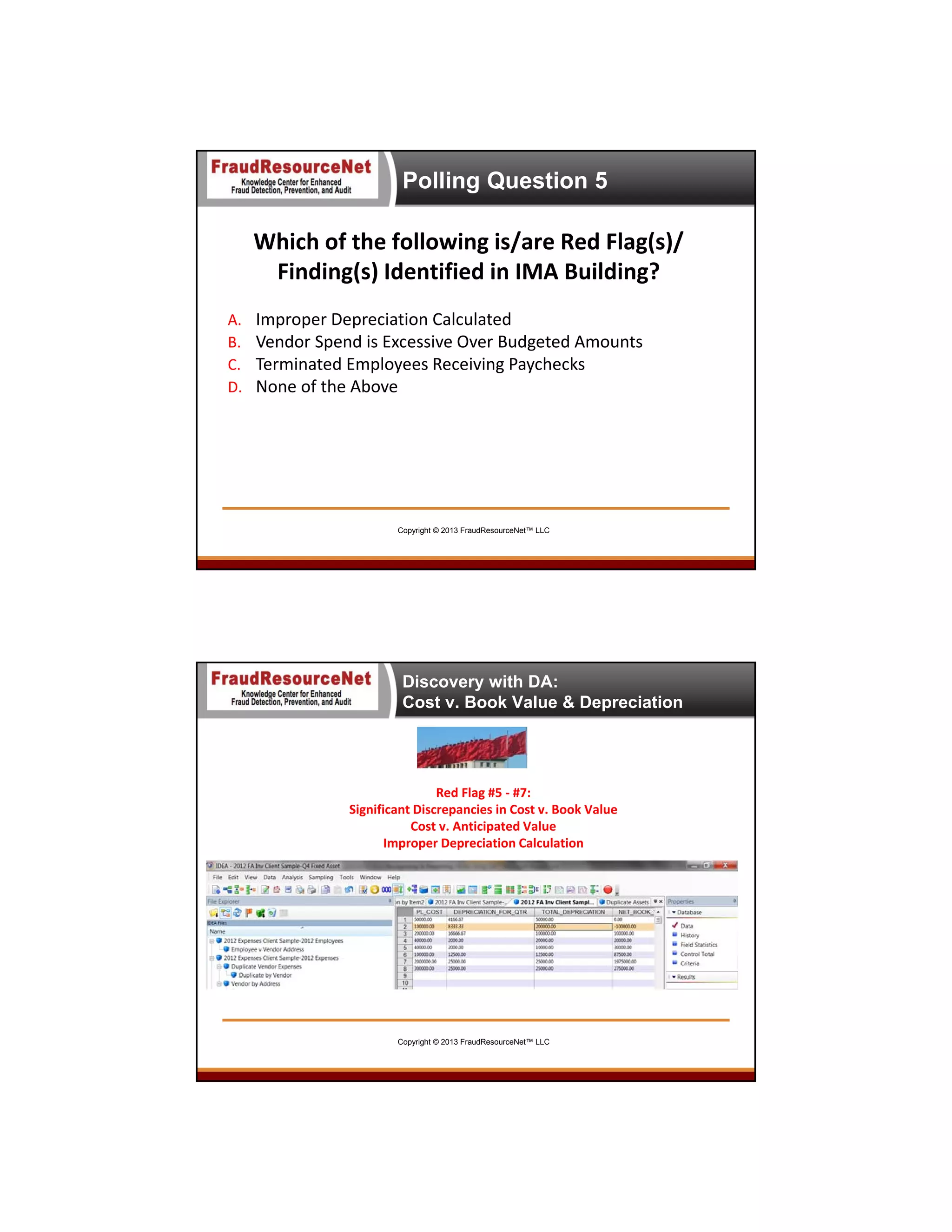

The document discusses a webinar focused on recognizing and preventing fixed asset and inventory fraud using data analysis, featuring expert presentations by Peter Goldmann, Jim Kaplan, and Katrina Kiselinchev. It outlines learning objectives, case studies of fraud schemes, the auditor's role in preventing fraud, and provides guidelines on using data analytics to uncover signs of asset misstatements. Additionally, it emphasizes effective preventive measures and continuous monitoring to mitigate fraud risks in organizations.