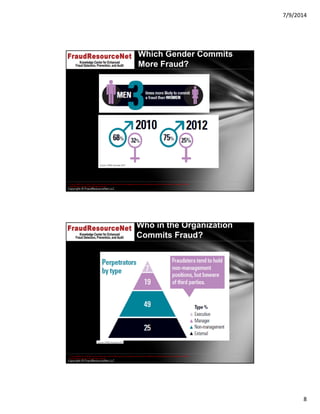

The document discusses profiling fraudsters and highlights key findings from KPMG's analysis of 596 fraud cases across various regions, revealing that most fraud perpetrators are between the ages of 36 and 55 and often employed by the victim organizations. It emphasizes the evolving nature of fraud, influenced by factors such as technology, collusion, and the environment, which require organizations to adapt their anti-fraud strategies. The analysis shows that misappropriation of assets is the most common type of fraud, stressing the need for robust internal controls to combat this growing trend.