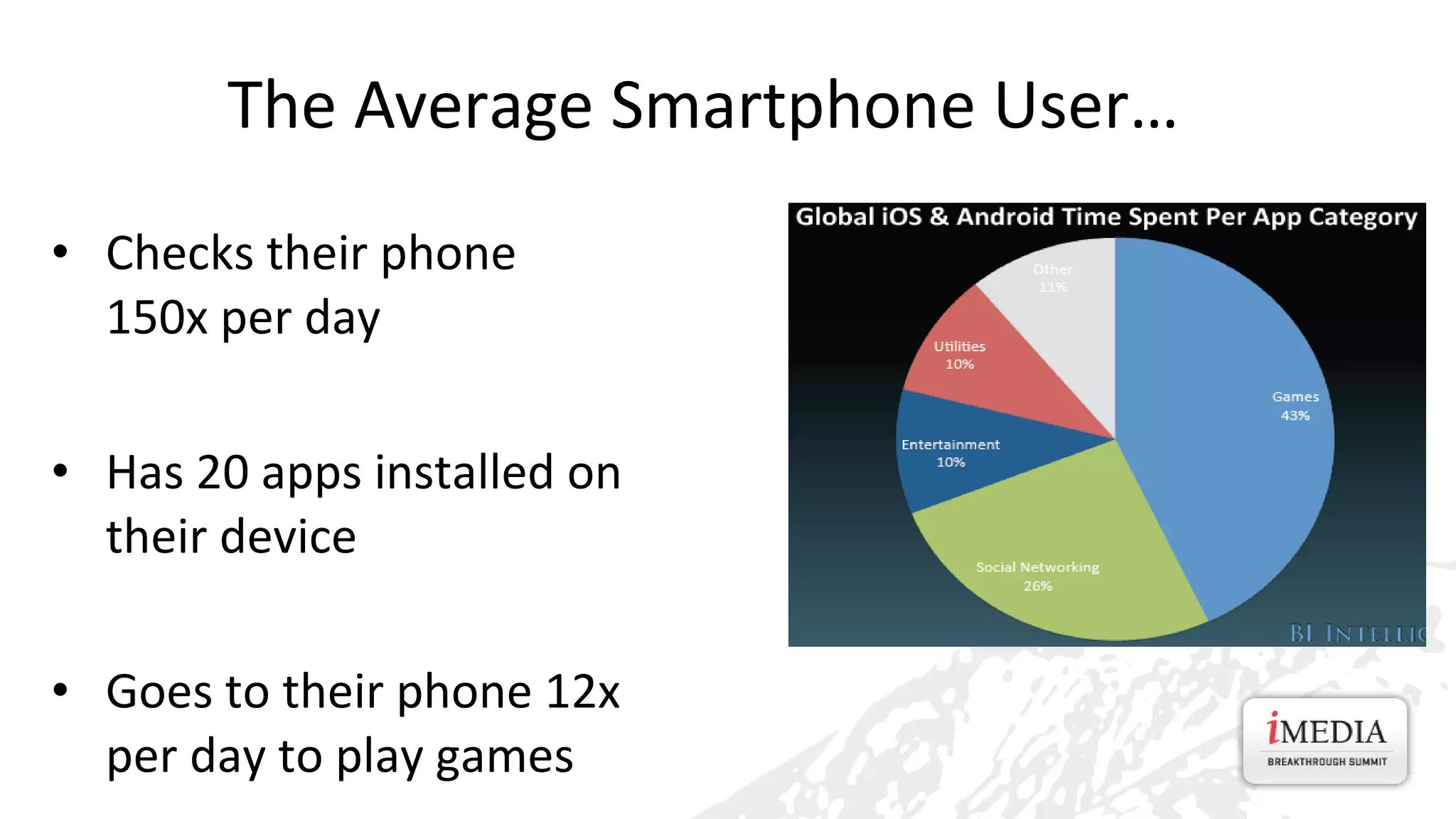

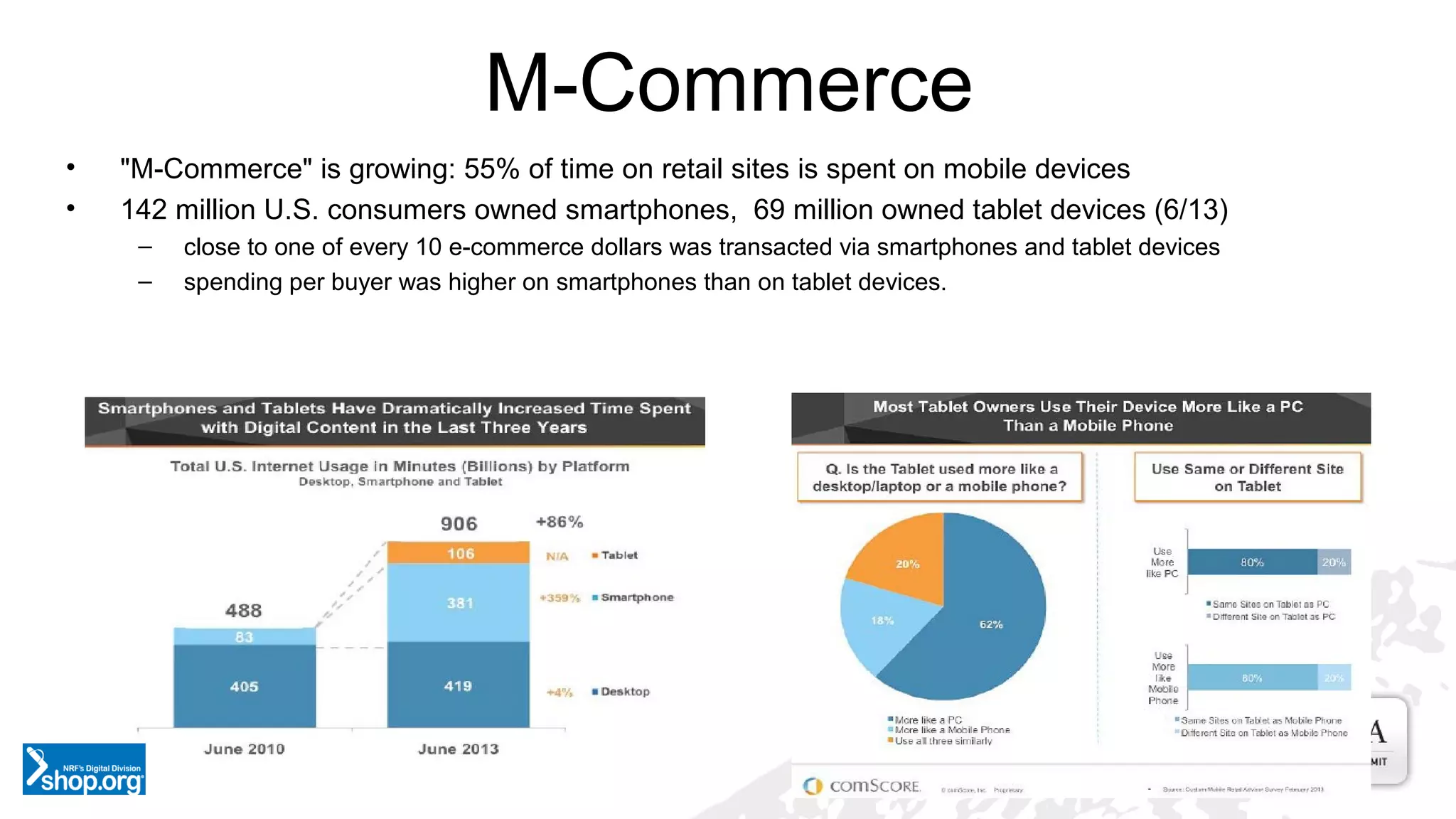

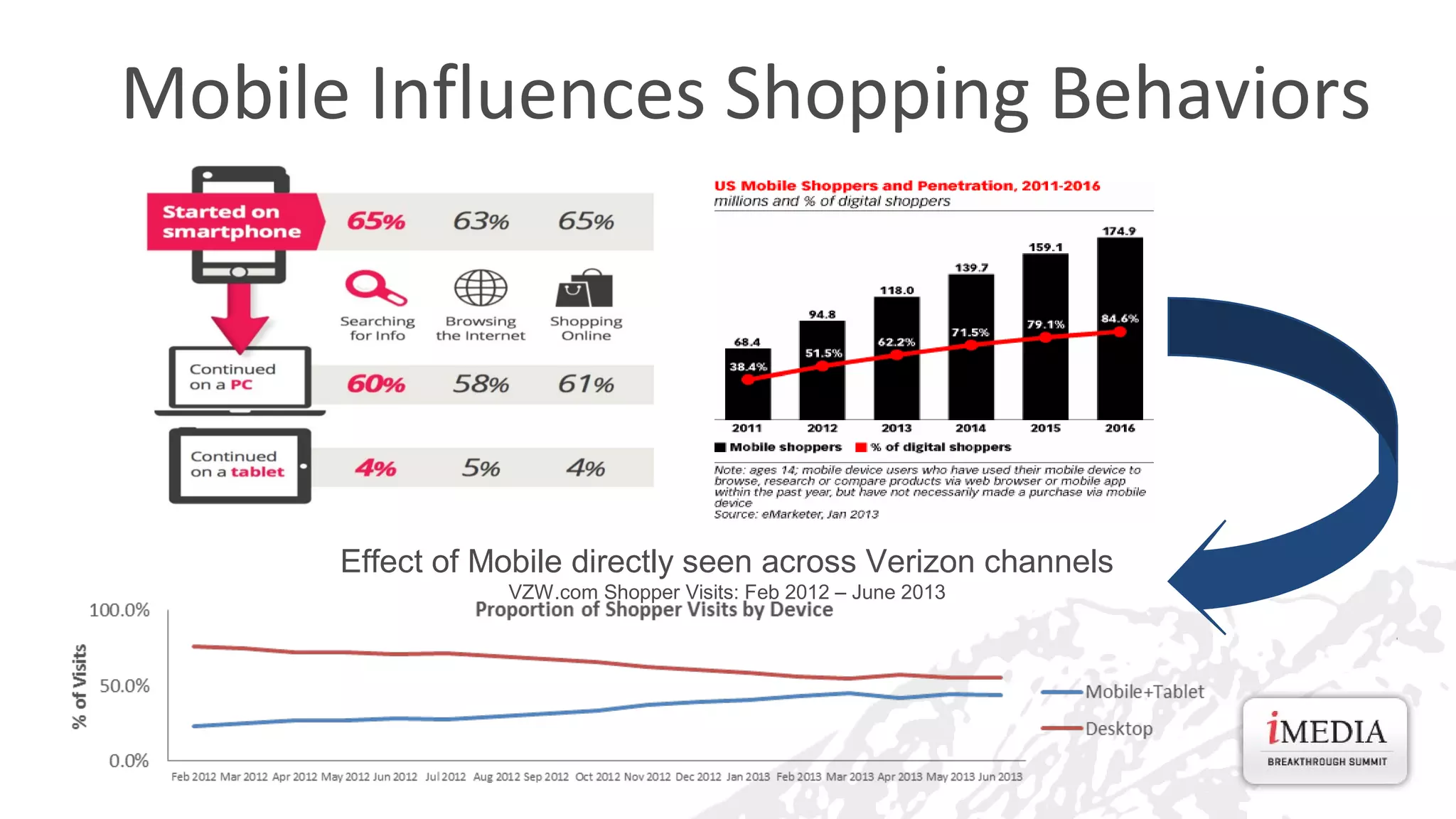

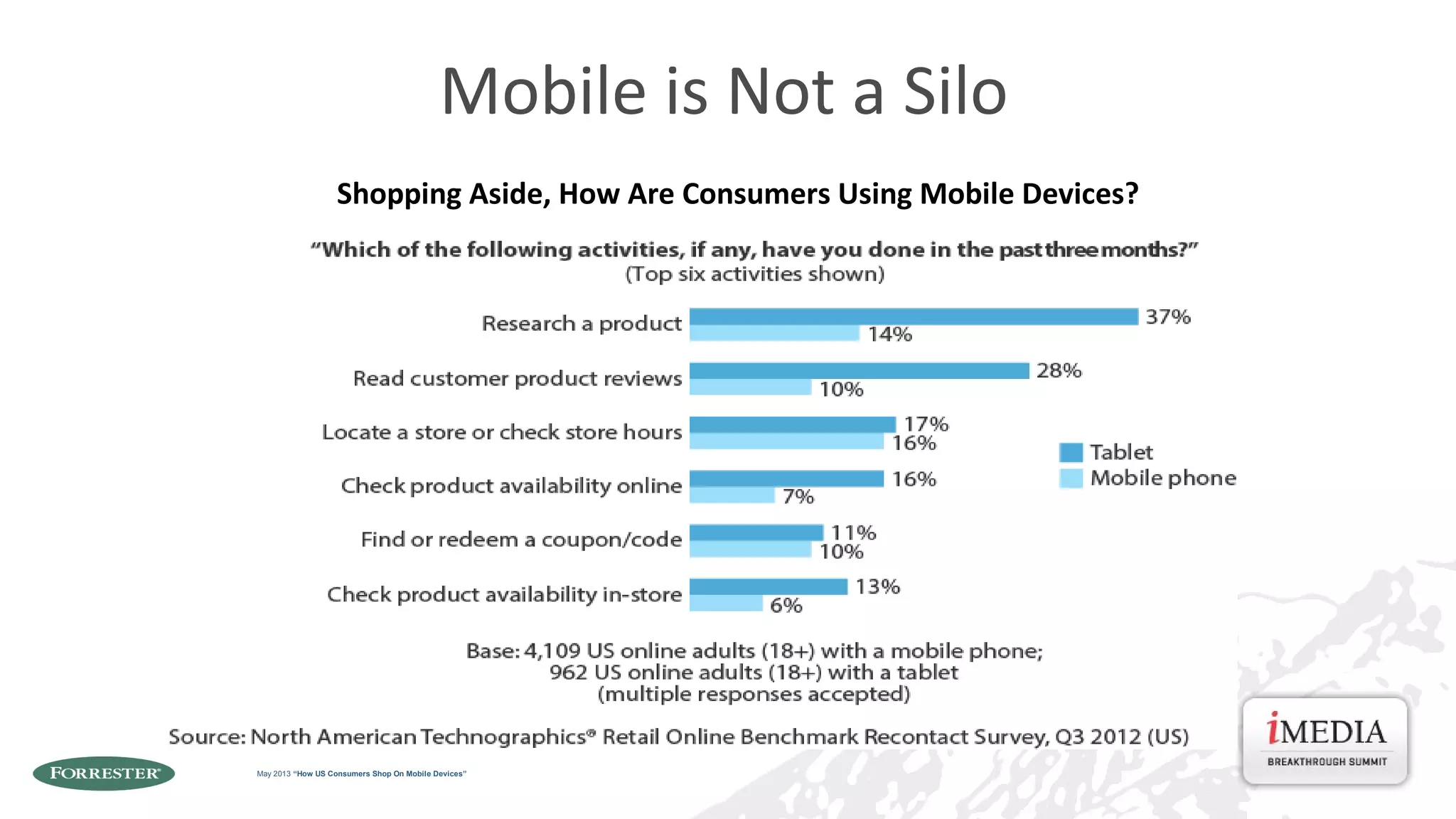

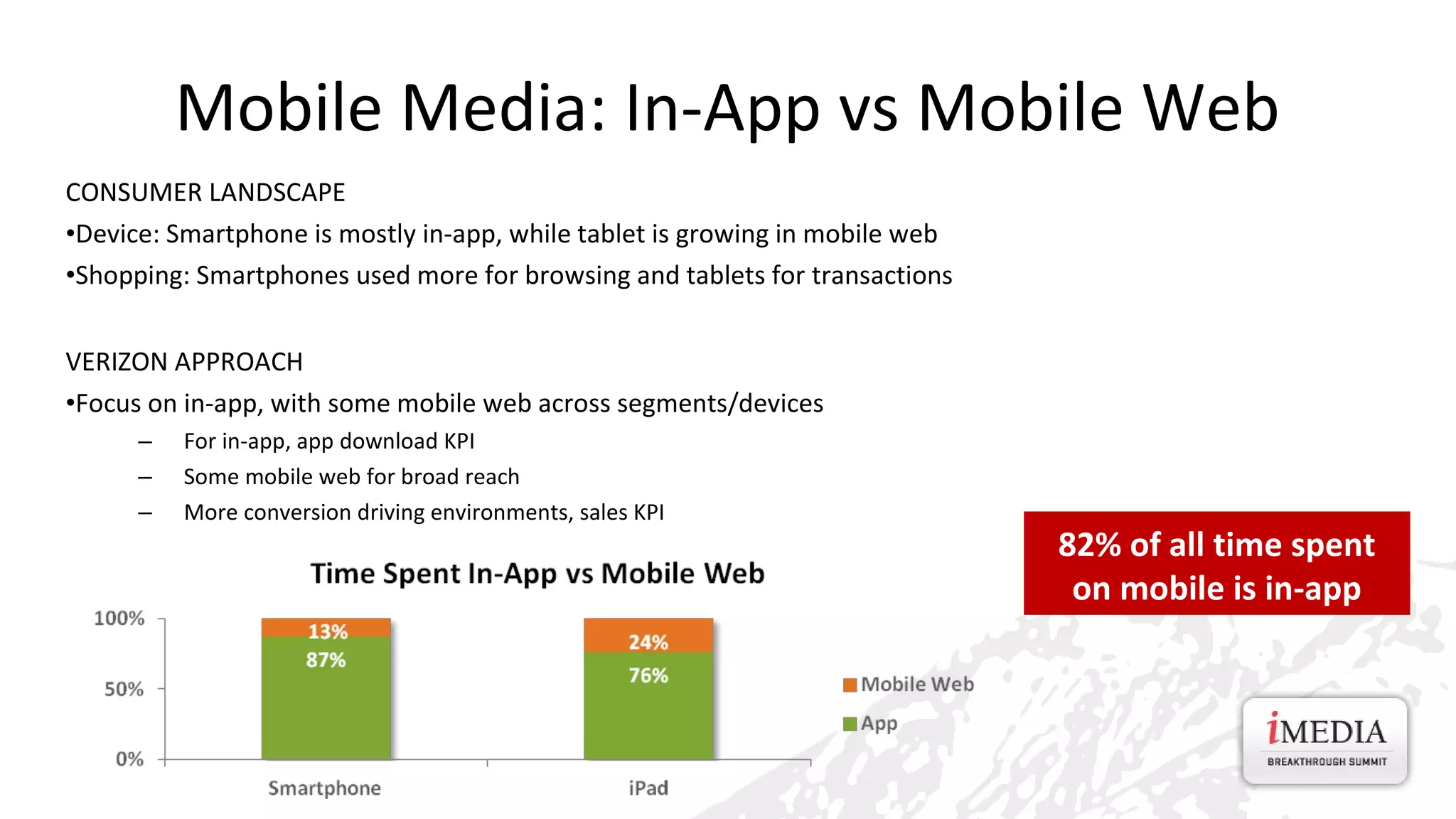

The document discusses mobile device usage and how it influences consumer behavior. It notes that the average smartphone user checks their phone 150 times per day, has 20 apps installed, and plays games on their phone 12 times a day. Mobile commerce is growing, with close to one in ten e-commerce dollars spent via smartphones and tablets. Mobile directly impacts shopping behaviors across various channels. Identification, targeting, and measurement present challenges for mobile marketing due to device fragmentation and limitations in current approaches.