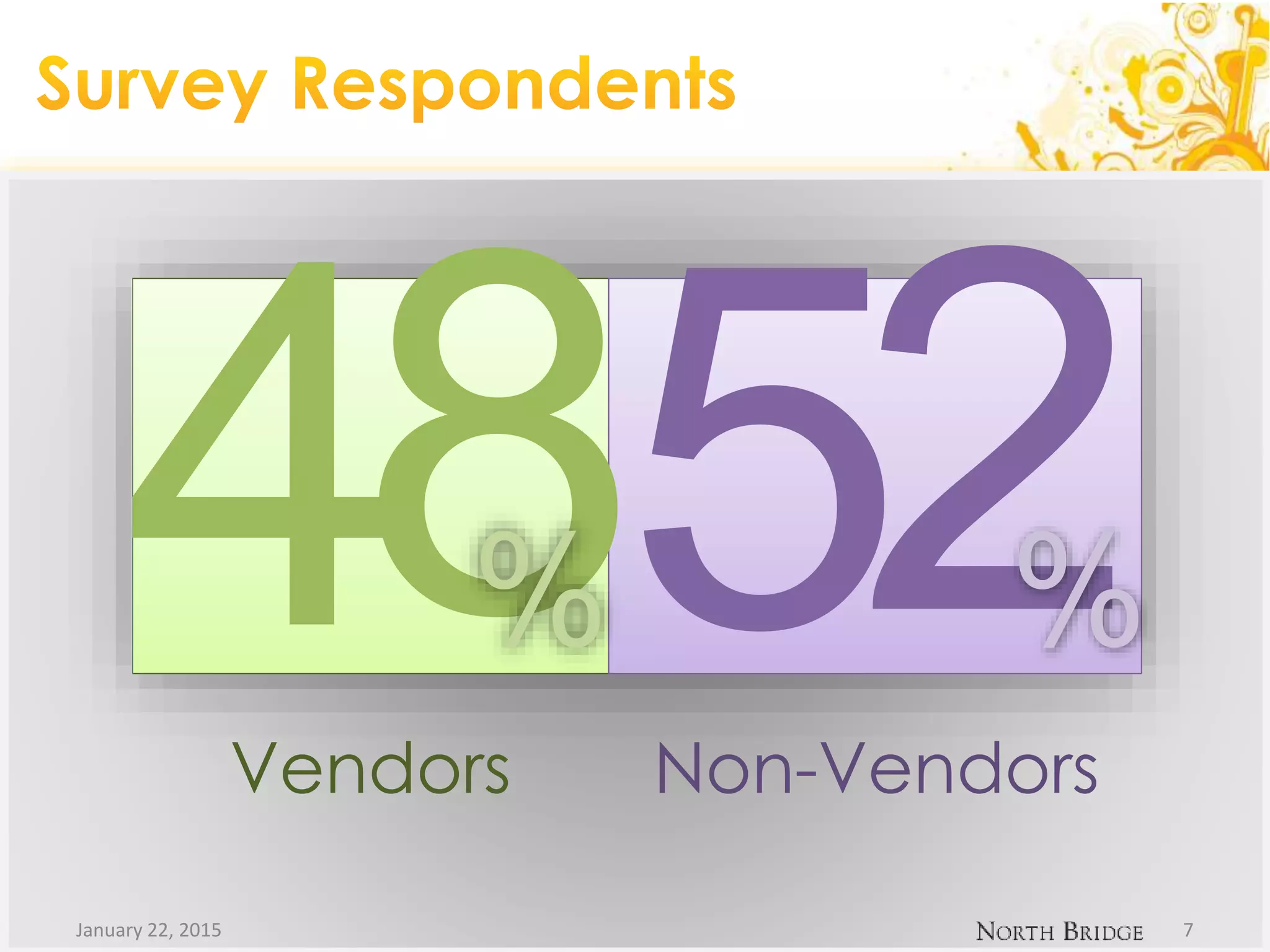

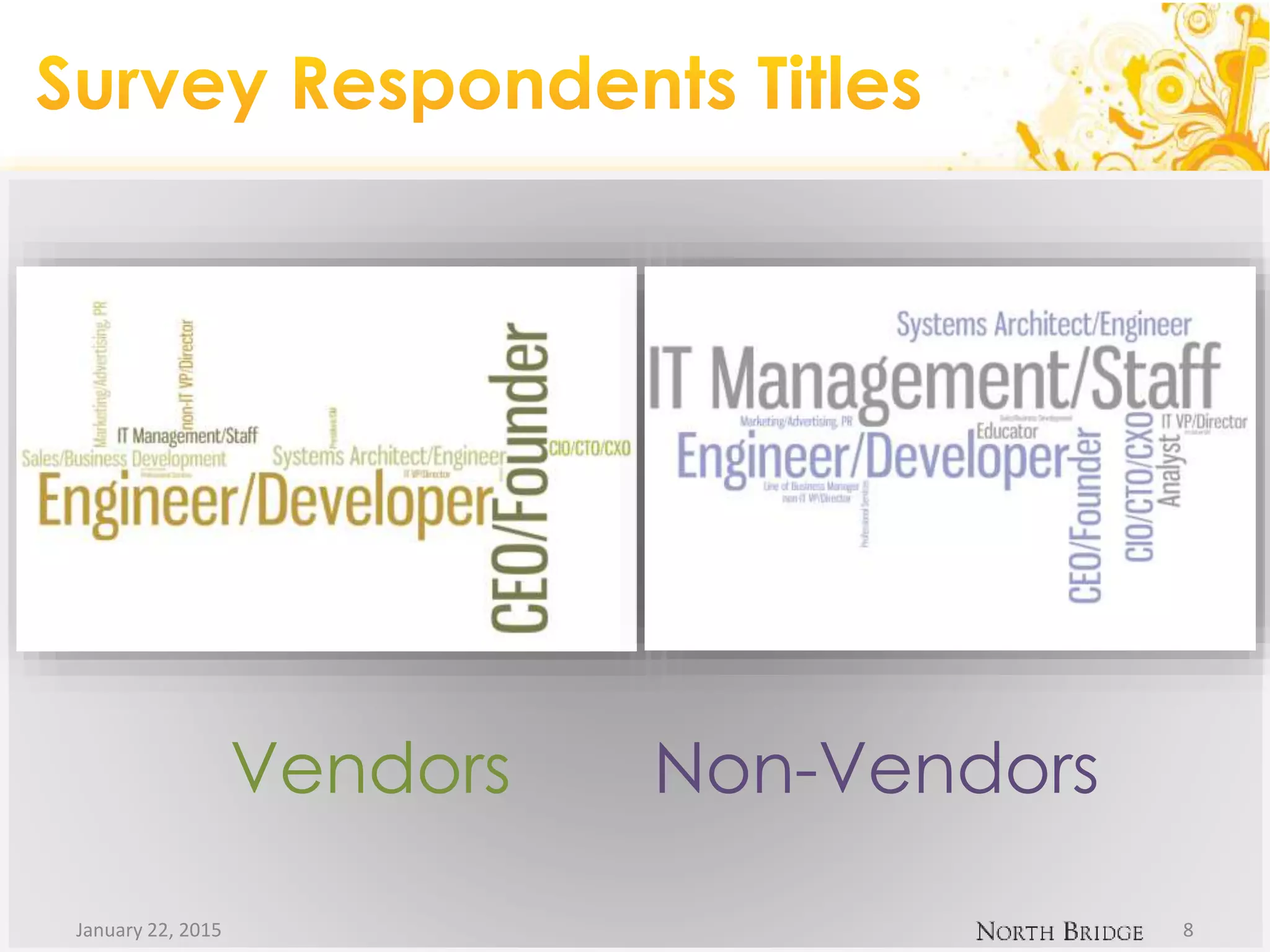

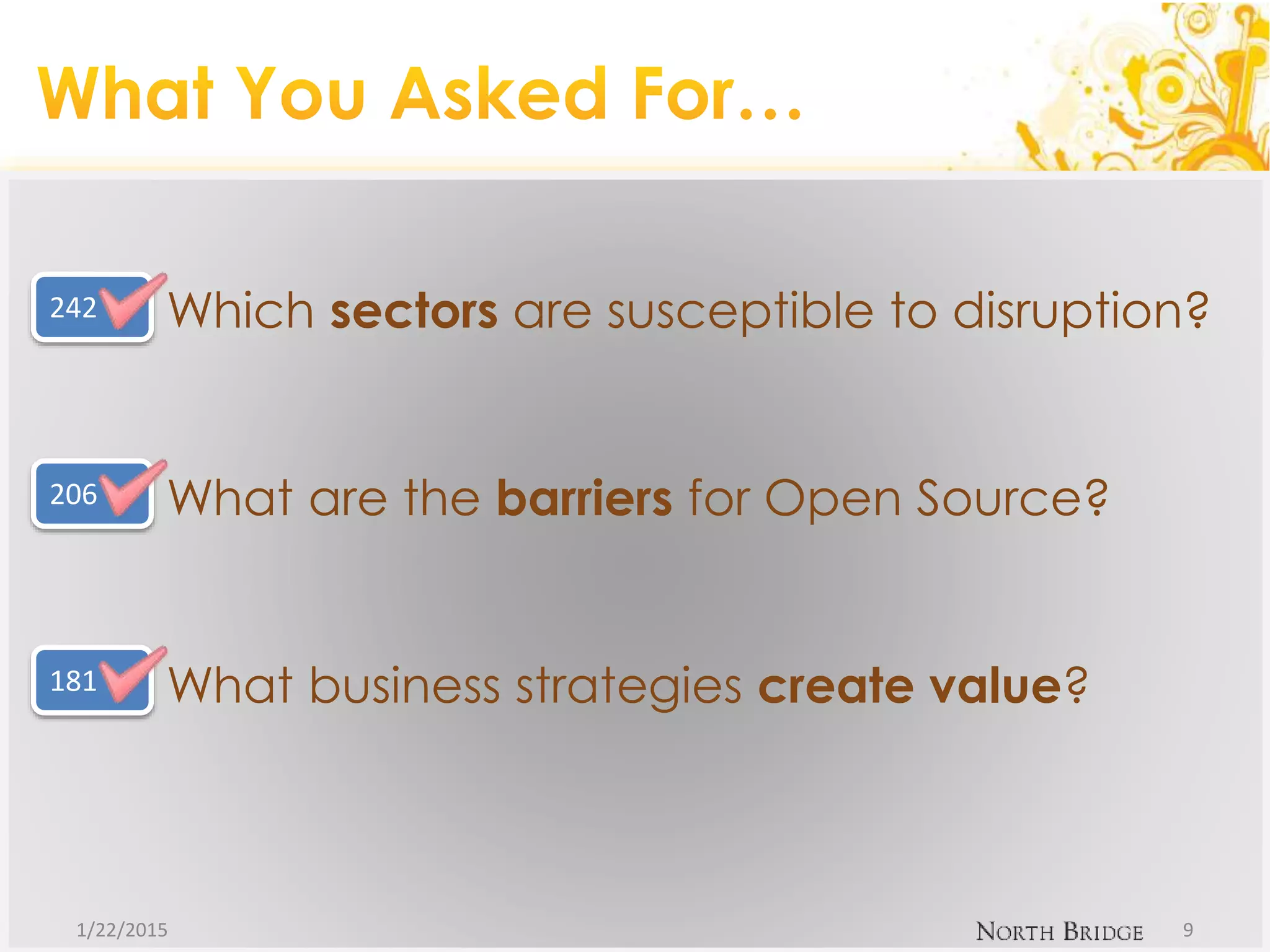

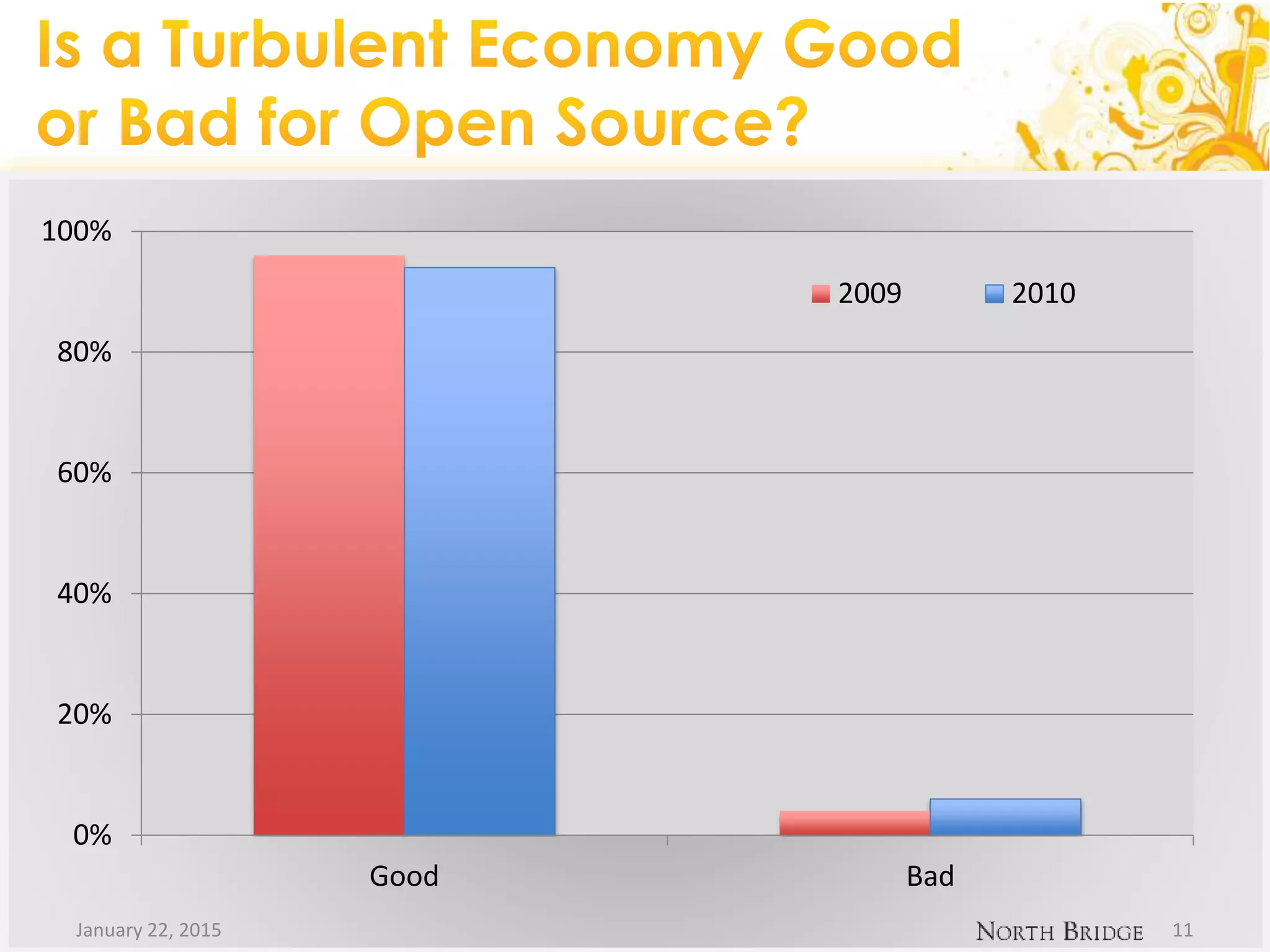

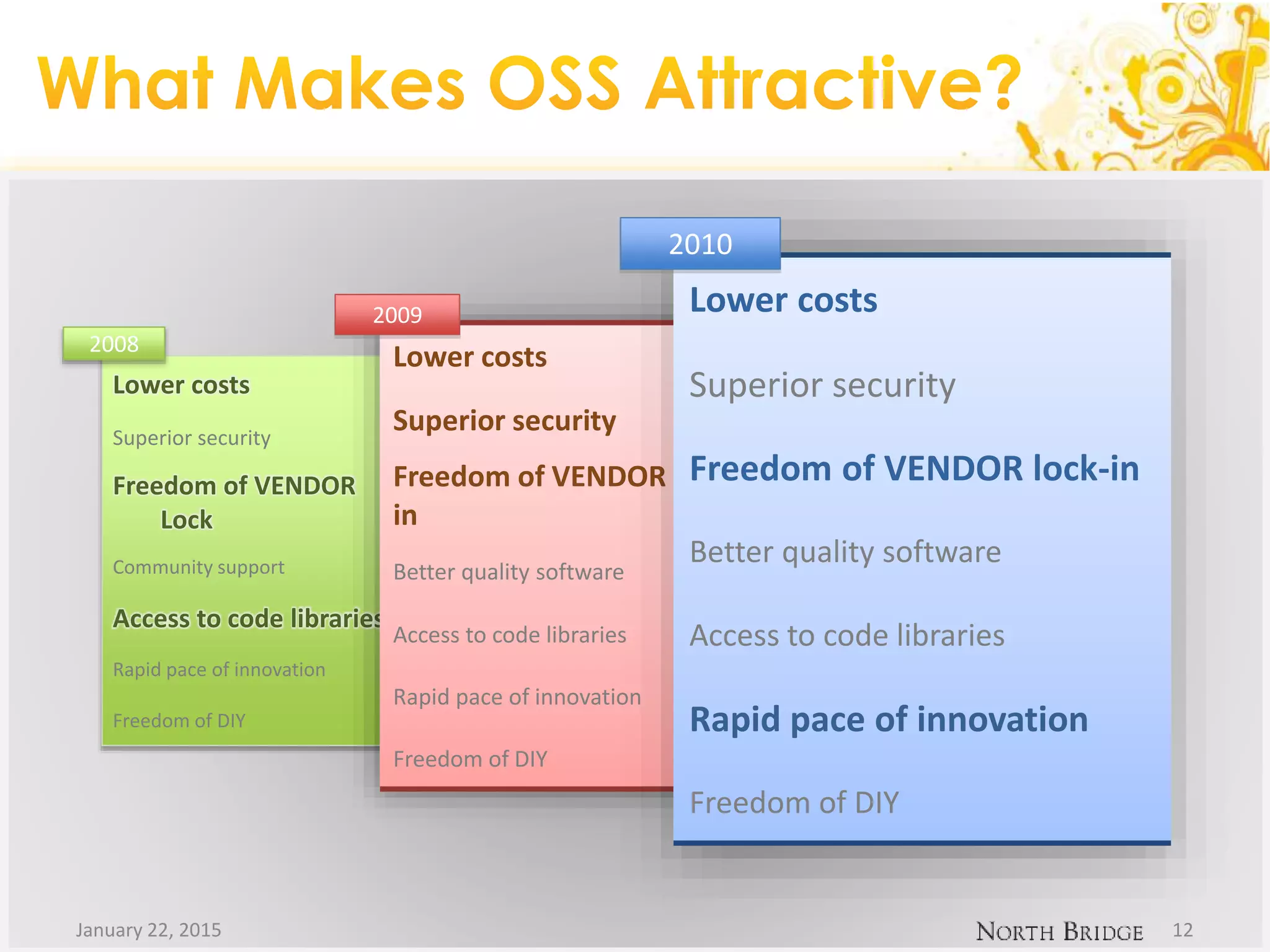

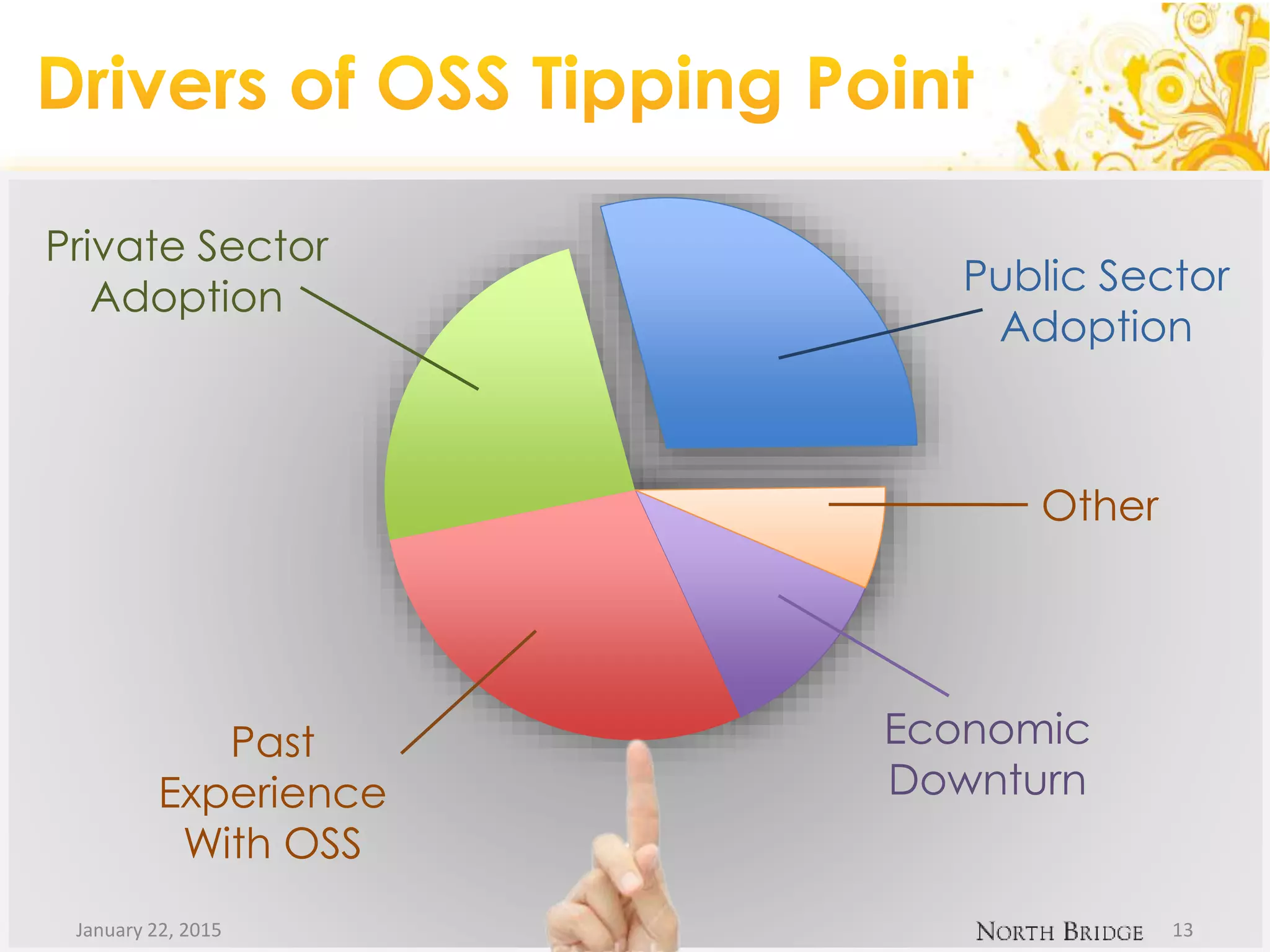

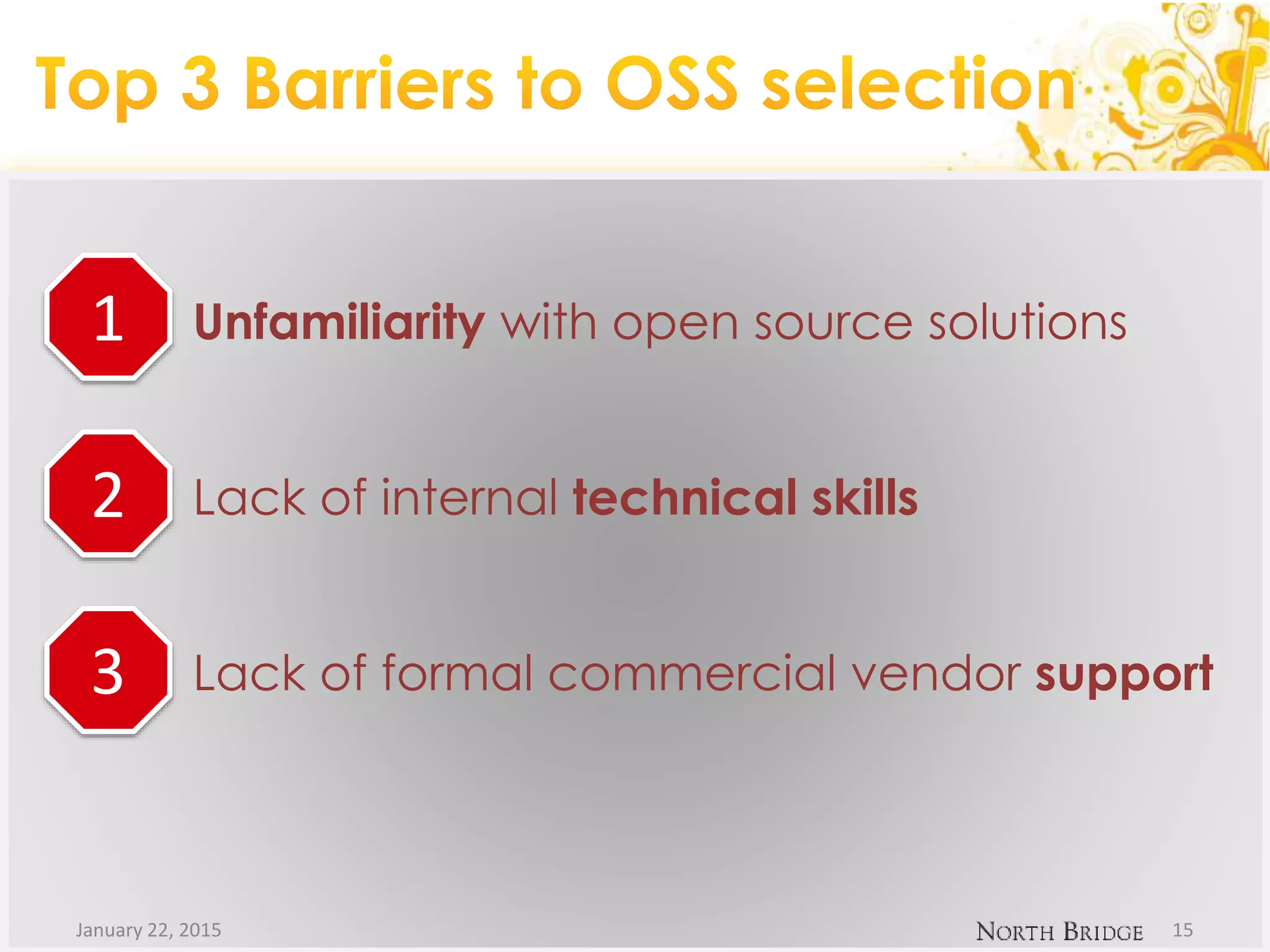

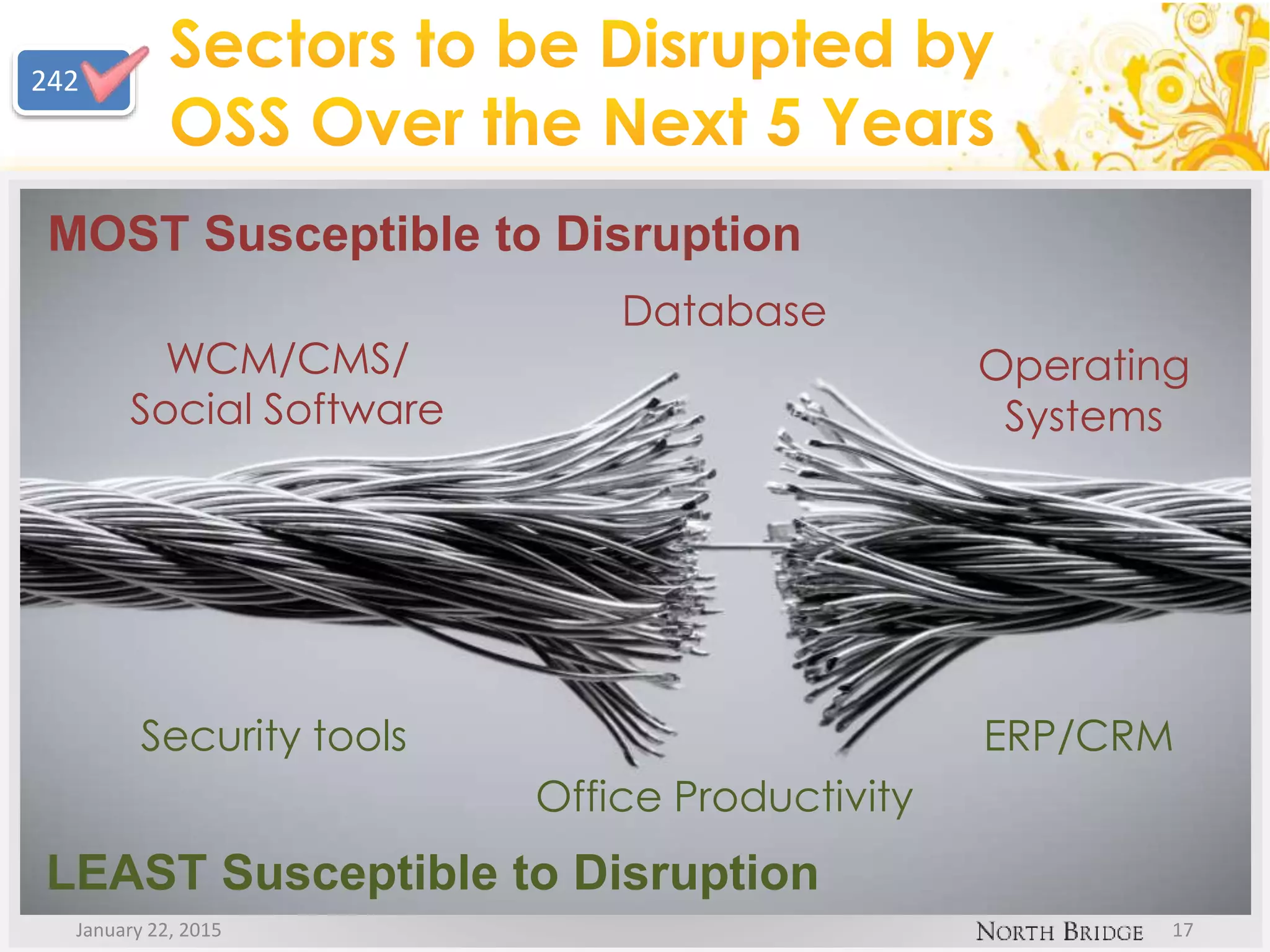

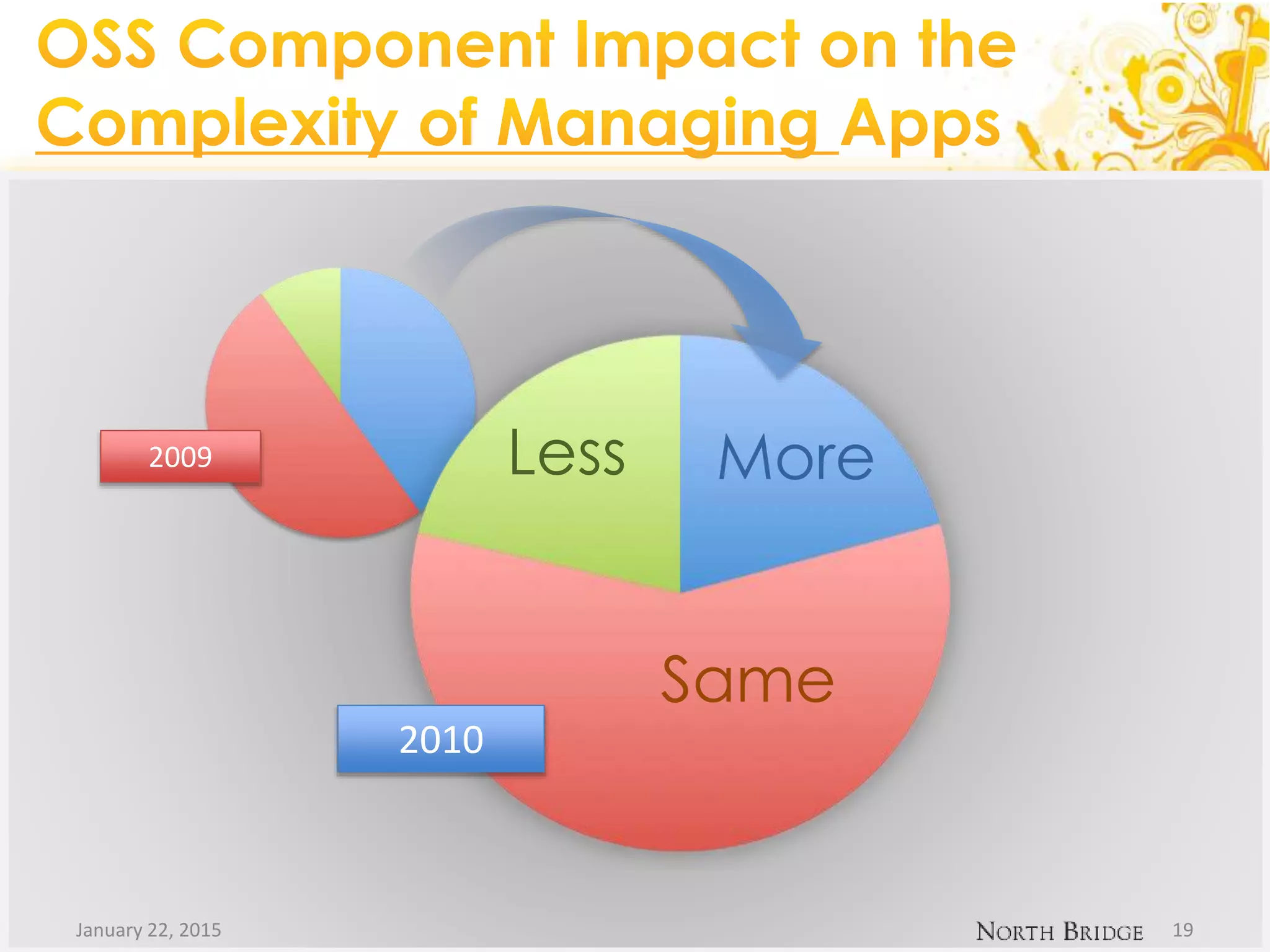

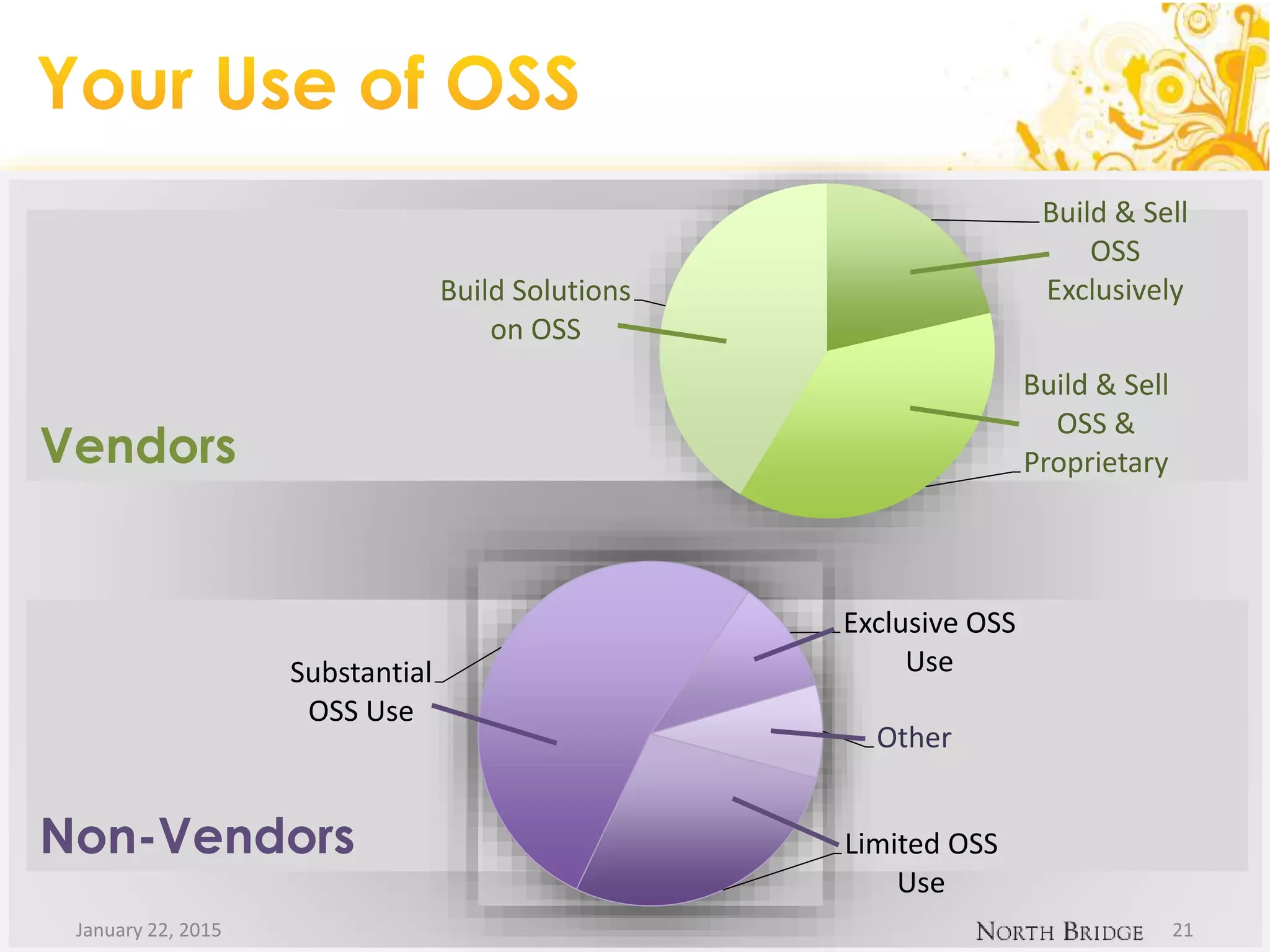

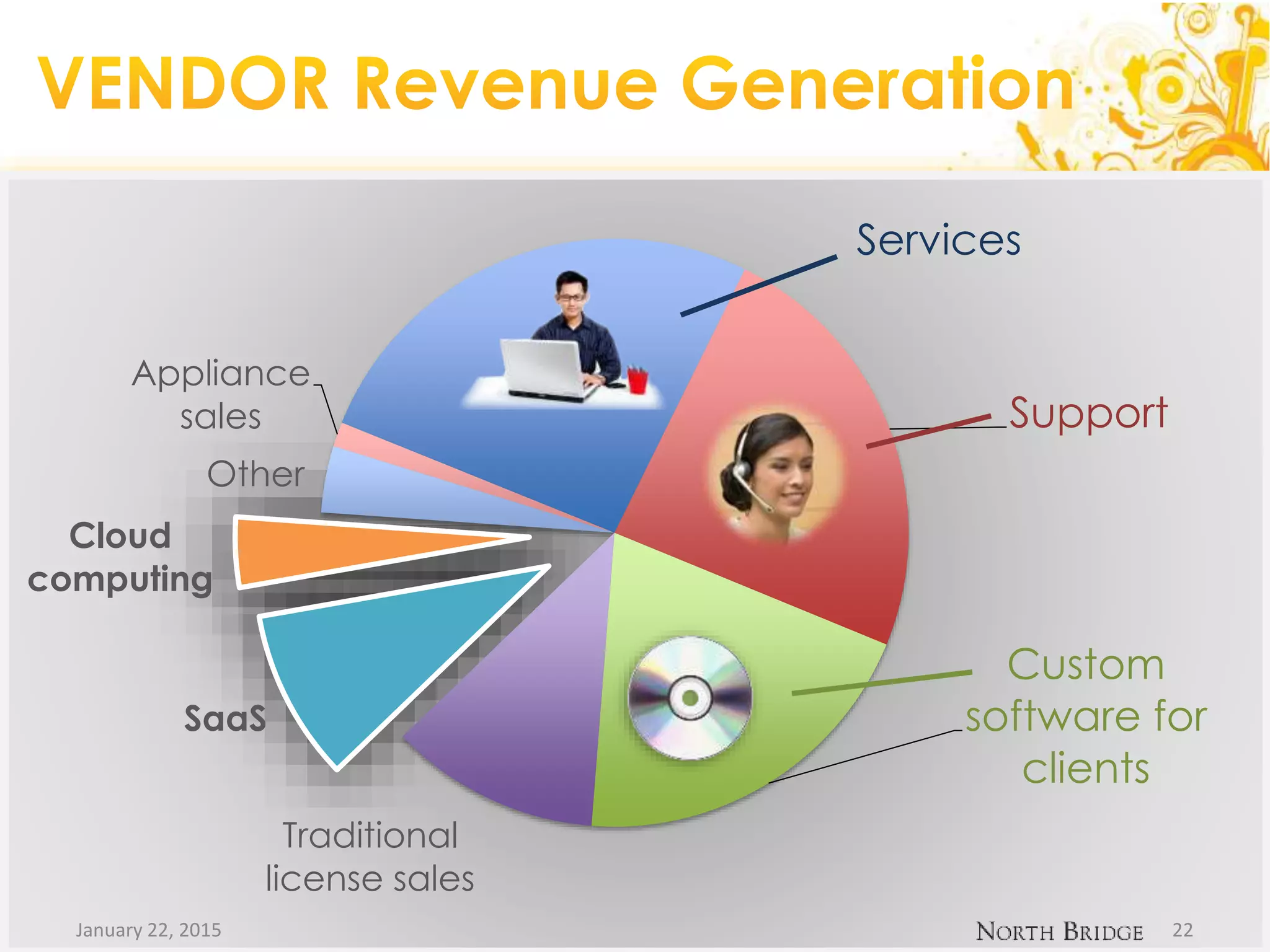

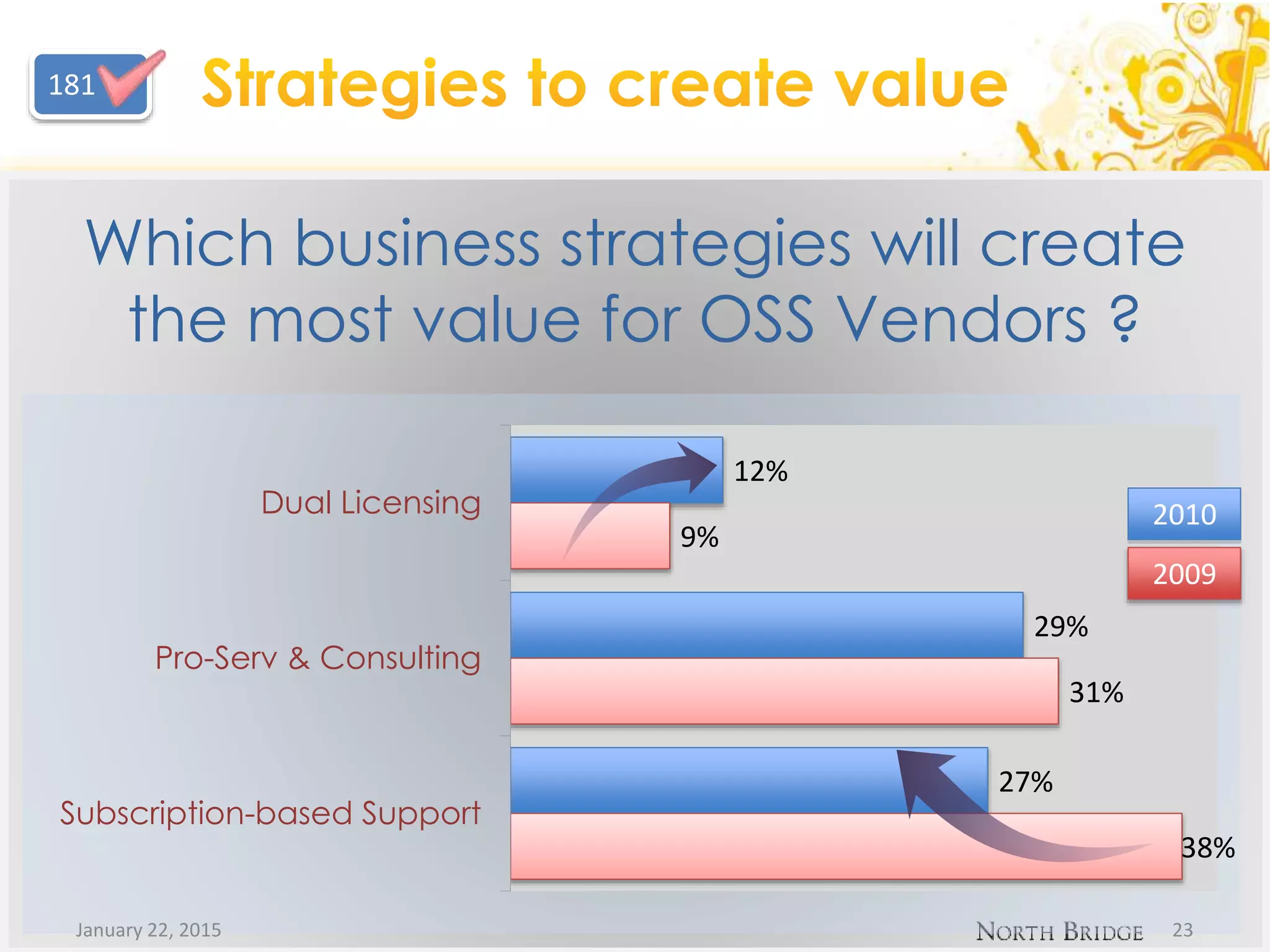

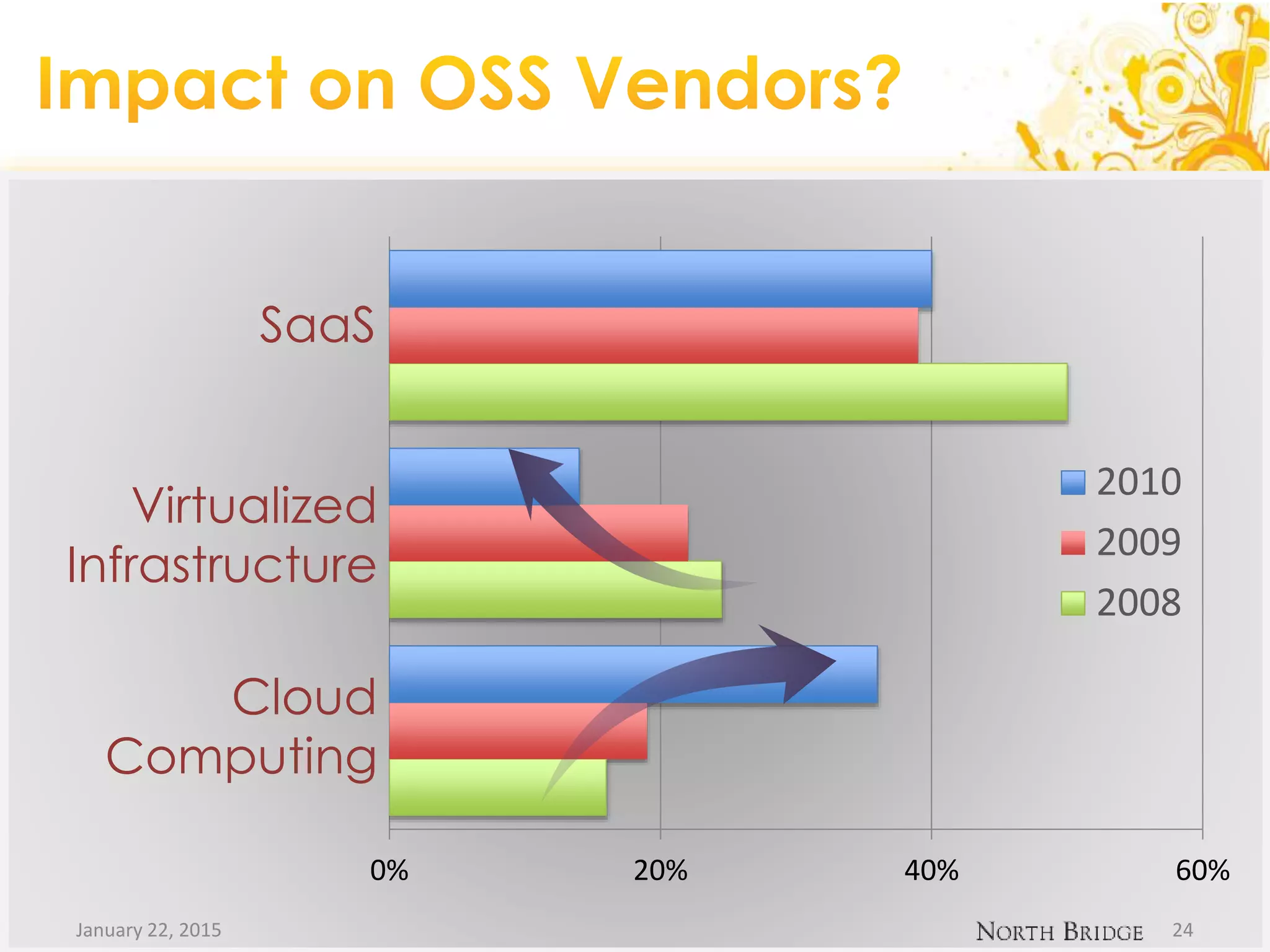

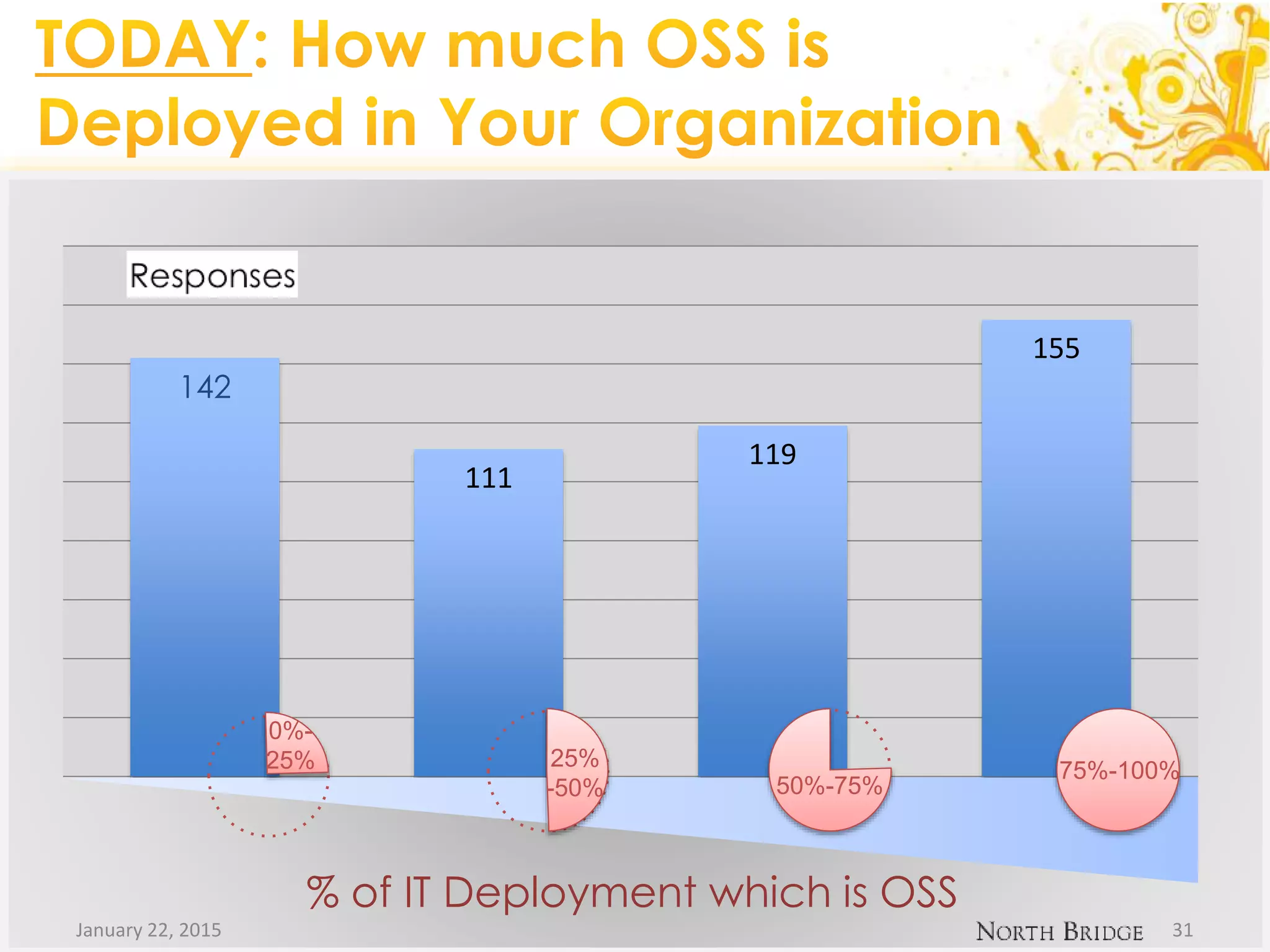

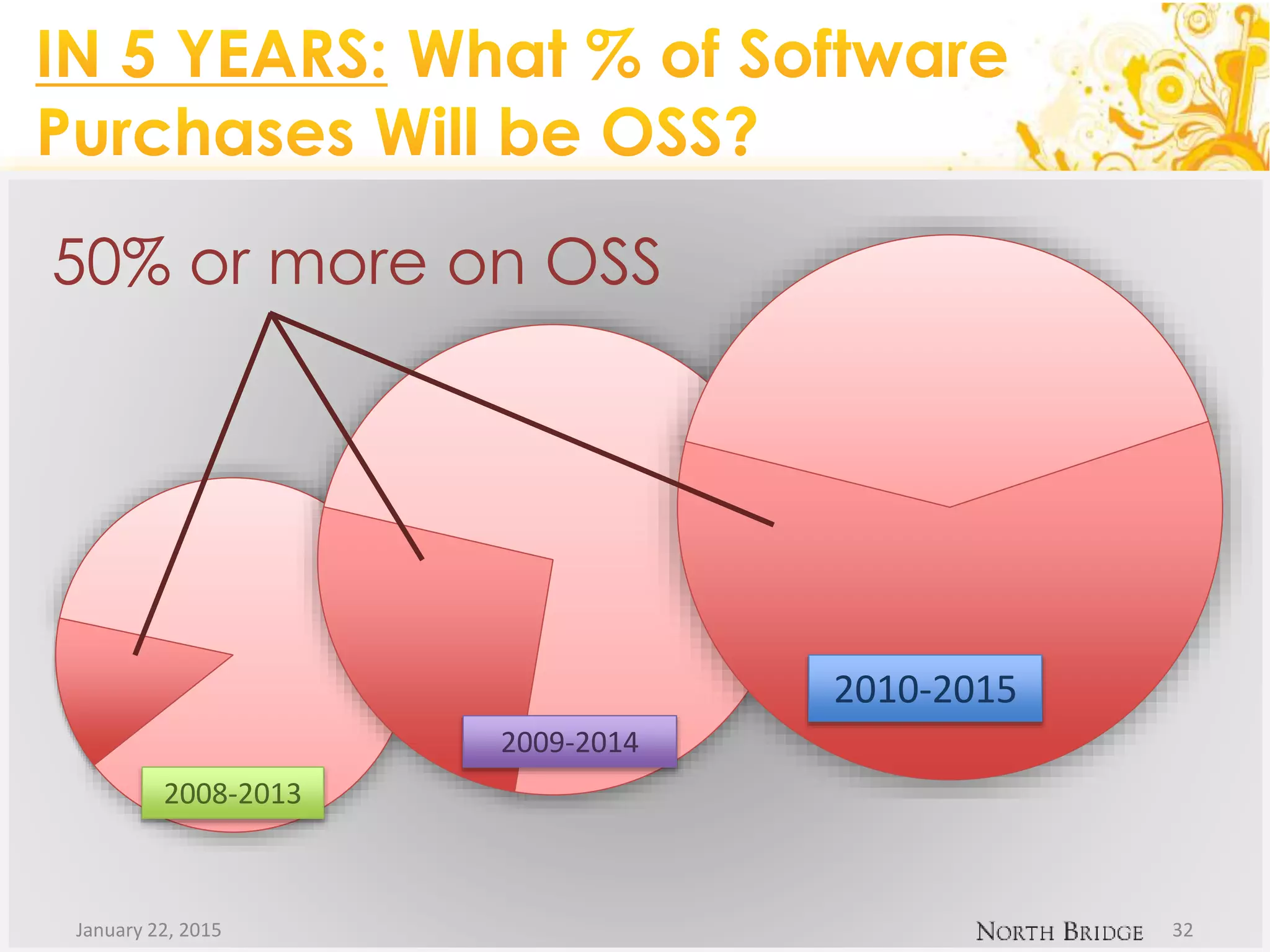

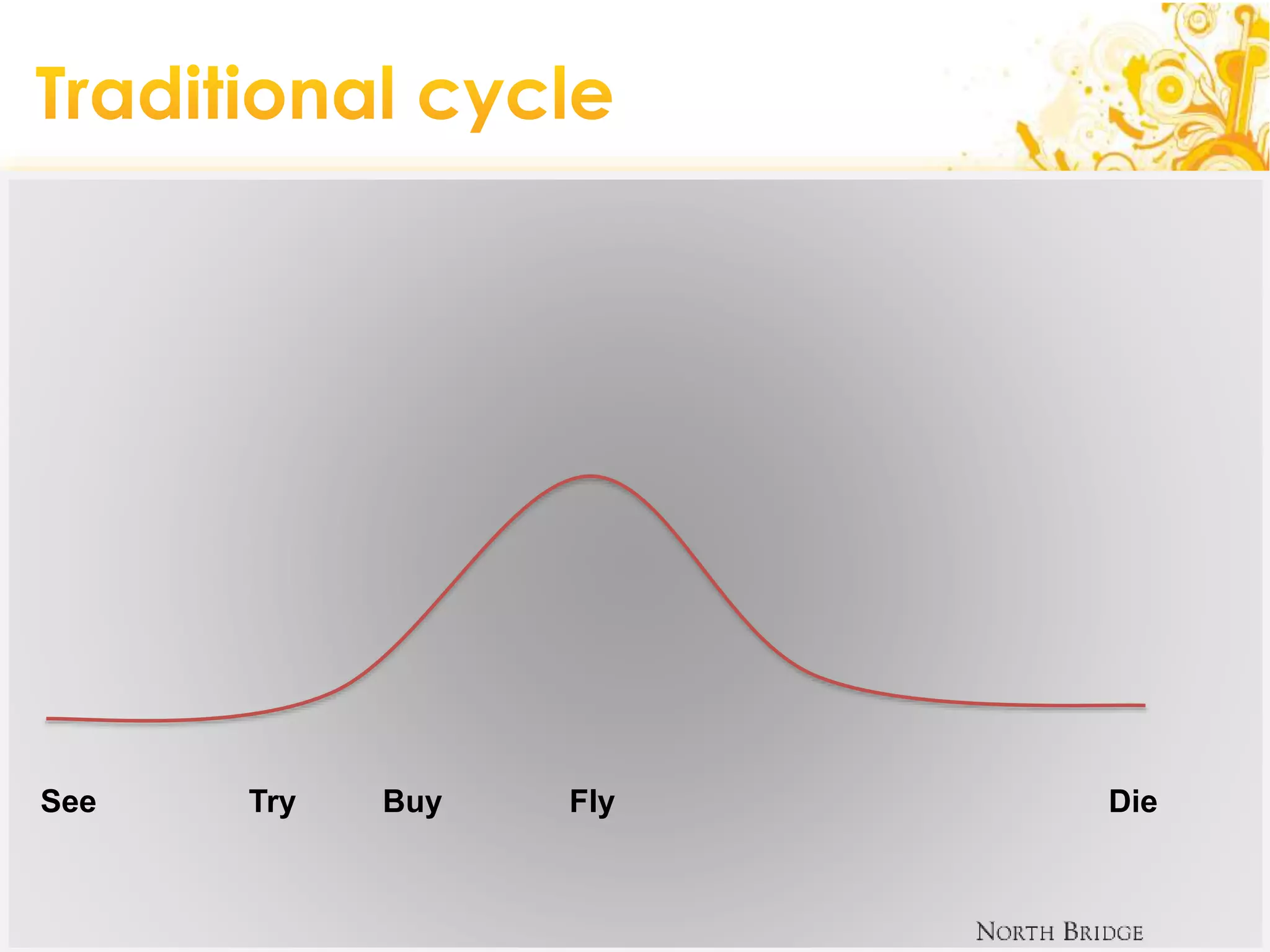

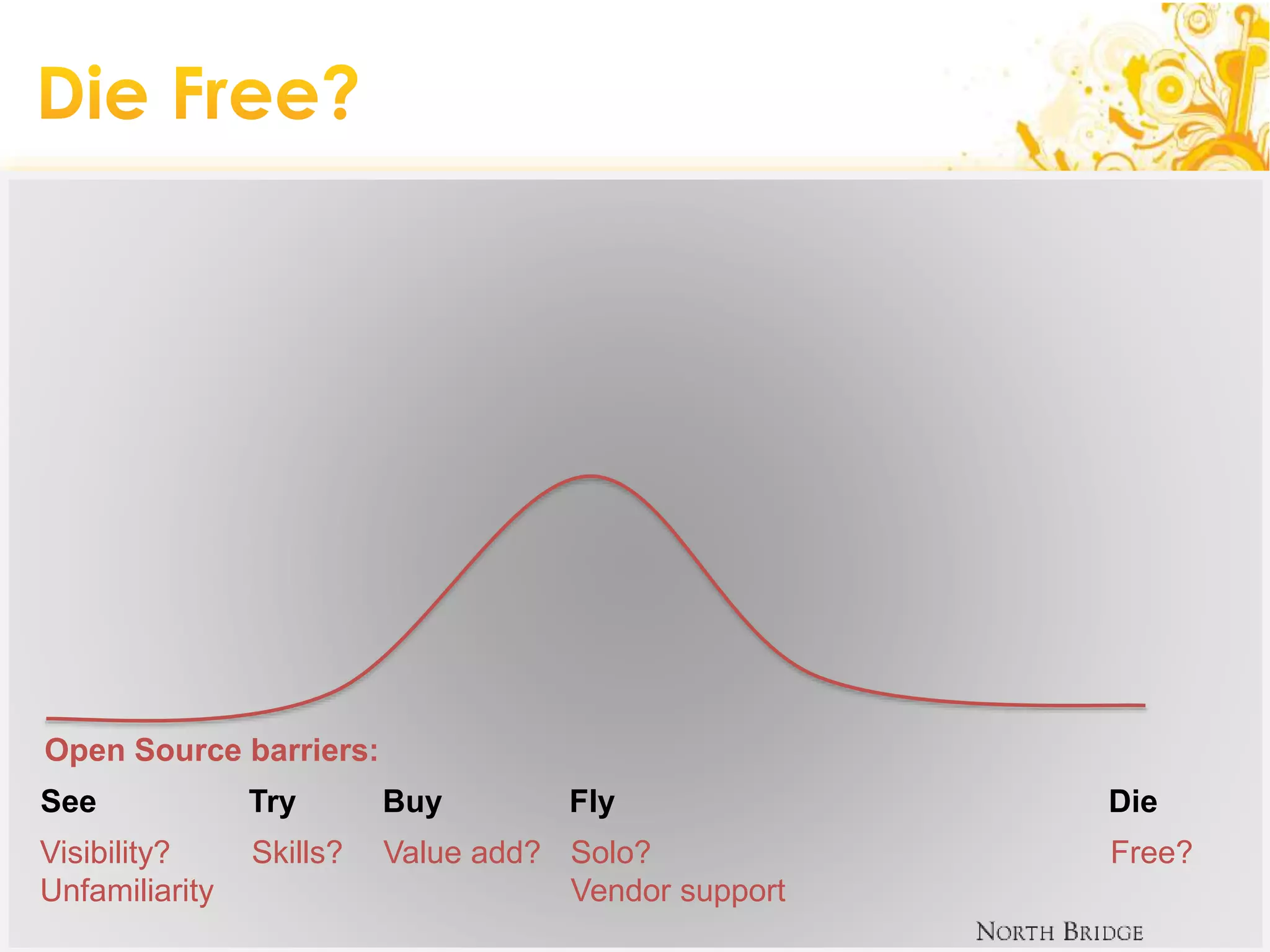

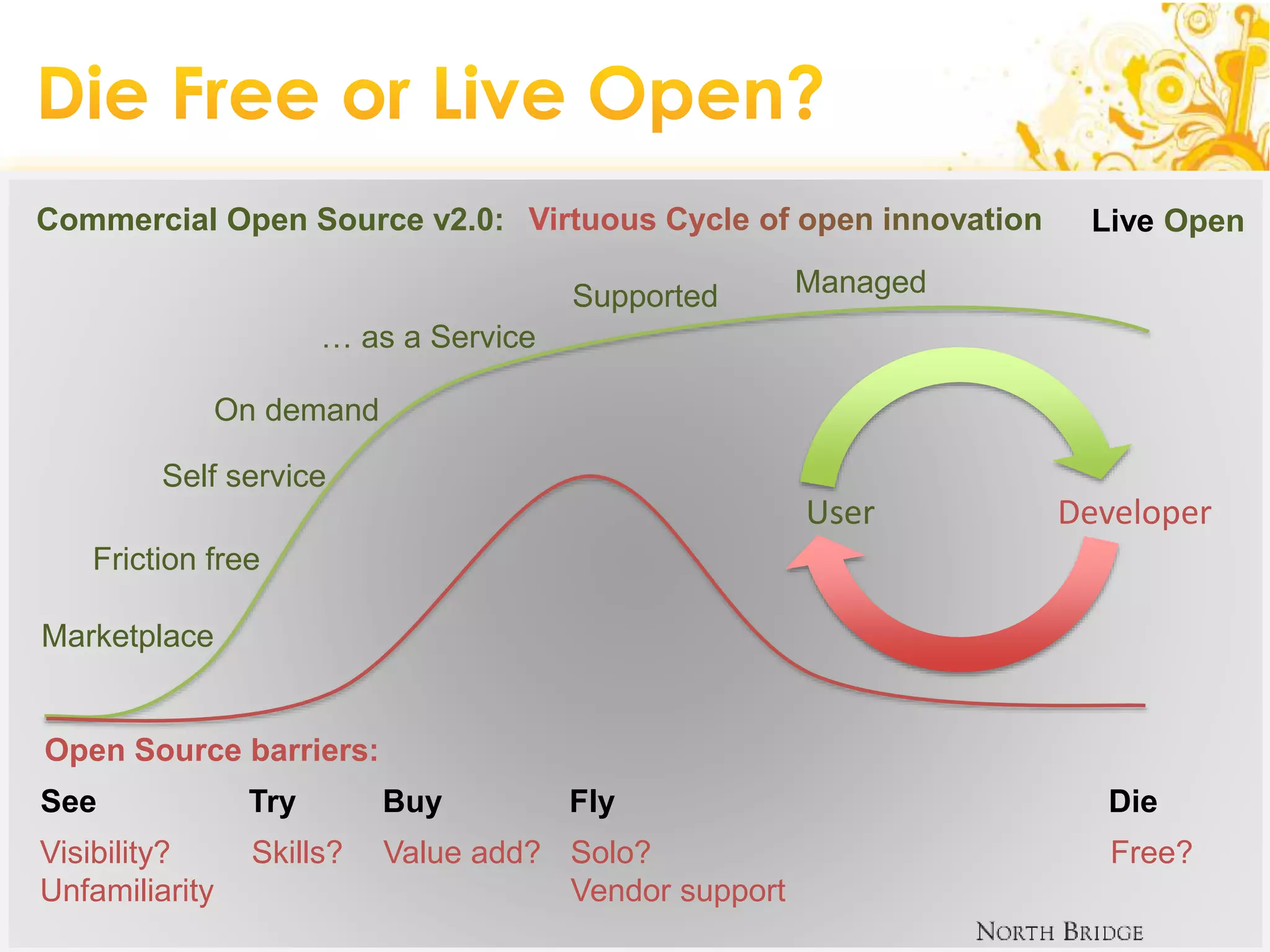

The document discusses insights from the 4th annual leadership keynote regarding trends and barriers in the open-source software (OSS) industry. It highlights findings from surveys on vendor versus non-vendor use of OSS, areas susceptible to disruption, and strategies for creating value in OSS businesses. Key statistics include investment amounts and the perception of OSS advantages, alongside challenges like skills and familiarity.