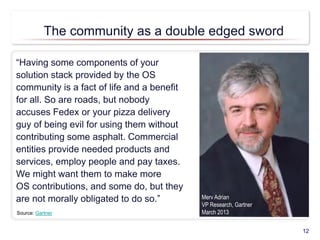

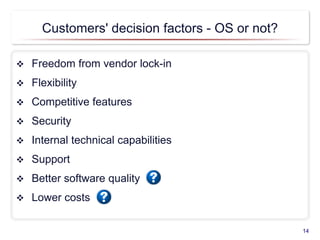

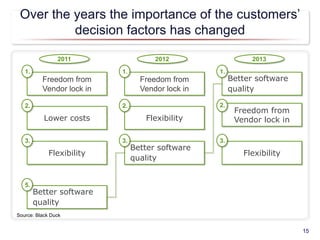

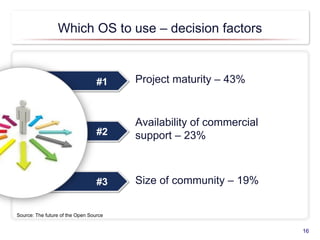

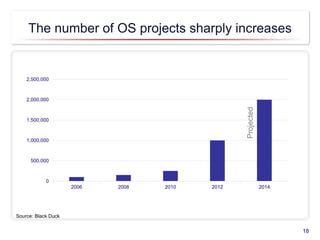

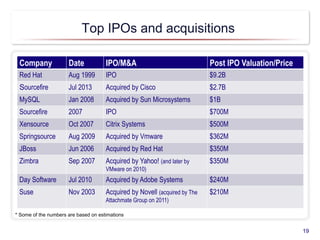

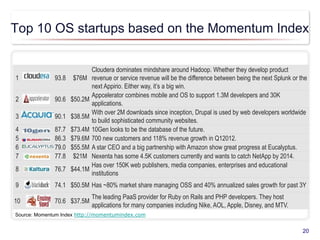

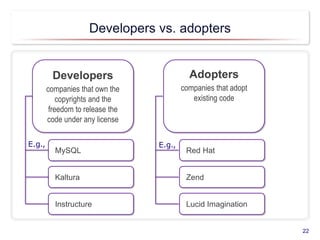

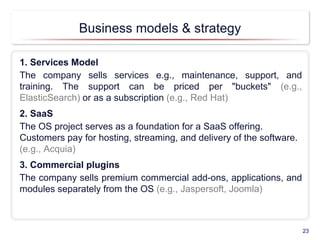

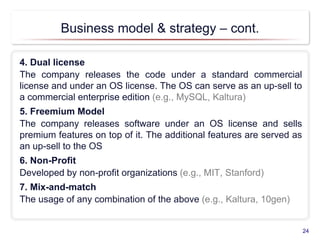

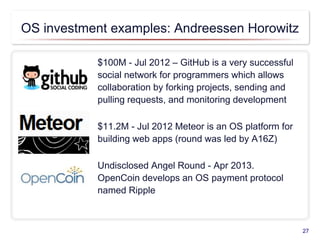

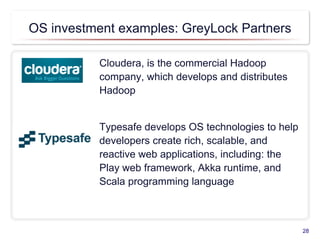

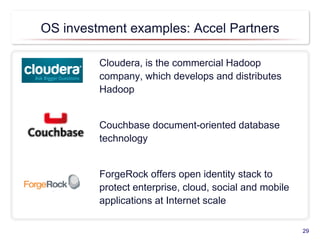

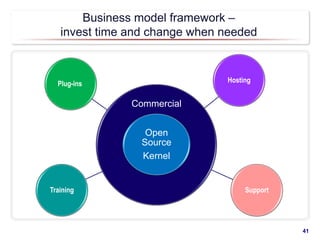

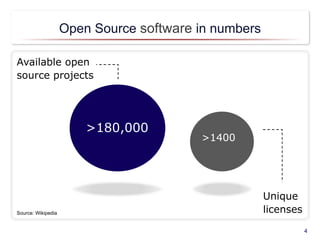

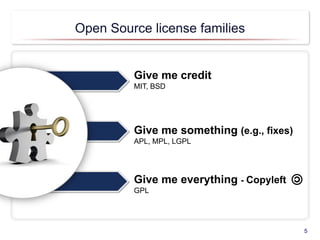

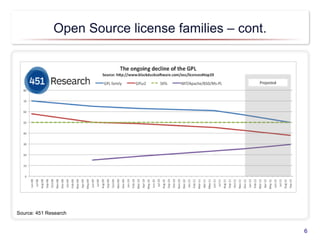

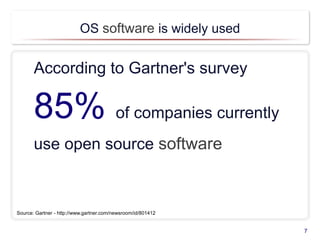

This document provides an overview of open source software including definitions, pros and cons, business models, and considerations for switching between open source and closed source models. It discusses key topics such as the open source community, customers' decision factors, popular licenses, market trends of open source projects and investments. Business models covered include services, SaaS, commercial plugins, dual licensing, and freemium. The document concludes with recommendations for open source companies regarding community engagement, transparency, and balancing commercial interests.

![Pros for software developers

Open platforms usually scale much more quickly

“Free” marketing and greater penetration

More likely to establish an industry standard and gain competitive

advantage (especially in infrastructure domains)

Creates community (free testing, bug fixing, users’ feedback, etc.)

Increases innovation - Joy’s Law - “no matter who you are, most of

the smartest people works for someone else” [1]

Promotes the company's image and reliability including its

commercial products if exist.[2]

Helps build developer loyalty as developers feel empowered and

have a sense of ownership of the end product.[3]

9

[1] Bill Joy, Sun Microsystems co-founder

[2] ,[3] Source: Wikipedia Open Source Software](https://image.slidesharecdn.com/opensourcev5-150831050047-lva1-app6892/85/Open-Source-9-320.jpg)